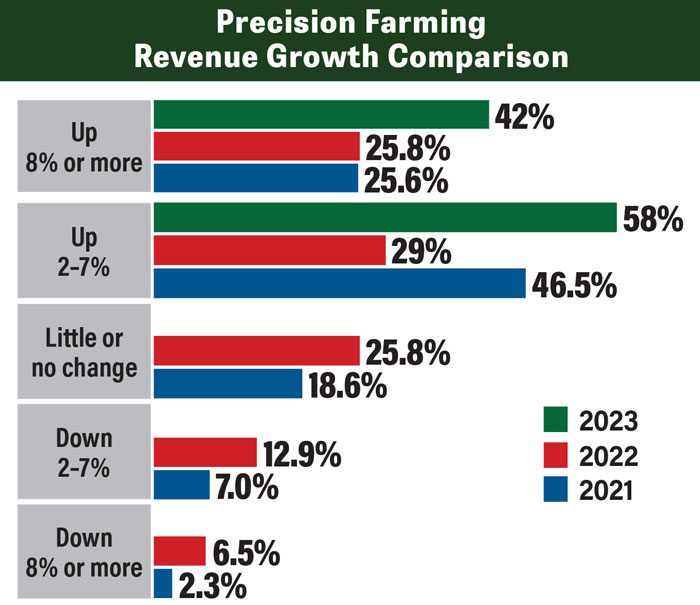

Dealers saw an increase in precision farming sales and service revenue in 2023, and most predict the positive trend will continue in 2024 according to the 11th annual Precision Farming Dealer benchmark study.

All dealers surveyed said their total precision revenue (sales and service) increased from 2022, with 58% reporting a growth of 2-7% and 42% reporting a growth of 8% or more. This is significantly more positive than 2022 when nearly 26% reported little or no change in revenue growth, 13% reported a decline of 2-7% and 6.5% reported a decline of 8% or more.

Joe Anderson, precision specialist with Case IH/New Holland/Kubota dealer Johnson Tractor in Baldwin, Wis., estimates revenue was up 13% for his company in 2023.

