In response to ongoing requests from both dealers and manufacturers about North American ag machinery demographics and the economic importance of the industry, the editors of Farm Equipment commissioned a new annual report in 2023 via the Farm Equipment 100™. Now in its second year, this compilation took a deep dive beyond the 13-year tradition of the Ag Equipment Intelligence Big Dealer report (a joint project with Machinery Advisors Consortium) to focus on the largest movers and shakers comprising the industry.

The list below arranged the North American dealer groups by the total number of their ag equipment stores (stand-alone construction and/or other machinery types were not included in the ag stores if a separate facility.) This data, excerpted from an appendix in the Big Dealer Report, details the stores, state/province, product lines, employees, executives, business system software and revenue range.

Click here to veiw the Top 100 of North America’s Largest Dealer Groups

In total, the list of the 100 largest dealers includes 1,984 ag stores, representing nearly one-third of all ag equipment store rooftops in North America. In total, these 100 dealers comprise an estimated $54.9 billion in annual revenues. These companies employ more than 59,200 people in their local, rural communities.

The Farm Equipment 100™ companies average 19.8 stores each, 611 employees and carry 15 product lines.

In addition to the hard data, 5 Farm Equipment editors personally connected with dealers in late April and May. Most of the data was verified by dealers but came from independent sources in some cases.

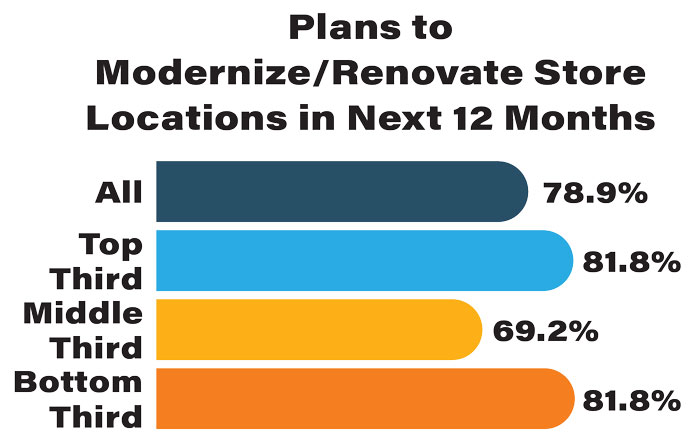

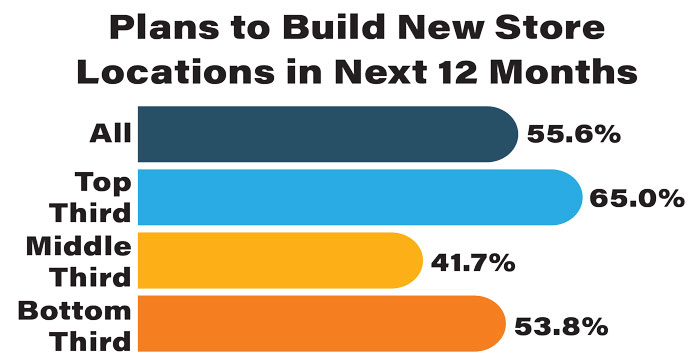

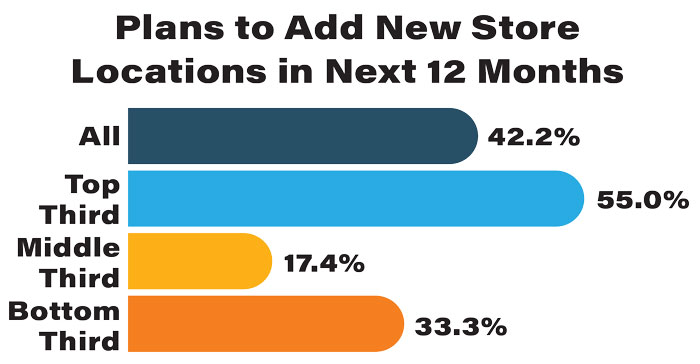

Additionally, editors also asked 5 questions about dealers’ plans for the next 12 months, which is summarized in the infographics below and drew a 61% response rate.

There are also plans in the works for a research panel to learn how the largest ag equipment dealers think and respond to specific topics and questions.

Email kschmidt@lessitermedia.com with any comments on the list, including changes. Farm Equipment will continually update the data as a service to subscribers.

