Sandhills Global’s agricultural market reports cover used tractors, combines, sprayers, and planters in Sandhills’ U.S. marketplaces. As buyers and sellers enter the end-of-year auction season, the reports show that auction prices ticked up month over month in most categories in November (the compact and utility category group was an exception), with combines leading the other categories.

“High-horsepower tractor and combine inventory is still climbing while asking values are coming down,” says TractorHouse Manager Ryan Dolezal. “In both categories, auction values have been increasing but are now on a steady trend. Combine auction values increased more than other categories from October to November. Compact tractors, on the other hand, showed decreases across the board in inventory levels, asking values, and auction prices.”

The key metric in all of Sandhills’ market reports is the Sandhills Equipment Value Index (EVI). Buyers and sellers can use the information in the Sandhills EVI to monitor equipment markets and maximize returns on acquisition, liquidation, and related business decisions. The Sandhills EVI data include equipment available in auction and retail markets and model-year equipment actively in use. EVI spread measures the percentage difference between asking and auction values.

Additional Market Report Takeaways

Sandhills market reports highlight the most significant changes in Sandhills’ used heavy-duty truck, semitrailer, farm machinery, and construction equipment markets. Key points from the current reports are listed below. Full reports are available upon request.

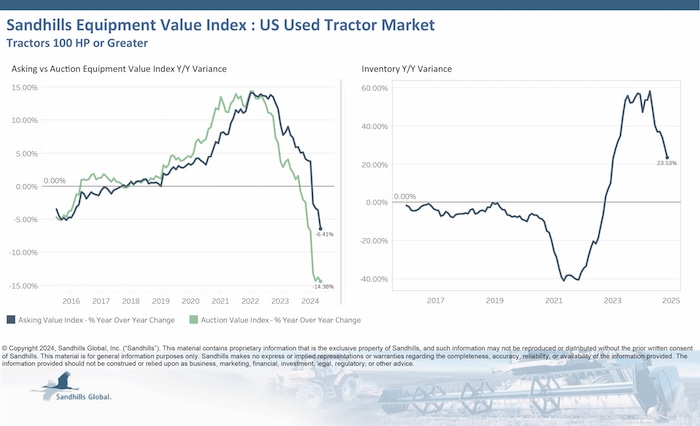

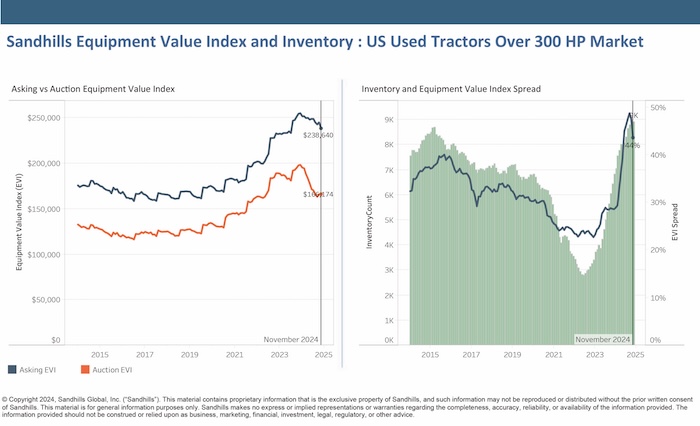

U.S. Used Tractors 100 Horsepower and Greater

-

Inventory levels in this market have been trending upward for several months. This trend continued in November, with inventory up 0.79% M/M and 23.53% year over year. Sandhills observed the largest M/M increase in the 100- to 174-hp tractor category, up 1.34%, and the largest YOY increase in the high-hp tractor category, up 38.18% YOY.

-

Asking values have been trending down for months and were down in November by 2.16% M/M and 6.41% YOY. The biggest drops were seen in high-hp tractors, down 2.63% M/M, and 175- to 299-hp tractors, down 8.37% YOY.

-

Auction values were up 0.17% M/M and down 14.38% YOY in November and are trending steady. The largest M/M increase occurred in the 100- to 174-hp tractor category, up 1.23%, and the most significant YOY drop was in high-hp tractors, down 16.03% YOY.

-

The EVI spread fell to 44% in November (down from 47% in October), but that figure is still greater than the historic highs set in 2015.