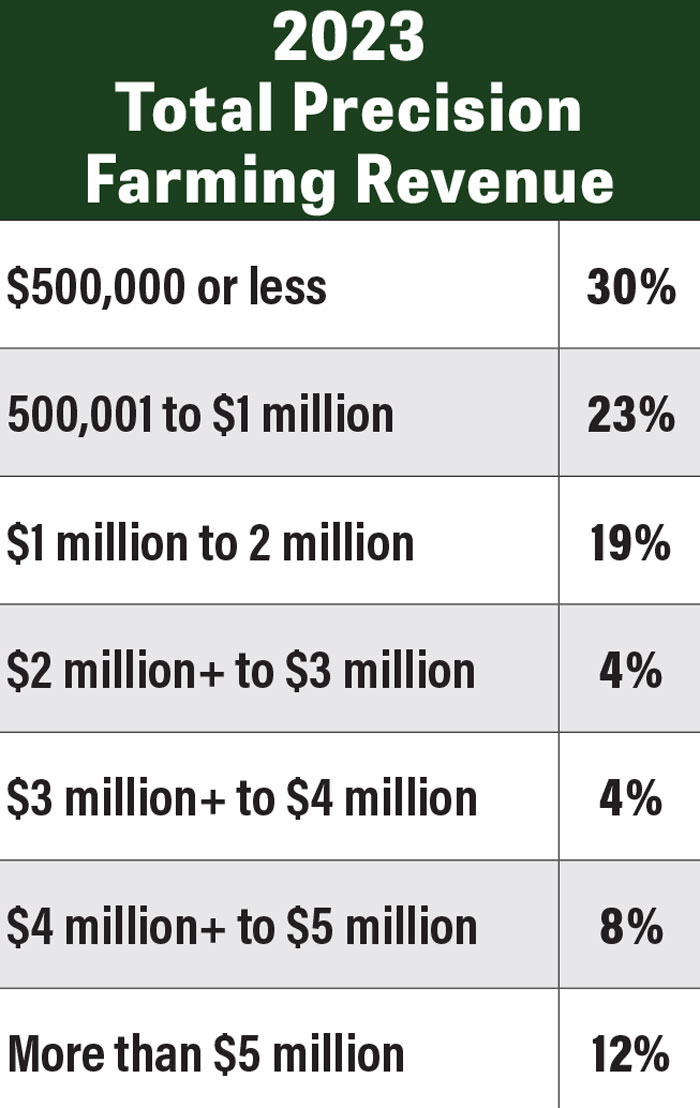

42% of dealers surveyed reported between $500,001 and 2 million in total precision revenue in 2023, while 30% reported $500,000 or less. 12% brought in more than $5 million in revenue, compared to only 3.5% breaking the $5 million barrier in 2022.

“We’re up across the board, but that number could be skewed a bit because we took on 4 new stores, and we have one precision budget for all 9 of our locations,” Anderson says. “We’ve been selling more high dollar technology, which factors into the equation. I also wonder if high interest rates are having a positive impact on precision sales. Some customers might not be able to afford a $400,000 piece of equipment. But they still have money to get rid of, so maybe the pendulum swings toward some of the smaller technology purchases.”

“Technology is growing so fast, and if we’re not ready for it, we’re going to miss the boat…”

42% of dealers estimated their total precision revenue in 2023 to be between $500,001 and $2 million, while 30% reported $500,000 or less. 12% brought in more than $5 million in revenue in 2023, compared to only 3.5% breaking the $5 million barrier in 2022. 8% reported between $2 million and $4 million, and another 8% reported between $4 million and $5 million.

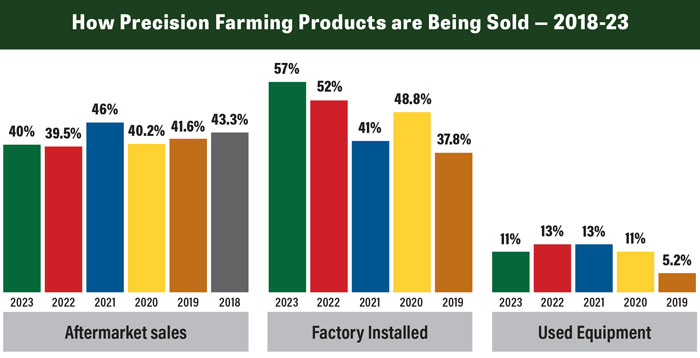

Factory installed precision systems saw a 5-point jump from 2022, while used precision sales dropped 2 points and aftermarket sales remained at 40%.

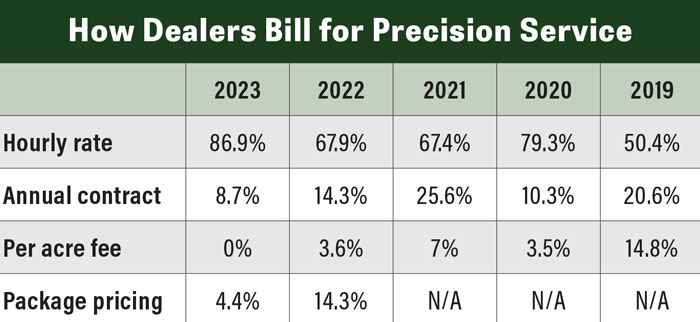

Neary 87% of dealers surveyed prefer to bill precision services by the hour, up 19% from 2022. The percentage of dealers using annual contracts was down 5.6 percentage points from 2022, while package pricing dropped nearly 10 points.