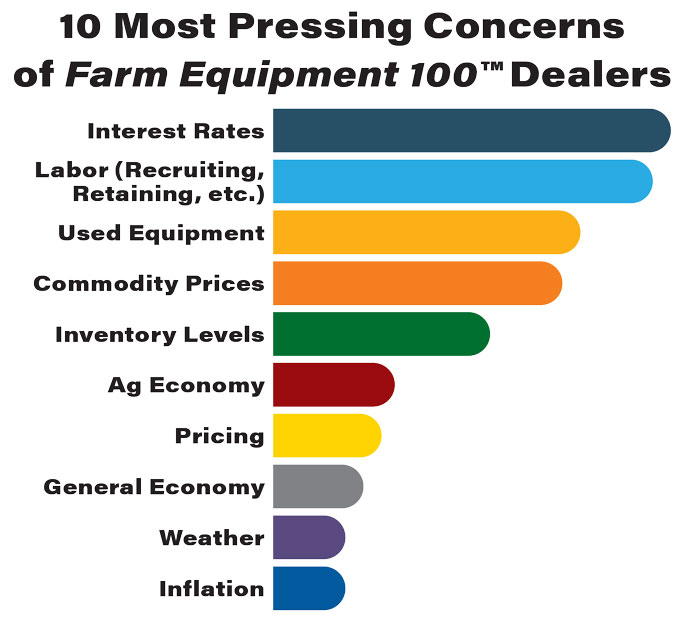

These are the most-cited concerns of the largest dealers as shared with Farm Equipment editors in their calls with the Farm Equipment 100™ dealer executives. — 2024 Farm Equipment 100™, Segmented by Number of Ag Stores

This map highlights the number of Farm Equipment 100™ dealerships represented in each state. The highest concentrations are in Iowa and Kansas, followed by Texas, Missouri, Nebraska and Indiana.

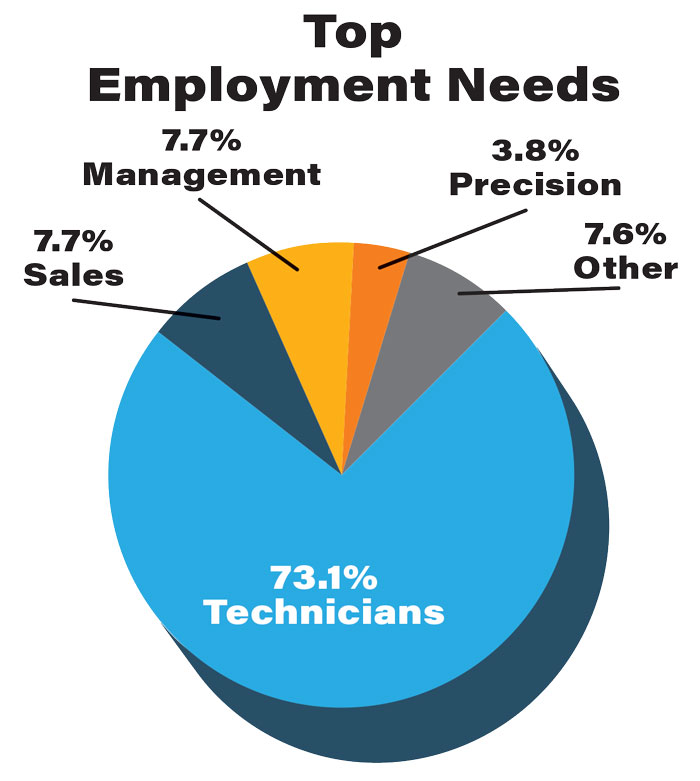

These are the most-cited employment needs of the largest dealers, as shared with Farm Equipment editors in their calls with the Farm Equipment 100™ dealer executives.

The number of ag stores operated by dealers with 20 or more stores rose 4.2% to 1,058 in this year’s Big Dealer Report, while the number of total stores operated rose 6.5% to 1,507. The average dealer with 20 or more locations now operates over ag 34 stores and almost 49 stores overall. Visit AgEquipmentIntelligence.com to order the full Big Dealer Report.

Analysis of Plans by Dealers’ Employee Totals

Analysis of the 12-month planning intentions by total employment numbers showed the smallest are the most aggressive in their plans to both acquire new stores and build a new store from scratch. When it came to modernizing their facilities, the dealers in the top and bottom third in terms of total employment were more aggressive than the middle group. — 2024 Farm Equipment 100™, Segmented by Employee Totals

Based on the responses from Farm Equipment 100™ dealer executives, 42.2% plan to add a new store in the next 12 months. The top third of dealers were most likely to add stores. — 2024 Farm Equipment 100™, Segmented by Number of Ag Stores

Top Case IH Dealers

- Titan Machinery

- Rocky Mountain Equipment

- Progressive Tractor

- H&R Agri-Power

- Birkey’s Farm Store

- Plains Ag

- Delta Power Equipment

- Monroe Tractor

- Bane-Welker Equipment

- Wylie Implement

Top AGCO Dealers

- Ziegler Ag Solutions

- Butler Machinery Co.

