ARMSTRONG, Iowa — Art's Way Manufacturing Co. (NASDAQ: ARTW), a diversified manufacturer and distributor of equipment serving agricultural, research and steel cutting needs, announces its financial results for the third quarter and year-to-date fiscal 2019.

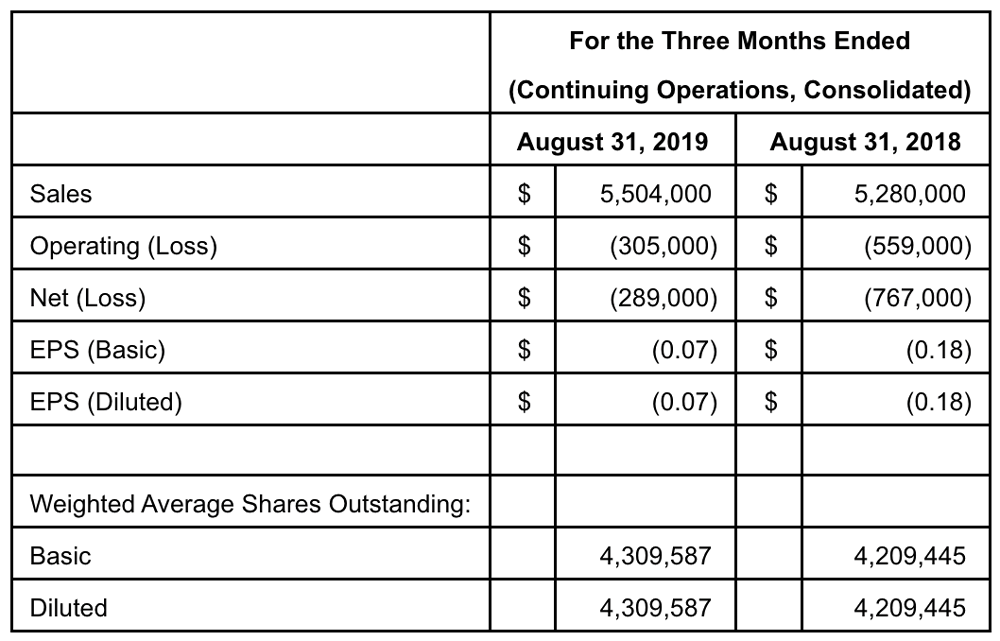

Sales: Our consolidated corporate sales for continuing operations for the three- and nine-month periods ended August 31, 2019 were $5,504,000 and $15,375,000, respectively, compared to $5,280,000 and $15,940,000 during the same respective periods in fiscal 2018, a $224,000, or 4.2%, increase for the three months and a $565,000, or 3.5%, decrease for the nine months. Our three-month increase in revenue is largely attributable to an $8.5 million project in our modular buildings segment that began in the spring of 2019 and increased lease revenue from modular building rentals. The $8.5 million project is approximately 31% complete and is expected to carry over into the spring of 2020. Our agricultural products and tools segments both saw decreases in revenues in the third quarter of fiscal 2019. The three-month decrease in agricultural products revenue is due to crop uncertainty driven by spring flooding across the United States. Many farmers planted on historically late dates during the 2019 planting season, which drove a decrease in demand for our portable feed equipment.

Our nine-month decrease in consolidated sales is primarily due to decreased revenue in the agricultural products and tools segments. The year-to-date agricultural products decrease is due to decreased demand for portable feed equipment, forage and receiver boxes, and UHC reels. Additionally, the liquidation of our Canadian subsidiary accounted for a decrease of approximately $420,000 in sales in fiscal 2019. Moreover, our year-to-date fiscal 2018 revenue reflects liquidation of an old model of manure spreader, which was sold at a decreased margin, and OEM blower revenue of approximately $262,000 that was not repeated in fiscal 2019 as our OEM blower customer elected not to purchase any blowers from us in 2019 due to slow-moving inventory on their dealer lots relating to poor agricultural market conditions. Despite the overall sales decrease, we did see increased sales for the nine months ended August 31, 2019 in land maintenance equipment, plows, beet equipment, bale processors and dump boxes compared to the same period in fiscal 2018. Our tools segment saw a decrease over the nine months due to the loss of a large volume customer at the end of the first quarter of fiscal 2018. Our modular buildings segment showed increased revenue year to date from the progress on an $8.5 million project and from increased modular buildings rental income.

Consolidated gross margin for the three-month period ended August 31, 2019 was 18.3% compared to 22.3% for the same period in fiscal 2018. Consolidated gross margin for the nine-month period ended August 31, 2019 was 16.7% compared to 21.6% for the same period in fiscal 2018. Our agricultural products segment contributed to a decrease in gross margin in fiscal 2019 due to lower revenues with less variable margin to absorb fixed costs coupled with labor inefficiencies in our plant. With the absence of steady demand for portable feed equipment, our most efficient equipment to build, we have struggled to gain operational efficiencies gained by continued production of a single product. Our efficiency has also been affected by the diversion of direct labor for operational changes that will have long-term benefits. We have partially completed warehouse reorganization, which we expect will improve inventory accuracy and decrease travel time for material handlers and machine operators. We have also implemented a material review board to decrease scrap and eliminate production errors. We believe our continued operational improvement projects will put us in a position to meet increased demand in an improved agriculture economy. Our tools segment also showed decreased gross margin for the nine months, largely due to lower revenues with less variable margin to absorb fixed costs. Our modular buildings segment improved our gross margin from a year ago due to increased revenue from leasing and modular construction providing more variable margin to cover fixed costs.

(Loss) from Continuing Operations: Consolidated net (loss) from continuing operations before income taxes was $(370,000) for the three-month period and $(1,610,000) for the nine-month period ended August 31, 2019 compared to net (loss) from continuing operations before income taxes of $(949,000) and $(2,034,000) for the same respective periods in fiscal 2018. The decrease in our net (loss) for the quarter and year-to-date is primarily related to the success of our modular buildings segment on an $8.5 million project and elimination of indirect positions at our agricultural products segment. In the third quarter of fiscal 2018, we also incurred costs of $520,000 related to the impairment and mold remediation of our West Union Facility, which were not repeated in 2019. We are committed to continuing our cost reductions and operational improvements to prepare for improving market conditions in the future.

(Loss) per Share from Continuing Operations: (Loss) per basic and diluted share from continuing operations for the third quarter of fiscal 2019 was $(0.07), compared to (loss) per basic and diluted share from continuing operations of $(0.18) for the same period in fiscal 2018. (Loss) per basic and diluted share from continuing operations for the nine months ended August 31, 2019 was $(0.29), compared to (loss) per basic and diluted share from continuing operations of $(0.47) for the same period in fiscal 2018.

Chairman of the Art's Way Board of Directors, Marc H. McConnell reports, "While it is clear that unfavorable market conditions and uncertainty continue to impact our business, we are pleased to see top line growth for the third quarter, driven by our Art's Way Scientific business. We continue to see strong backlog and ongoing demand in this business and have experienced the benefits of diversification helping the company overall. While consolidated profitability remained elusive in the third quarter of fiscal 2019, we continued to make operational