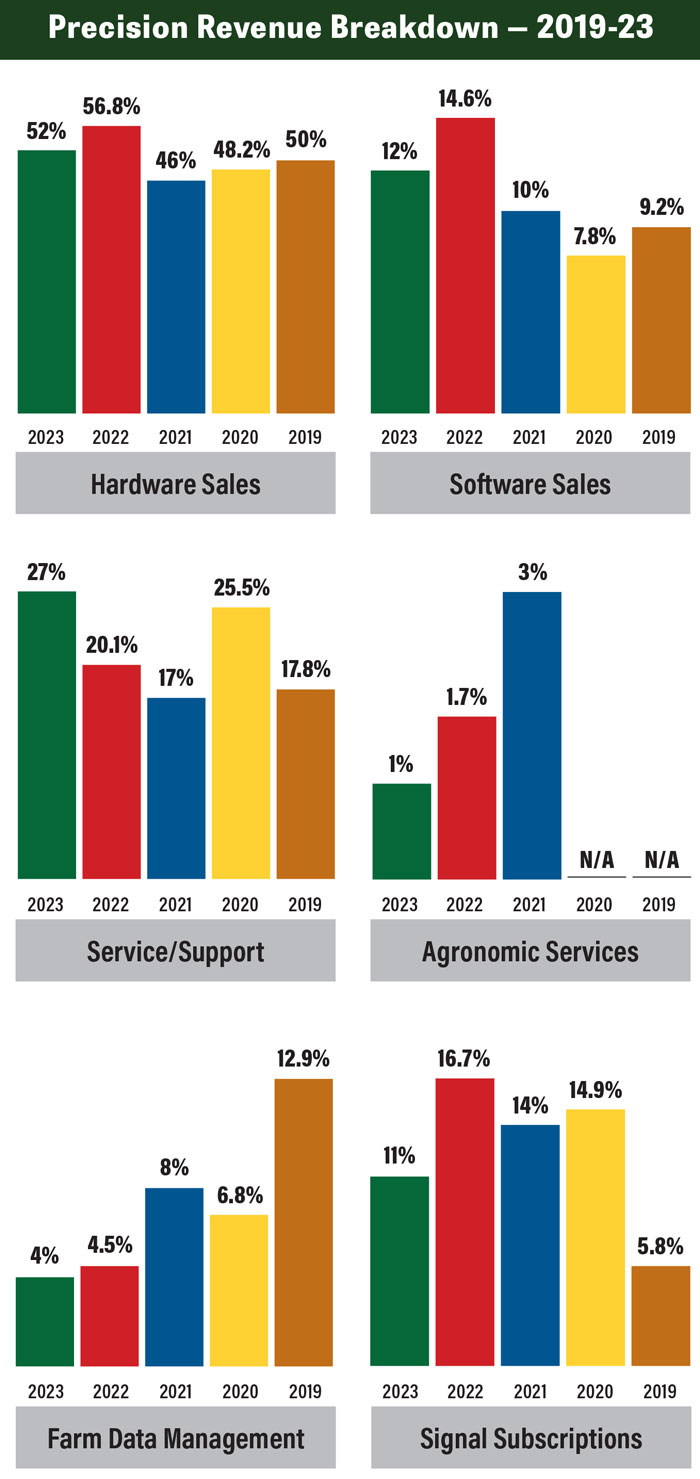

Hardware sales once again represented most of the total precision revenue in 2023 at 52%, compared to 57% in 2022 and 46% in 2021. Service/support made up an average of 27% of dealers’ total precision revenue, up 7 percentage points from 2022. Software sales (12%) and signal subscriptions (11%) rounded out the top 4.

“Our signal subscriptions number is a little bit higher than that because we sell Trimble products,” Anderson says. “Hardware is definitely king, but I think signal subscriptions are going to increase as more technology comes factory fit and is dealt with in house rather than through a third party.”

