In this episode of On the Record, brought to you by Weasler Engineering, we break down the key takeaways from Ag Equipment Intelligence's newly released 2024 Big Dealer Report. In the Technology Corner, Noah Newman shows us how cover crop planting could be done autonomously. Also in this episode, CNH Industrial reports a drop in ag sales, AGCO combine and application equipment sales are down year-over-year and a UK New Holland factory strike could impact North America.

For more than 70 years, Weasler has proudly led the industry in unsurpassed quality, reliability and service. We are a global leader in manufacturing and distribution of drive train systems and components for agricultural original equipment manufacturers around the world. Since 1951, our promise to our customers has remained the same: We will continually focus on our values, including expertise, quality, innovation and customer experience, to ensure that you have the best driveline products to meet the demands of your business and the market. Work with us and you’ll find we live our values. That's the Weasler Promise. Visit Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Big Dealer Consolidation Continues in 2024

- Dealers on the Move

- Farmer Takes Retrofit Route with Smart Sprayer in 2024

- CNH Industrial Ag Sales Down in 1Q24

- AGCO Combine & Application Eq. Sales Down 30% in 1Q24

- UK New Holland Tractor Plant Hit with Union Strike

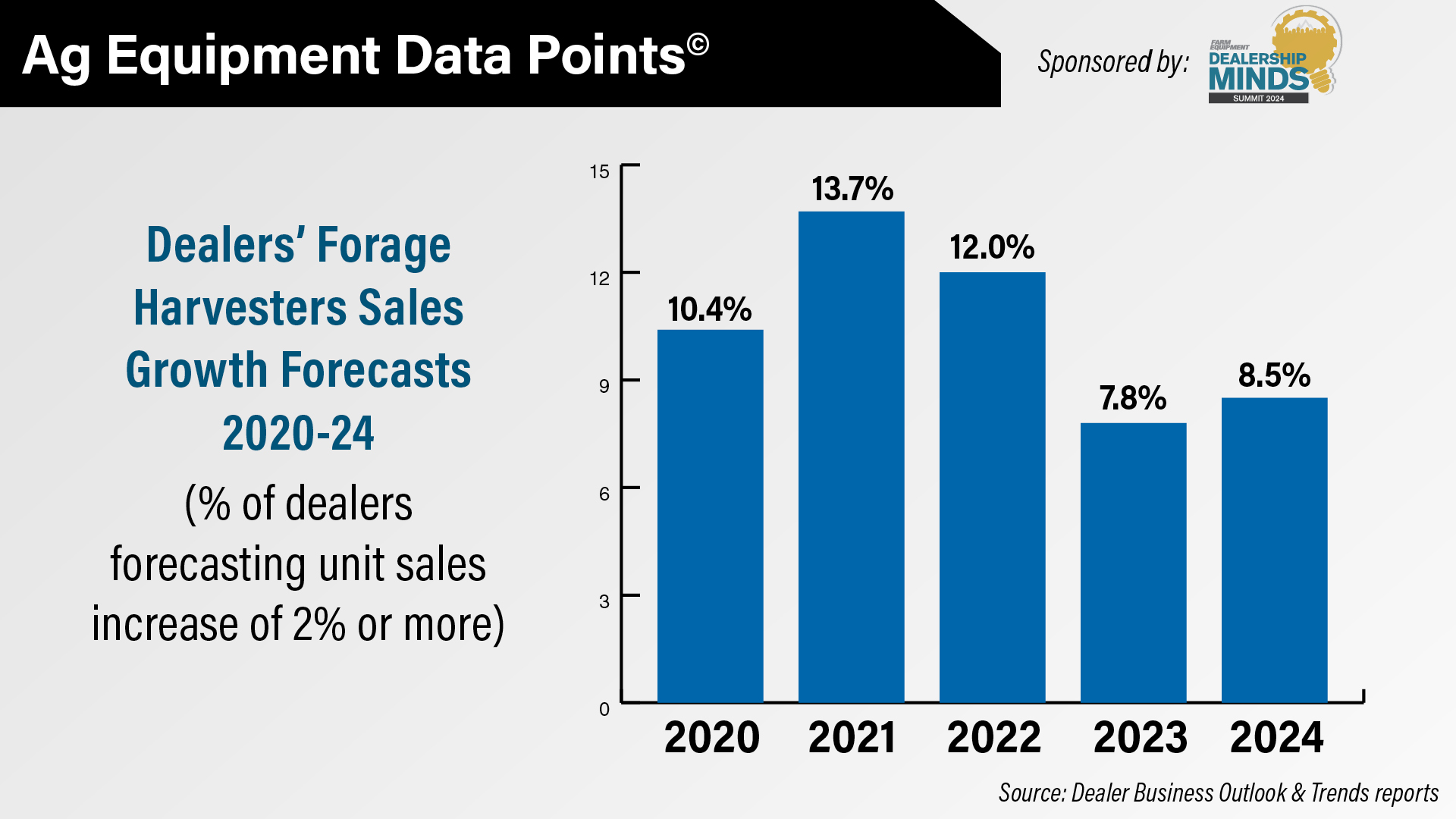

- DataPoint: Forage Harvester Sales

Big Dealer Consolidation Continues in 2024

The number of big dealers in North America dropped for the second year in a row as consolidation continues to impact the ag equipment industry. After rising to a record high of 214 big dealers in 2022, the industry now has 206 dealers with 5 or more ag equipment locations in the newly released 2024 Big Dealer Report. The total number of ag equipment stores owned by these big dealers increased as well for the second year in a row.

Deere once again has the most big dealers at 82, which is down from 86 in 2023 and 90 in 2022. The industry now has 22 big AGCO dealers, down from 23 in 2023. After dropping to 38 last year, the number of Case IH dealers rose to 41, and New Holland’s big dealers remained unchanged at 27. Kubota’s big dealers declined by 1 to 29. Looking at “Other” big dealers, which includes company-owned and shortline-only dealerships, that number rose to 21 in 2024.

Compared to 2020, the total number of big dealers in the industry is up 8% from 191, with only John Deere showing a decline: down 15% from 96 in 2020. New Holland and Kubota have seen the largest increases since 2020, up 29% and 71% respectively.