- Parallel Ag

- Ring Power Equipment

- Quinn Ag Products

- Kelly Tractor/Atlantic & Southern

- Agri-Service

- Agriterra Equipment

- LDI (Lang Diesel Inc,)

- Holt At Solutions

Top John Deere Dealers

- United Ag & Turf

- Ag-Pro Companies

- Papé Machinery

- C&B Operations

- RDO Equipment

- SN Partners

- Brandt Holdings

- AgriVision/PrairieLand JV

- Hutson

- Greenway Equipment

Top New Holland Dealers

- Mazergroup

- KanEquip

- Garton Tractor

- Brim Tractor

- TERAPRO

- Avantis Cooperative

Dealers to Watch

These 5 dealers fell just short of the Farm Equipment 100TM. As they grow — and as others on the list change — they may join the 2024 listing.

- WCTractor

- Enns Brothers

- Grossenburg Implement

- Lansdowne-Moody

- Ohio Ag Equipment

What Keeps the Top 100 Dealers ‘Up at Night’

Farm Equipment editors contacted executives at the Top 100 dealers about the biggest challenges over the next 12 months. In addition to the total tally in the chart above, below is a sampling of dealers’ remarks in their own words.

“Labor shortages, net farm income, dealer profitability, geopolitical factors, right to repair (Terrible bills have stuff that goes against EPA and OSHA standards, don’t want to see anyone get hurt, requiring dealers to sell parts at cost would bankrupt every dealer), government meddling.”

“Manufacturer quality, pricing, commodity prices. The Racine, Wis., plant sucks, lost a lot of experience during the pandemic.”

“Used equipment management, managing anticipated downturn in ag market (not in bad times but the last 3 years were awesome and we’re going back to average), ensuring aftermarket is profitable to carry us through until next up cycle.”

“How the whole dealer channel manages used inventory (the entire channel suffers for its weakest link), we can’t directly control this.”

“Ag economy, talent capabilities, inflation, degradation of American culture, the fact that we can’t find anything better than two washed up old men to run for president … and its effect on our future.”

“Interest rates creating a significant impact on the balance sheet, cashflow issues, spending $22,000 a day in interest. Turning used inventory (about to have another auction). Auctioned $70 million in 2023, keeping the balance sheet. Annual interest expenses up 100% vs. 2023.”

“1. Biggest concern is markets that are really struggling, hay and dairy. 2. Concern that used equipment is going to get more challenging. 3. Recruiting and hiring service technicians.”

“1. In or rapidly heading toward cyclical downturn. Commodities price and used equipment demand softening. Prices, inventory management. Closely followed up by our ability to manage all the technology that’s being developed and demonstrate it. More like a 5-year concern. A lot of the technology Deere is developing, if used right, can really unlock for customers. Must work right, dealers support it and customers must understand. If any of the 3 do not work, won’t make an investment to begin with.”

“1. Expenses have increased. 2. Farmers’ expense is tightening their margins — a serious concern. For what we grow here — cotton and peanuts — we’ll be quite a few cotton pickers off. Farmers cannot afford to trade, their margins are really pushed. We’re also off in small ag too. The general economy is very questionable — surprising that it’s held up this strong.”

“1. Farm income reduction, don’t have cash, won’t spend. 2. Keeping OEMs satisfied when #1 happens. Inventory levels are too high, interest rates are impacting our business. List price has gone up so high that its affecting sales. Don’t care how good it is, the price is too high for our business. Did presentation to salesmen yesterday. We have to cut expenses. Positive, balance sheets are probably as positive as they’ve ever been in any downturn. Will buy what they need and not want. We farm too!”

“Losing customers, the economy, keeping employees happy, going out of business (not being able to make enough money), getting new customers, and being able to get technicians.”

“Interest expense and rate, amount of inventory we have on the ground and on order, trade values declining, ag market is down so far for 2024 based on industry units sold. Keeping good team members and making sure the new ones are aligned with our values.”

“1. Equipment inventory levels and associated interest expense. 2. Softening used equipment market and maintaining desired equipment turns. 3. Customer adoption and utilization of technology offerings, including subscription-based features and functionality. 4. Employee retention and shifting workforce needs and expectations, continuing to develop and adapt management strategies that recognize the diverse and multi-generational nature of the workforce.”

“Interest rates, inventory control/turn, sales team training, sales management training. As always, weather affects our customers as the single biggest external influence on our business. We are going into what appears to be a very dry year.”

“Interest rates, commodity prices are strapping people down for cash and cashflow. It’s an ongoing issue until things start to turn around in the marketplace. Will probably back off selling new combines because of used being so depreciated out as far as their value.”

“Interest rates, autonomy, global unrest (supply chain, unpredictability). In terms of autonomy, this is going to be disruptive. Who wins? Someone has figured this out and is going to come to market with something that is truly disruptive.”

“California regulations and laws (PAGA).”

“Employee turnover; interest rates impact on sales. The direction Deere is going with autonomy.”

“Shift from no inventory to everyone having too much inventory in a high interest environment. Commodity prices, moisture levels, ransomware and staffing.”

“Man power, used equipment values and supply, farm economy, farm bill, political turmoil in the U.S.”