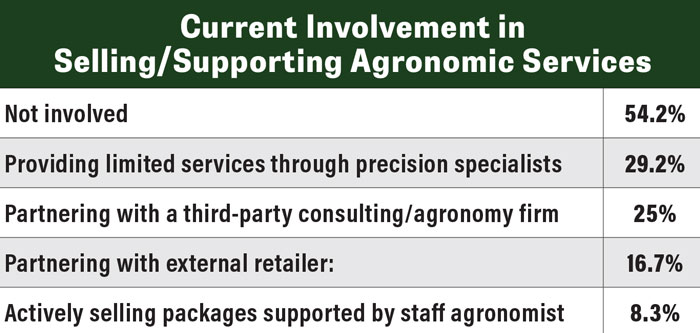

Over half of dealers surveyed are not currently selling or supporting agronomic services, while almost one-third are providing limited services through their own precision specialists.

Factory installed precision systems made up 57% of total sales in 2023, up 5 percentage points from 2022 and 16 percentage points from 2021. Aftermarket sales (40%) were the same as 2022, while used precision equipment (11%) dropped 2 percentage points.

“There is a whole lot of technology that is getting ordered right from the factory now,” Anderson says. “Industry standard plays a bit into it, too. If Deere’s doing it, then Case IH is going to do it. But we also have a customer base that is definitely attracted to the higher technology equipment.”

2024 Sales Outlook

Looking ahead to 2024, 54% of dealers forecast precision farming sales revenue to be up 2-7%, while 23% forecast an even bigger increase of 8% or more. 19% forecast little or no change and 4% project a revenue decline of 2-7%. Those numbers are more positive across the board than in 2022 when 10% projected a revenue decline of 2% or more, 13% projected an increase of 8% or more and 47% projected an increase between 2-7%.

Dealers continued to generate the majority of their precision revenue from hardware sales, followed by service/support and software sales.

“I think there’s a lot of skepticism surrounding the economy, but I don’t think anybody’s going to slow down their buying plans,” Anderson says. “I think we just have to be prepared when our customers are ready for their next purchase, because I don’t think it’s going to be at the timing we’re used to. Technology is growing so fast, and if we’re not ready for it, we’re going to miss the boat.”

Q&A: What Do You See as the Biggest Challenge Facing Your Precision Business in the Next 12 Months?

“Low markets and high interest rates.”

“High cost of initial investment and getting farmers to buy into the total benefit of the service.”

"Transitioning from selling Trimble to selling more Raven and CNH products.”

“Keeping our staff up to date on the technology changes.”

“Defining how our business model is going to change with autonomous vehicles.”

“Supply chain finally getting close to normal, but still needing to sell a season earlier than before. Getting enough help to cover the product line and territory.”

67% of survey respondents said precision specialists are responsible for selling precision products at their dealership, while 25% rely on farm equipment salespeople and 8% employ dedicated precision salespeople. Those numbers ring true for Kyle Fischer, precision technology advisor for Ag Leader dealer HTS Ag in Harlan, Iowa.

“Almost 90% of my day is spent trying to sell products,” Fischer says. “Obviously, that changes a bit in the spring or fall, but we have a dedicated support hotline as part of our service plans. If the phone rings, one of us in the precision department takes care of it.”