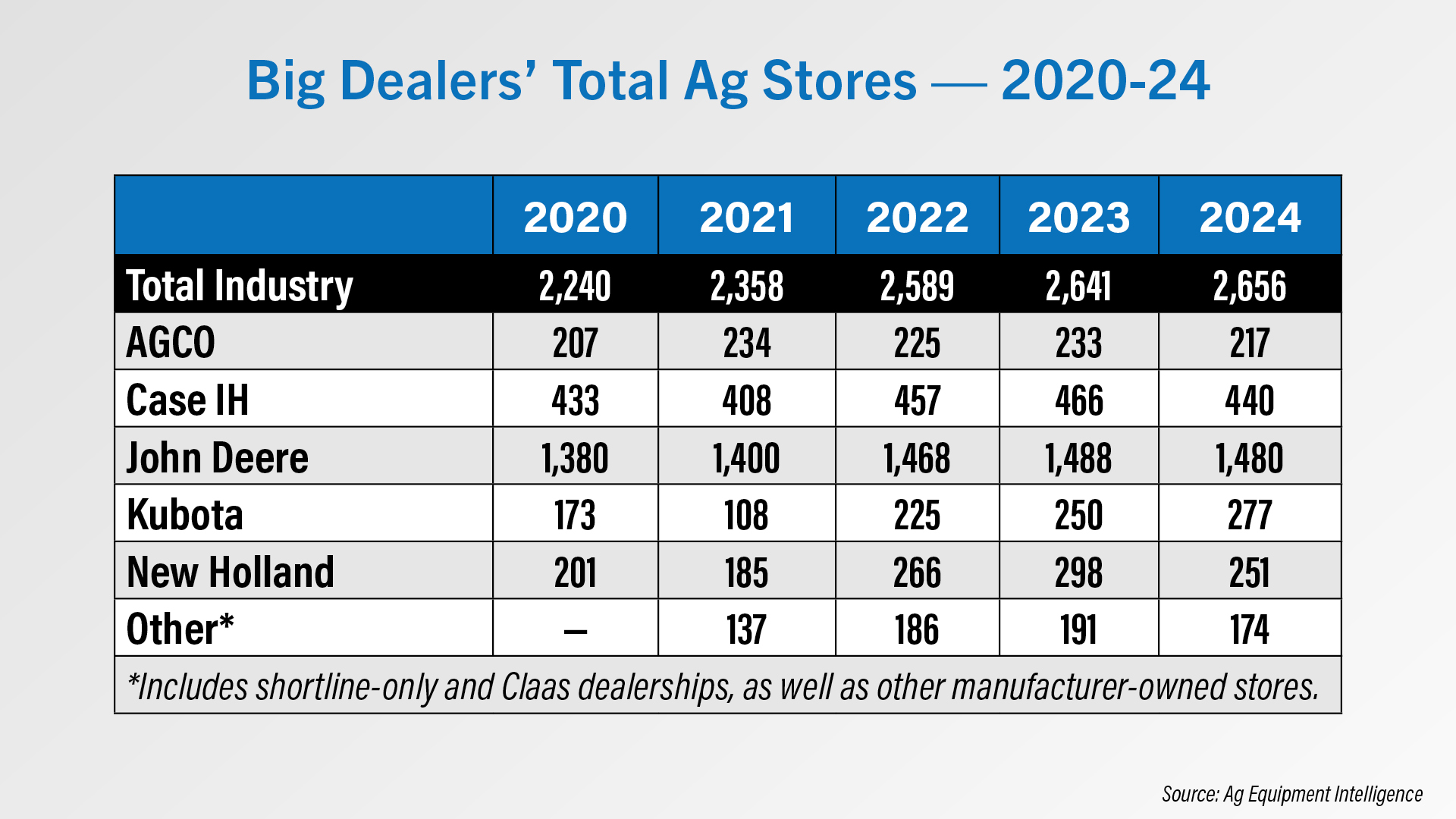

In 2024, there are 2,656 total industry ag stores owned by big dealers, up from 2,641 last year. John Deere big dealers now own a total of 1,480 ag equipment locations, down slightly from 1,488 last year. Case IH big dealers operate 440 total ag stores, which was down from 466 a year ago. AGCO big dealers have a total of 217 ag stores, down from 233 in 2023.

New Holland big dealers saw the largest percentage decrease in total ag stores: a 16% drop to 251 vs. 298 in 2023. Kubota big dealers went from 250 ag stores in 2023 to 277 in 2024, the only big dealers by brand to see an increase in ag stores.

Compared to 2020, big dealers for every brand have seen an increase in their total ag stores, and the industry total is up 19%. Case IH big dealers had the smallest increase in ag stores at 2%, followed by AGCO big dealers at 5%. The number of ag stores owned by big Deere dealers rose 7% since 2020 and rose 25% for New Holland big dealers.

One trend noted in the 2024 report is non-contiguous acquisitions, where big dealers jump to different parts of the U.S., like Missouri-based SN Partners’ acquisition of New York dealer Cazenovia Equipment.

George Russell, founding member of the Machinery Advisors Consortium and consultant on the Big Dealer Report since 2011, believes non-contiguous M&A will become more common in the coming years, pointing to several large dealership groups that have made these types of acquisitions in the past.

