From AgriBank’s May 2015 Insights newsletter

The current market conditions and resulting long-run forecasts suggest we are in the beginning of a down cycle in economic returns primarily for crop production, the largest segment of agriculture across the 15-state AgriBank District. Lower receipts and higher expenses have led to a decline in current and projected net farm income. While strong balance sheets give individual producers a window of opportunity to adjust to changing market conditions, the ultimate solution?in times of tighter margins must involve bringing income and expenses in line. Historically, the successful implementation of this solution must start with implementing a higher level of operational efficiency that drives down the?cost per unit of production. If current price forecasts are correct, enhancing gross receipts will be very difficult, but pricing opportunities will still present themselves. Adept marketing and risk management by producers will still have a substantive payoff in this economic environment.

Note our use of cost per unit (or bushel) of production as distinguished from total cost of production. Some avenues exist whereby total cost of production may increase but unit production increases enough so that cost per unit?of production decreases. An example of this would be implementing new machinery technologies or seed genetics.

Corn: Reducing the Cost Per Bushel of Production

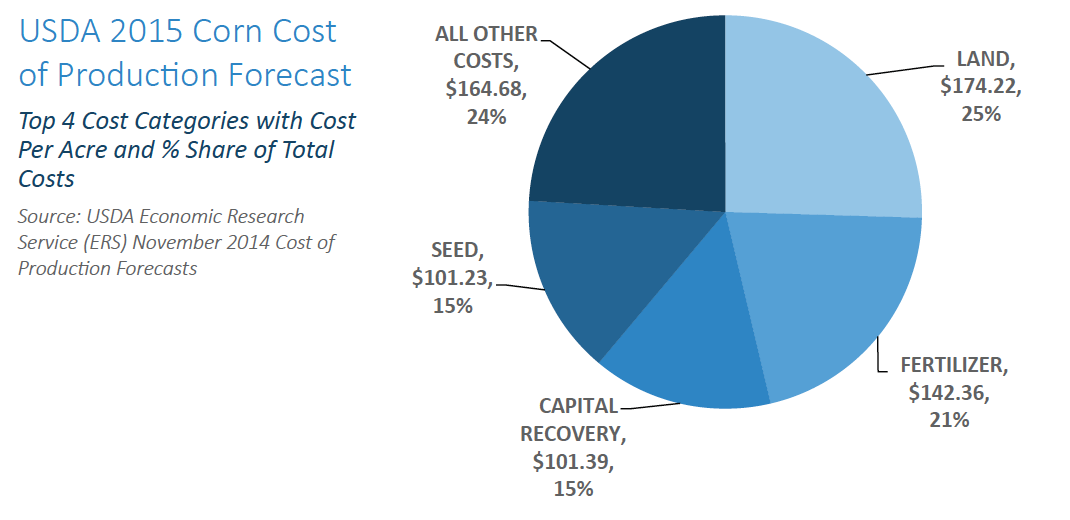

Producers can begin by focusing on achieving efficiencies in the largest cost categories for the commodities they produce. In these categories, even a small increase in efficiency can result in a significant reduction in the cost per bushel of production.

Consider corn, the largest crop in terms of total production in the AgriBank District. The accompanying pie chart shows the USDA 2015 forecast for corn cost of production. The top four cost categories, by share of total costs per acre, are land, fertilizer, capital recovery (i.e., depreciation on buildings, machinery and equipment) and seed.

The greatest opportunity for corn producers is to become more efficient in their cost of land, fertilizer, buildings, machinery and equipment and seed. If you’re a corn producer, you need to answer some tough questions. Are you in a position to negotiate more favorable terms to rent cropland? What is the trade-off on your fields between fertilizer/chemical usage and the choice of seed (genetically modified or not)? Would it be more cost-effective to delay purchases of new equipment when compared to the anticipated maintenance costs for new equipment? Could use of precision farming and Enterprise Resource Planning (ERP) improve your productivity and realize enough cost savings to justify the investment? The answers to these and related questions likely will be different for each producer, depending on their unique circumstances.

The USDA forecasts for net farm income don’t account for any “shocks” to the system such as weather events. Nor do they account for changes in producer behavior. Producers should not accept the forecasts as inevitable. They can help shape the future — and potentially do better than the forecasts — if they can reduce their cost structure on a per unit basis.

About AgriBank

AgriBank is one of the largest banks within the national Farm Credit System, with more than $90 billion in total assets. Under the Farm Credit System’s cooperative structure, AgriBank is primarily owned by 17 affiliated Farm Credit Associations. The AgriBank District covers America’s Midwest, a 15-state area stretching from Wyoming to Ohio and Minnesota to Arkansas. About half of the nation’s cropland is located within the AgriBank District, providing the Bank and its Association owners with expertise in production agriculture. For more information, visit www.AgriBank.com.