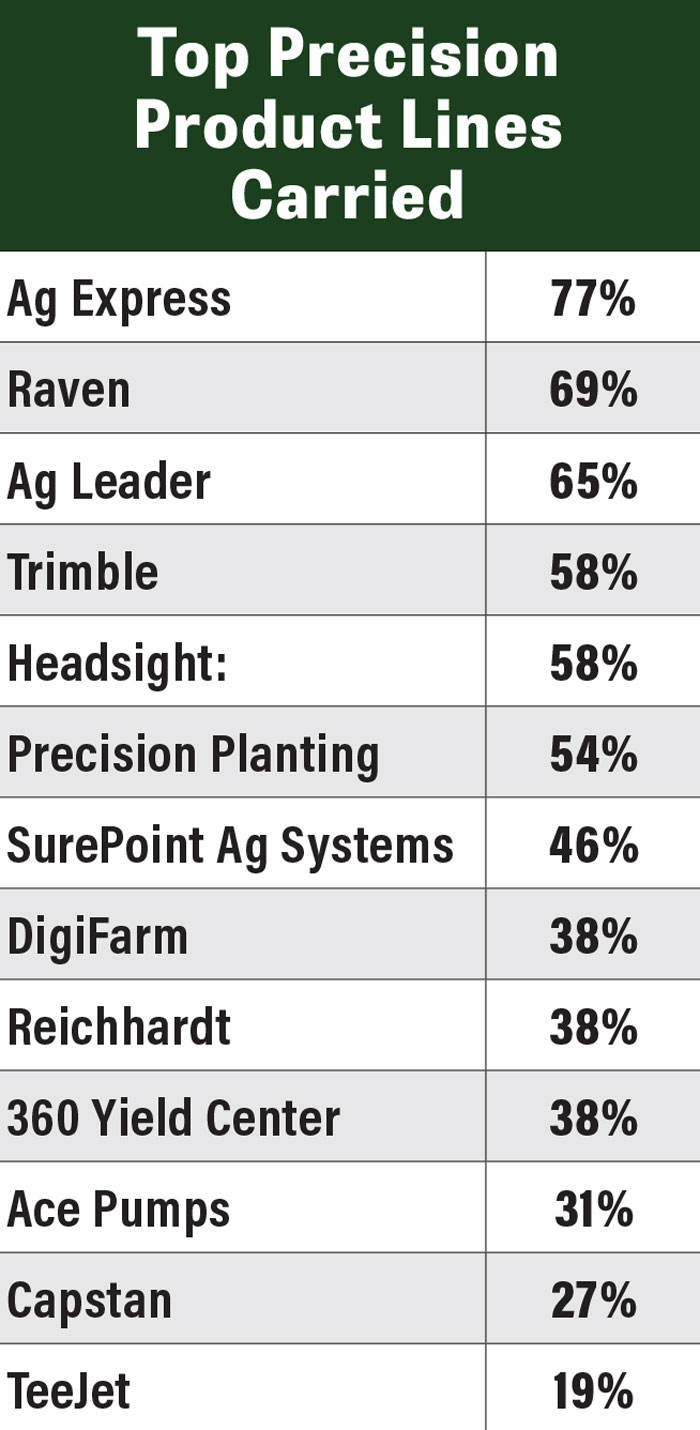

Ag Express topped the list of most popular brands carried by precision dealers in 2023, followed by Raven, Ag Leader, Trimble, Headsight and Precision Planting.

Data Management on the Rise

For the third year in a row, over half of dealers surveyed are offering data management services, with 63% offering the services in 2023, an 8-point increase from 2022. Of those who aren’t currently selling data management services, 22% said they are likely to begin doing so in the next 2 years.