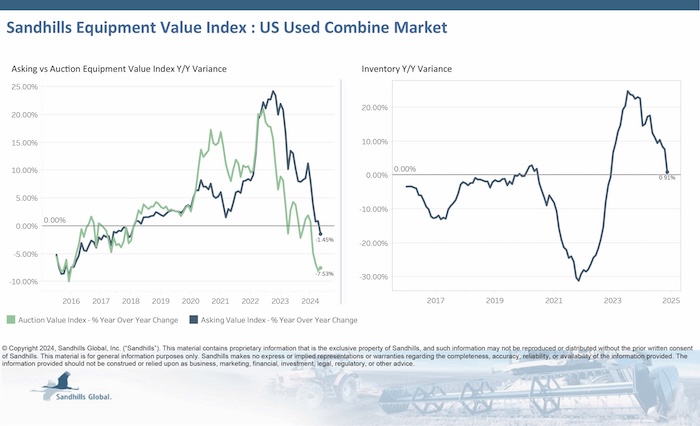

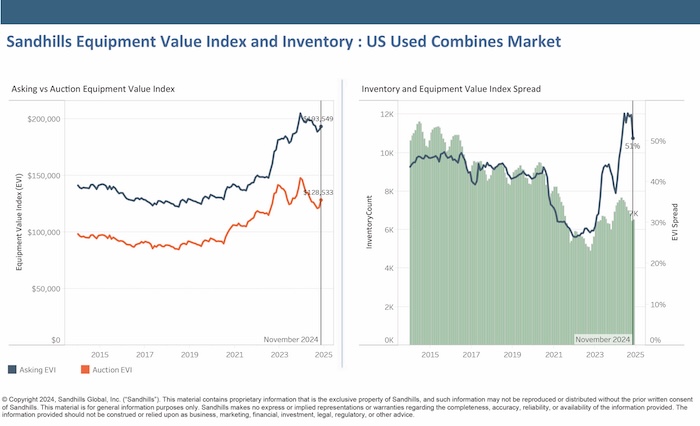

U.S. Used Combines

-

Inventory levels of used combine harvesters in Sandhills’ U.S. marketplaces were up 0.99% M/M and 0.91% YOY in November and are trending down.

-

Asking values ticked up 1.66% M/M, dipped down by 1.45% YOY, and are trending steady.

-

Auction values were up 5.52% M/M (a greater M/M increase than other farm equipment categories in November), down 7.53% YOY, and are trending steady.

-

The EVI spread fell from 56% in October to 51% in November but that figure is still higher than the previous record highs of 2015.

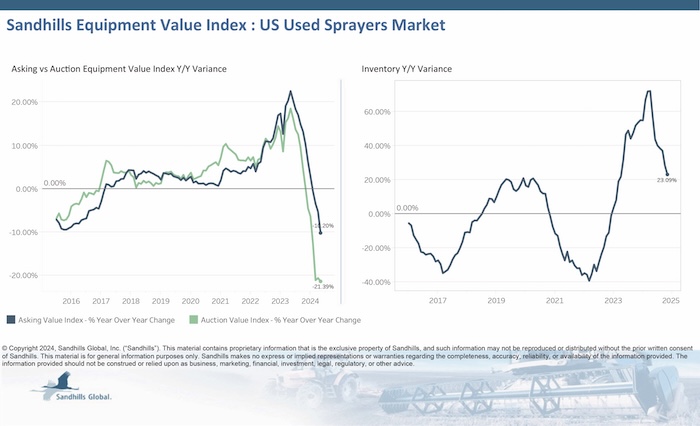

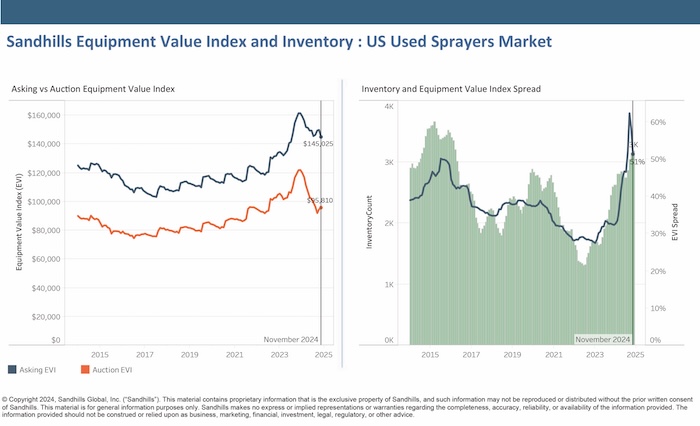

U.S. Used Sprayers

-

Inventory levels in this market have been rising for months. This trend continued in November, with inventory up 1.21% M/M and 23.09% YOY.