“That's what you saw with Hutson — and they were your Dealer of the Year — but before that was, even though Deere considers them separately, but you're familiar with the Roder family that owned the 4Rivers in Colorado and Wyoming, and James River in the Southeast? Now that's been cleaned up on the ag side with 21st Century buying the 4Rivers ag stuff. But that just shows you that Deere has that model.”

“These large industrial organizations, once they develop a core competency, they have that capability of going and taking over and plugging their processes and their people and their manufacturer relationships and moving the needle for OEMs.”

The 2024 Big Dealer Report is now available for purchase at AgEquipmentIntelligence.com

Dealers on the Move

This week’s Dealers on the Move include Farm-Rite Equipment, Parallel Ag and Mountain View Equipment. Minnesota Bobcat dealer Farm-Rite Equipment opened its newly expanded Willmar location on April 5. A.C. McCartney announced April 26 it will join the Parallel Ag family of dealerships. A.C. McCartney ‘s name will remain unchanged and the merger increases Parallel Ag’s family of dealerships to 17 stores across Texas, Oklahoma, Kansas, Missouri, Iowa, Minnesota and Illinois. And four-store Claas dealer Mountain View Equipment Co. recently moved into its new facility in Jerome, Idaho.

Farmer Takes Retrofit Route with Smart Sprayer in 2024

It’s planting season, which means a lot of the technology we spotlight on this program is being used in the field as we speak. I paid a visit to Eagle, Wis., farmer Tyler Troiola who’s using John Deere See and Spray for the first time this growing season. He says it took his dealer about 2 solid weeks to install the system on his 2018 John Deere sprayer.