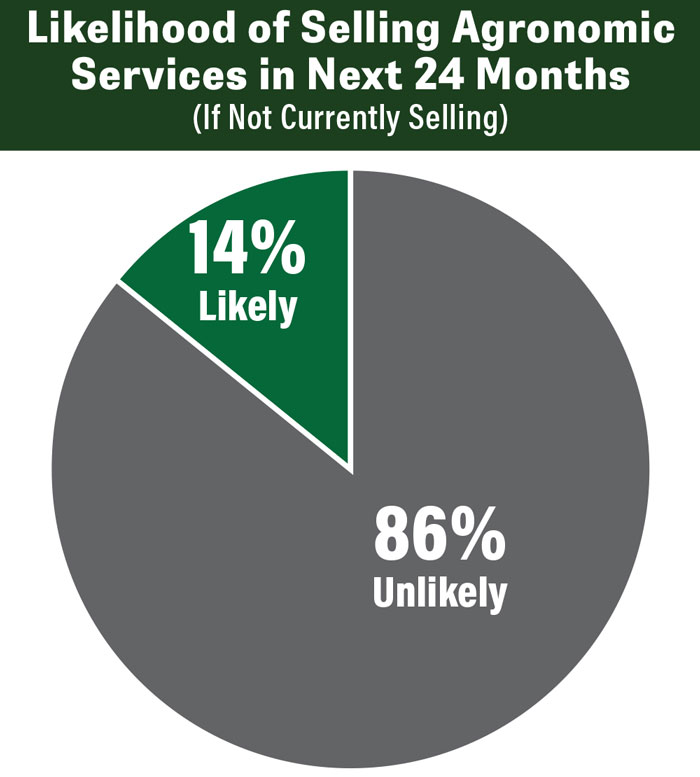

Of those who are not currently selling agronomic services, 86% are unlikely to change directions in the next two years.

“That 63% number sounds a little low, maybe because we’re on the high end of it,” Anderson says. “The younger farmers are really craving the data. As a dealership, especially as the OEM farm management software comes in, we need to be focusing on training the customer to use the tools that are available to them.”

“Hardware is king, but I think signal subscriptions are going to increase…”

Of those offering data management services, 74% offer entry level services like map printing and field data downloads, 61% offer internal operations/communication services like CRM, vehicle tracking and inventory management, and 39% offer advanced services like variable rate prescriptions and farm data analysis.

Q&A: How Will Autonomous Machinery Impact Your Dealership in the Next 3 years?

“Partial autonomy will play a big role over the next 2 years, but full autonomy not so much.”

“I don’t think it will have much impact on sales, but the next 3 years will be pivotal in learning how autonomous machinery can help customers in our area.”

“Grain cart automation will grow, but pricing will limit it. Combine automation is huge.”

“Keeping techs on call longer and more frequently. Increased revenue and cost within dealership.”

“I don’t think it will have an impact yet. Most farmers I talk to are not ready to trust it. A big hurdle right now is the lack of quality cell signal if the machine needs it.”

50% are actively selling data services and packages supported by precision specialists, 25% are partnering with a third-party consulting or agronomy firm and 21% are partnering with external seed or chemical retailers.

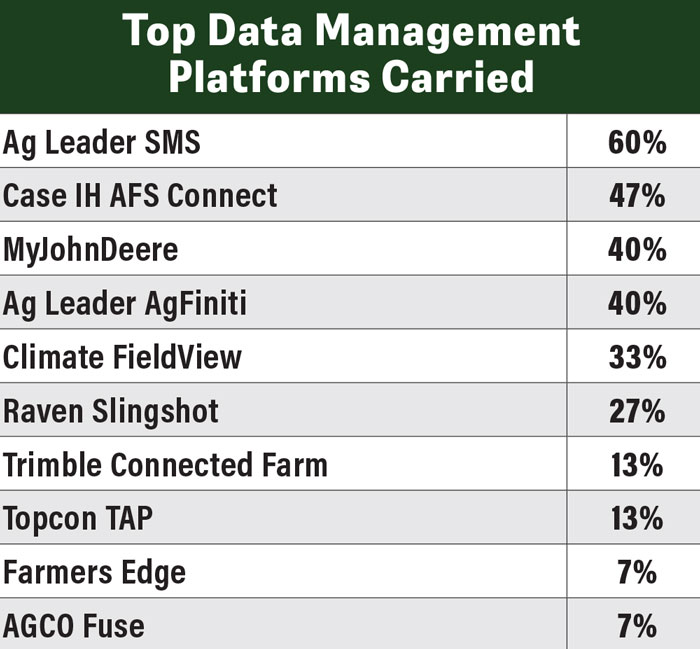

Ag Leader SMS (60%) was the most popular data management platform carried in 2023, followed by Case IH AFS Connect (47%), MyJohnDeere (40%), Ag Leader AgFiniti (40%) and Climate FieldView (33%).