-

Asking values, however, are trending down. Asking values fell 3.25% M/M and 10.2% YOY in November.

-

Auction values were mixed in November, up 1.22% M/M and trending sideways despite a 21.39% YOY drop.

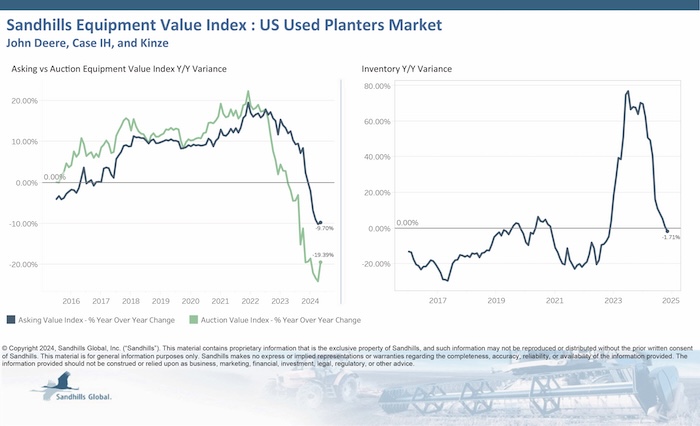

U.S. Used Planters

-

Inventory levels of used planters in Sandhills’ U.S. marketplaces were down 3.08% M/M and 1.71% YOY in November but are trending sideways overall.

-

Asking values were up slightly M/M, by 0.74%, but fell 9.7% YOY and are trending down.

-

Auction values were up 4.18% M/M but dropped significantly YOY, by 19.39%. Auction values are trending sideways.

-

The EVI spread in this category was 63% in November (down from 69% in October). This is a higher value than normal but still slightly lower than the historic values set in 2015 (the peak that year was 72%).

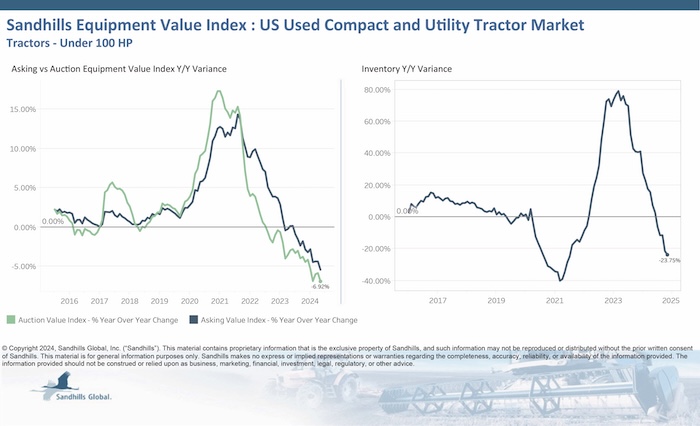

U.S. Used Compact and Utility Tractors

-

Sandhills has noted downward trends in inventory levels and values for used compact and utility tractors for several months. In November, inventory levels were down 0.76% M/M and 23.75% YOY, led by less-than-40-hp tractors, which posted a 28.69% YOY inventory drop.

-

Asking values have been trending down for 11 months and were again down in November. Asking values decreased 0.83% M/M and 5.44% YOY, led by less-than-40-hp tractors with a 6.41% YOY decrease.

-

Auction values have been trending down for nine months. Auction values decreased 0.87% M/M and 6.92% YOY in November, with less-than-40-hp tractors again leading the way, in this case with an 8.67% YOY drop.

Trade Values & Trends is brought to you by TractorHouse.

TractorHouse is your headquarters for buying and selling new and used farm equipment. TractorHouse.com offers an intuitive platform for listing agricultural equipment and attachments for sale. And if you're wondering what your equipment is worth, Value Insight Portal (VIP.TractorHouse.com) delivers fast and accurate valuations for free. TractorHouse.com and TractorHouse magazine give buyers quick and easy access to thousands of for-sale listings for tractors, harvesters, seeders, planters, hay and forage equipment, tillage equipment, ag trailers, and any other type of ag machinery from every major manufacturer. Visit TractorHouse.com today to find out more.

Click here to view more from this series.