“It's the Premium kit. So, I bought a used John Deere sprayer. It's not new so you can't get Ultimate on anything that's not from the factory. So, it's a Premium system that they added on. I think the Ultimate is the better system, but it wasn't in my budget. So, we're going to start with the Premium and go from there.”

“I'm kind of hoping that it'll pay for the difference from the sprayer I traded into this sprayer. I kind of hope it'll not in the first year, but over the depreciation schedule or the life of the sprayer, I'm hoping that the chemical savings will pay for the cost of the technology. I'm not really looking at it from a custom spraying standpoint, but more from just a farmer standpoint. If you can save X amount of dollars on your chemicals every year, you should be able to apply that to the technology and invest in technology instead of invest in a jug of chemicals.”

Troiola broadcast applied herbicide with the sprayer before planting. He’s going to use See and Spray on his second pass to target weeds sometime in June, and he says technicians from his dealership, Sloan Implement, will help calibrate the system beforehand. We’ll check back in with him this summer to see how it works.

CNH Industrial Ag Sales Down in 1Q24

CNH Industrial’s first quarter ag net sales were down 14% year-over-year to $3.4 billion, mainly due to lower industry demand and dealer inventory management.

According to the earnings report released May 2, agriculture net sales for the quarter fell back to levels seen in the first quarter of 2022, though remained about ag net sales for the first quarters of 2020 and 2021.

CNH Industrial also reported first quarter dealer inventories were up compared to Q4 of 2023 for both tractors and combines, while unit production in the first quarter outpaced retail activity in both those categories.

In a note to investors, J.P. Morgan's Tami Zakaria said CNH Industrial’s restructuring program is on track to be completed during its second quarter, saying:

"Previously, CNHI announced an immediate restructuring program to reduce its salaried workforce by 5%. It also unveiled its plan to right-size its cost structure. These two initiatives are expected to reduce total selling, general, and administrative expenses (SG&A) by a 10-15% run-rate. CNHI reduced its SG&A expenses by around 12% year-over-year in the first quarter as management imposed strict discipline on discretionary spending, expanded support operations to lower-cost countries and rationalized back-office operations.”

Zakaria also noted that the company fell short of decreasing dealer inventory to its desired levels during the quarter. While the company looks to complete dealer inventory cuts during Q2, she said it could potentially carry into Q3