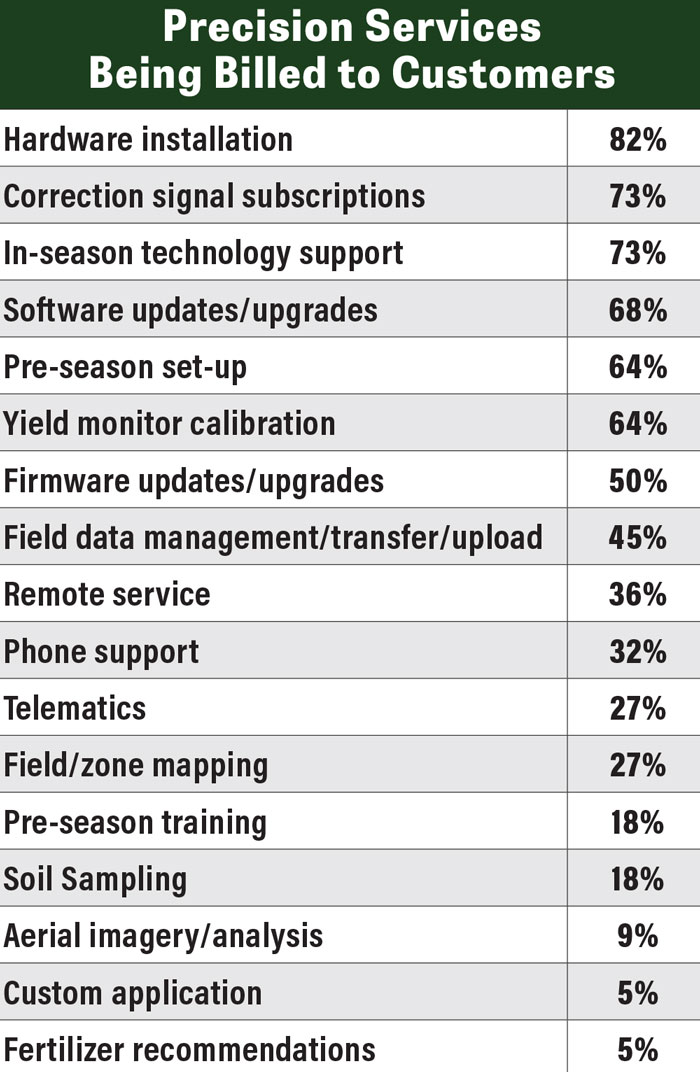

Hardware installation is the most commonly charged-for-service provided by dealers, followed by correction signal subscriptions and in-season technology support.

62% of dealers surveyed offered data management services in 2023. Ag Leader SMS, Case IH AFS Connect, MyJohnDeere and Ag Leader AgFiniti were the top farm data management platforms carried.

Dealers were asked, “Where do you find the most success recruiting precision employees?” 41% recruit from within, while 23% said other, which included family members and peers.

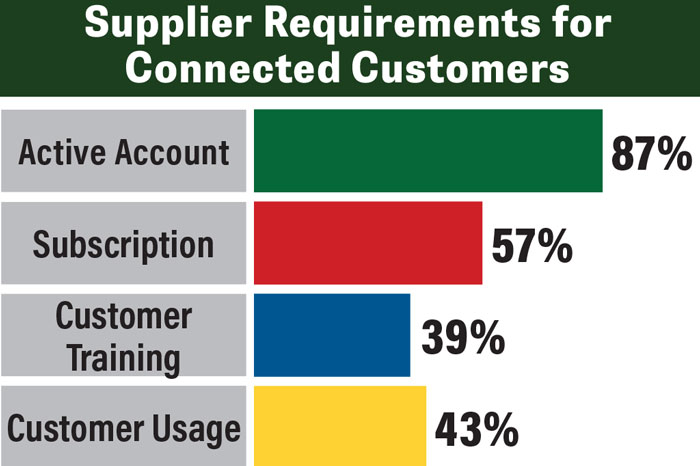

Dealers were asked about the requirements their suppliers have for connected customers. Most require an active account, and over half require a subscription. 87% of dealers surveyed said their precision specialists are responsible for setting up connected customer accounts, while 40% said precision managers, and 30% said sales staff.