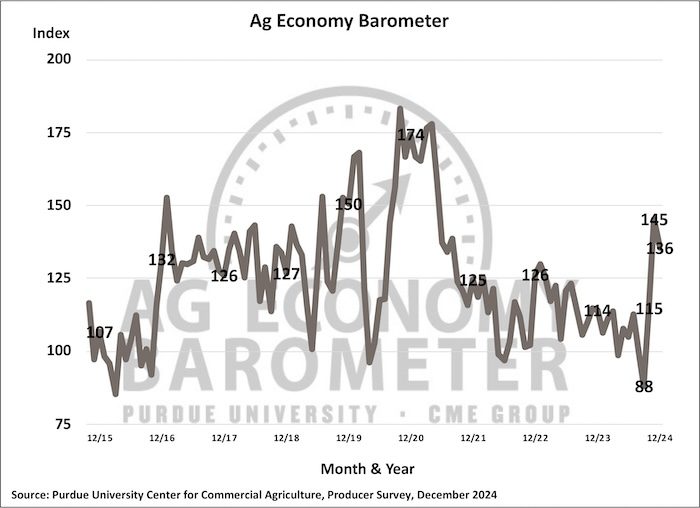

Farmer sentiment drifted lower in December as the Purdue University/CME Group Ag Economy Barometer dropped 9 points to a reading of 136. The decline was driven by producers’ weaker perspective on current conditions in U.S. agriculture and their farms, with the Index of Current Conditions falling 13 points to 100. Although the Current Conditions Index declined this month, it remains 24 points above its low in September and 5 points higher than in October. The Index of Future Expectations also fell 8 points to 153, remaining 59 points above its September low and 29 points higher than the October reading. This month’s survey was conducted from Dec. 2-6, 2024.

While sentiment dipped this month, it’s clear that much of the post-election optimism about future conditions is still holding strong. Producers’ optimism about the future seems to stem largely from their expectations for a more favorable policy environment over the next five years. Farmers’ views on the current and long-term outlooks for agriculture showed some noticeable differences in December. While sentiment regarding the current situation and the one-year outlook was more cautious than in November, expectations for the agricultural sector over the next five years were notably more positive. The percentage of producers anticipating widespread good times in U.S. agriculture over the next five years increased to 57%, from 52% in November and 34% in October. This optimism extended across both the crop and livestock sectors, with 4-point and 5-point increases, respectively, in the percentage of respondents expecting good times. In contrast, views on the near-term outlook were less favorable. When asked about financial conditions on their farms compared to a year ago, 57% of producers reported worse conditions in December, up from 51% in November. Similarly, 51% of farmers expressed concern about the U.S. agricultural economy over the next 12 months, an increase from 40% in November.

Following a 13-point increase in November’s survey, the Farm Capital Investment Index fell 7 points to a reading of 48. The weakening in investment sentiment was reflected in a lower percentage of farmers who believe it is a good time to invest, dropping to 17% from 22% in November. At the same time, the proportion of producers who viewed it as a bad time to invest increased slightly to 69%, up from 67%. This dip in investment sentiment mirrored the decline in the Farm Financial Performance Index, which fell 8 points in December to 98.

Continuing the trend from November, the Short-Term Farmland Value Expectations Index dropped 5 points to a reading of 110, following a similar 5-point decrease the previous month. Despite these two consecutive decreases, the short-term index remains well above its low of 95 in September. The Long-Term Farmland Value Expectations Index, which reflects producers’ outlooks for farmland values over the next five years, decreased by just 1 point to 155.

Farmers’ outlook for the future of their farms and the agricultural sector remains noticeably more positive than at the end of summer. This shift appears to be driven by expectations of policy changes following the 2024 election, particularly in areas such as environmental, estate and income tax policies. Leading up to the election, over 40% of producers anticipated more restrictive environmental regulations over the next five years. However, following the election, fewer than 10% expressed concerns about tighter regulations. Similarly, 40% of farmers expected estate taxes to rise before the election, but less than 10% foresee an increase in estate taxes within the next five years. Regarding income taxes, nearly 38% of producers anticipated rises before the election, with that percentage also dropping below 10% postelection. Lastly, more than half (55%) of survey respondents expect the election outcome to lead to a stronger farm income safety net than was in place prior to the election.

One ongoing concern for U.S. farmers is the future of international trade in agricultural products. In December, 4 out of 10 (43%) farmers chose “trade policy” as the most important policy for their farm in the upcoming five years. Both the November and December barometer surveys asked producers about the likelihood of a “trade war” that could negatively affect U.S. agricultural exports. The results indicate that many producers remain worried about this scenario. In December, 48% of farmers said they believe a trade war that harms agricultural exports is either likely (32%) or very likely (16%), an increase from 42% in November. Conversely, only 21% of respondents in December viewed a trade war as either unlikely (17%) or very unlikely (4%), down from 26% in November.