AGCO Combine & Application Eq. Sales Down 30% in 1Q24

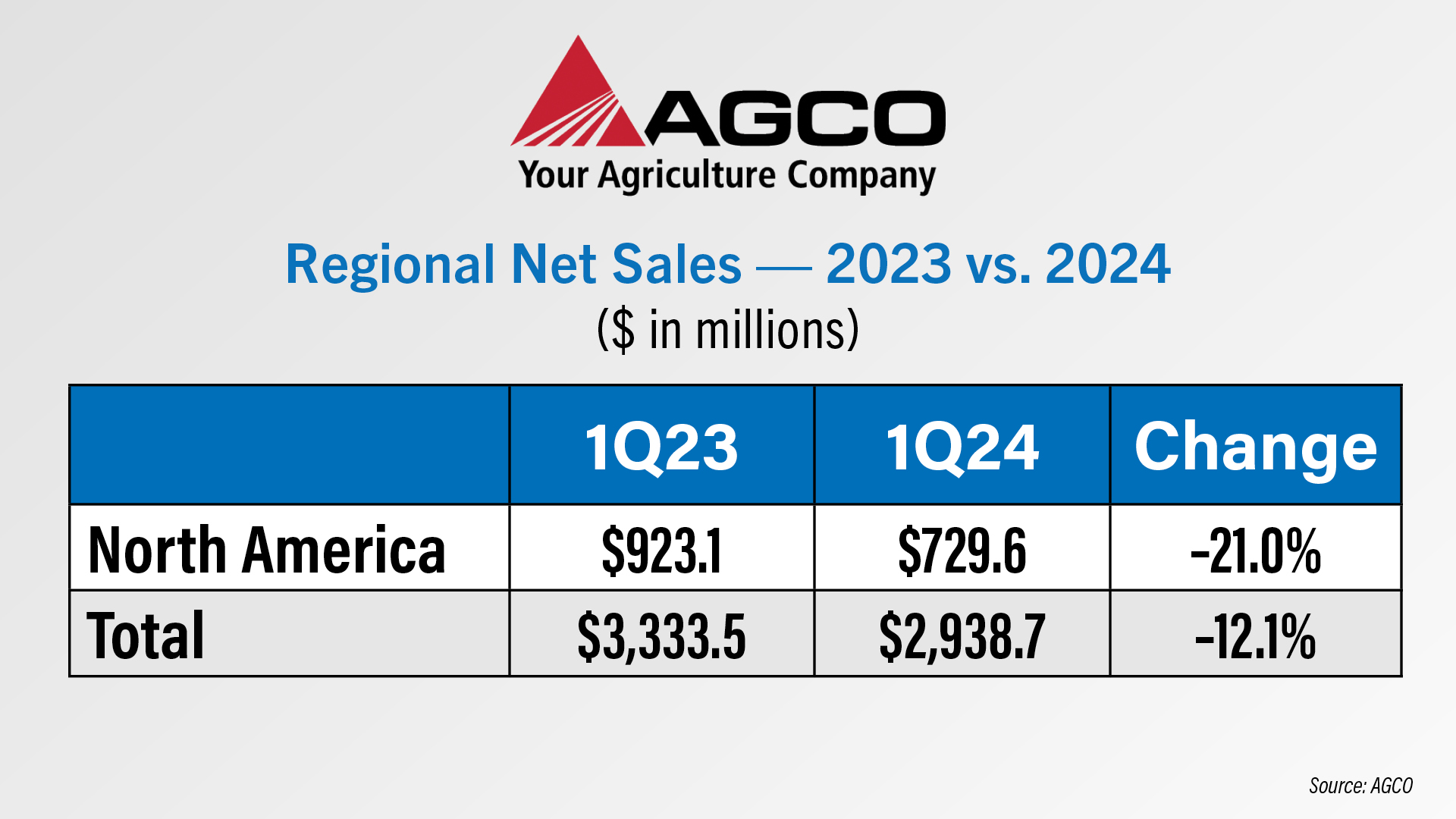

AGCO reported net sales of $2.9 billion for its first quarter, a decrease of 12% year-over-year.

This was down 12% from over $3.3 billion in AGCO first quarter of 2023. Net sales from North America specifically brought in $730 million for the first quarter of 2024, down 21% from last year. AGCO reported that softer industry sales and lower end market demand were partially offset by positive pricing. Its most significant sales declines were in hay equipment, mid-range tractor and combines.

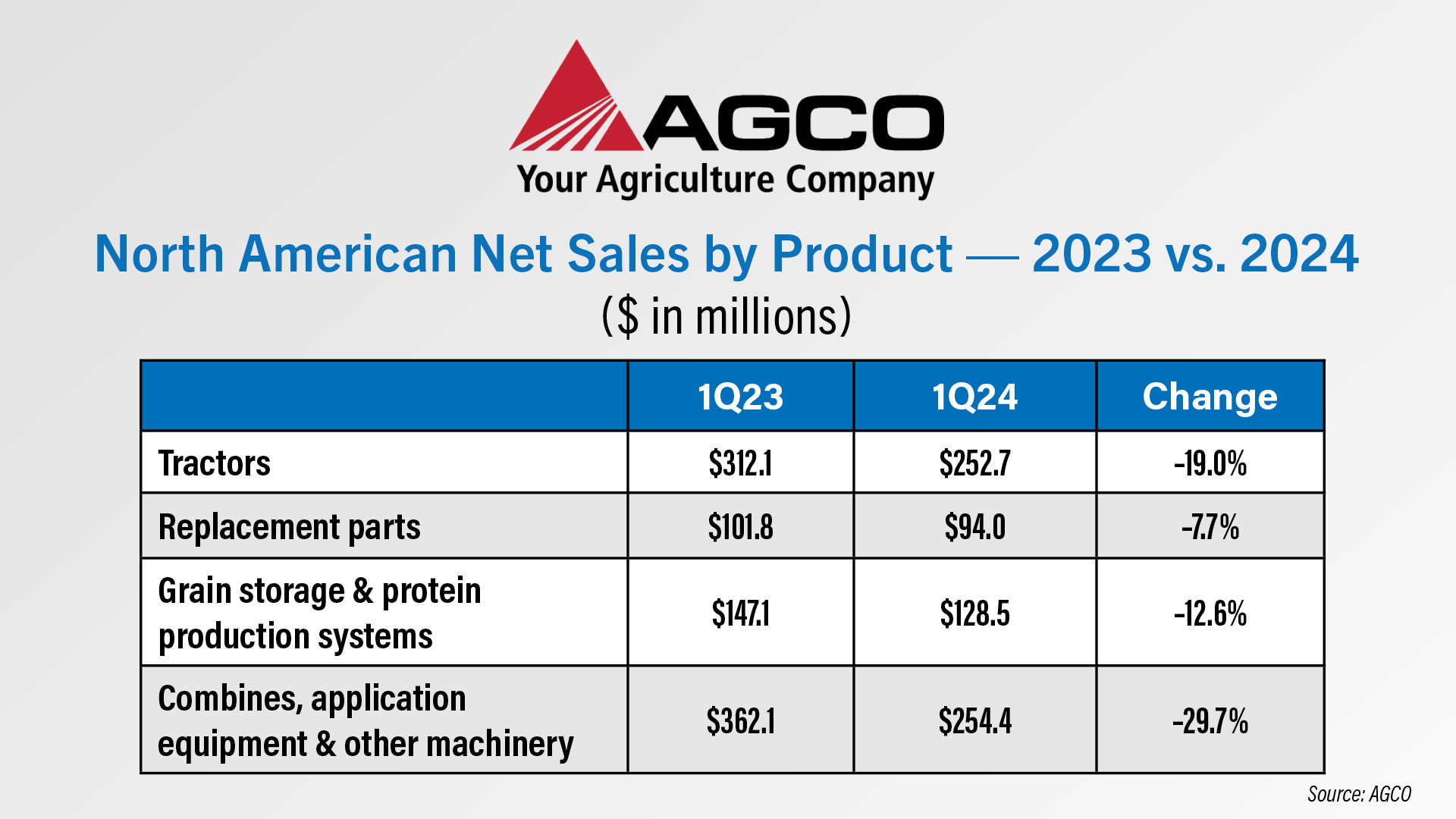

By product segment, AGCO’s biggest sales decline in North America was in combines, application equipment and other machinery, which was down almost 30% to $254 million in the first quarter of this year. Tractor sales were down 19% year-over-year to $253 million and grain storage and protein production systems sales were down 13%. Replacement parts saw the smallest decline at 7.7%.

In a note to investors, J.P. Morgan's Tami Zakaria said production cuts and destocking continue, but AGCO's order books remain "relatively health." She continued,

"Management noted that it is ‘aggressively’ managing dealer inventory to align with softening retail demand. By Q4, it expects production levels to match retail demand across regions, as it continues to destock the dealer channel."

AGCO's net sales for 2024, including the positive impact of its new joint venture with Trimble, are expected to be approximately $13.5 billion.

UK New Holland Tractor Plant Hit with Union Strike

500 union employees at CNH Industrial’s Basildon, UK, plant will strike periodically throughout May in response to a pay increase dispute, according to Unite, the union representing those workers.

The union claims CNH Industrial has offered a 4% pay increase for 2024, despite an agreement struck in 2022 that dedicated pay increases would be calculated by the average rate of inflation over the year, which would be 7.4%. Striking workers, which make up nearly the entire factory shopfloor, will strike on 9 days through May, with more strikes to be scheduled if the dispute is not resolved.

The UK strike could impact the international supply of New Holland T6 tractors, which are built solely at the Basildon plant. This plant also manufactures the T7 tractor line, though that tractor is also produced at New Holland’s St. Valentin plant in Austria. In a statement to BBC, a New Holland spokesperson said the company was "disappointed" about the decision, but it did not foresee any disruption to its tractor supply. The Basildon plant is also where New Holland’s T6 methane tractor is produced, which hit the North American market in 2022.

CNH Industrial just recently avoided a strike at its Fargo, N.D., plant, when it reached an agreement with union members on the morning of May 4 after workers rejected the company’s initial offer.

DataPoint: Forage Harvester Sales

This week’s DataPoint is brought to you by the 2024 Dealership Minds Summit.

The percentage of dealers forecasting sales growth of 2% or more for forage harvesters rose to 8.5% for 2024, according to the latest Dealer Business Outlook & Trends report. This percentage peaked in the last 5 years when almost 14% of dealers were forecasting unit sales growth for 2021.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.