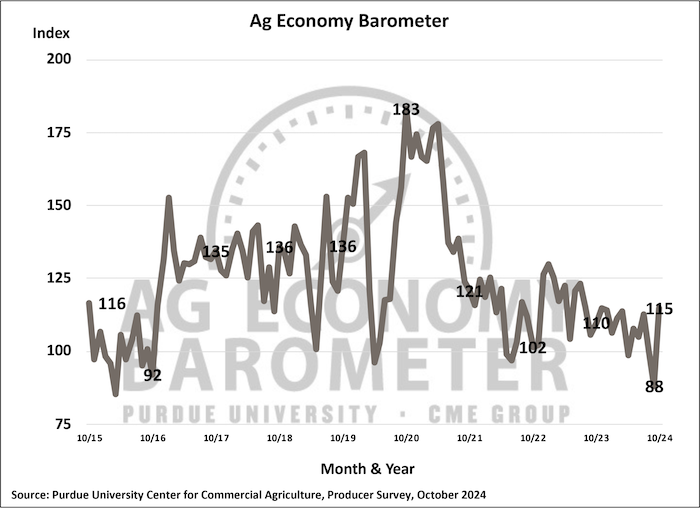

October provided a surprising pre-election bounce in farmer sentiment as the Purdue University-CME Group Ag Economy Barometer index climbed to 115, 27 points higher than in September. The biggest driver of the sentiment improvement was an increase in producers’ confidence in the future, as the Future Expectations Index jumped 30 points to 124. The Current Conditions Index also rose in October but by a smaller amount. With a reading of 95, the Current Conditions Index confirmed that farmers think economic conditions this year are worse than last year and weaker than during the barometer’s base period of 2015-2016, which was in the early days of a multi-year downturn in the U.S. farm economy. Producers this month expressed some optimism that economic conditions will improve and not precipitate an extended downturn in the farm economy. The October barometer survey took place from October 14-18, 2024.

The overall improvement in farmer sentiment is better understood by examining responses to the individual questions used to generate the barometer. Much of the sentiment improvement was attributable to producers possessing a less pessimistic view of the U.S. agricultural economy. For example, the percentage of producers who expect bad times for the U.S. agricultural economy in the upcoming year declined from 73% of respondents in September to 53% in October. Similarly, the percentage of producers who expect bad times for U.S. agriculture in the next 5 years fell from 48% to 33%. Looking at a related question, fewer producers this month said they expect their farm’s financial condition to worsen over the next 12 months, with just 23% looking for conditions to worsen compared to 38% who felt that way in September. However, despite the improvement in the main barometer indices, it’s clear producers financial situation deteriorated in 2024. For example, over half (56%) of the October respondents said their farm’s financial condition was worse than a year earlier. That was lower than reported in September but matches the response to this question in August.

The last question on each month’s survey provides respondents with an open-ended question asking them to share what’s on their minds. Figure 3 is a word cloud representation of responses received in the October survey. Unsurprisingly, politics was mentioned quite often, with the elections looming just a few weeks into the future. Perhaps more importantly, it’s clear that many producers were thinking about possible policy shifts that could impact their farms and the agricultural economy. Mentions of regulation, environment, and taxes were featured prominently, along with concerns about prices. When asked explicitly about their biggest concerns for the upcoming year, producers still point to higher input costs and lower output prices as their biggest concerns. The trend of fewer producers citing interest rates as a top concern continued this month. Just 15% of producers, down from as much as 26% of producers in late 2023, chose interest rates as one of their biggest concerns in October.

One of the biggest surprises arising from this month’s survey was the increase in the Farm Financial Performance Index. The index is based upon a question that says, “As of today, do you expect your farm’s financial performance in the next 12 months to be better than, worse than, or about the same as in the past 12 months.” The October reading of 90 jumped 22 points above September’s and was just 2 points lower than a year earlier. High fall crop yields and a stress-free fall harvest season in the Corn Belt and Plains states likely contributed to the index’s rise. However, those two factors alone don’t account for the index’s sharp rise. The index’s improvement provides another indication that farmers’ optimism about the future shifted in October, leading to an expectation of better financial performance in 2025 than in 2024. Coincident with the rise in the financial index was a modest improvement in the Farm Capital Investment Index,which, at 42, was 7 points higher than in September, another signal that producers in October might be viewing 2024’s weak income prospects as transitory.

The Short-Term Farmland Value Expectations Index tends to be correlated with financial performance expectations, and that was the case this month, with the index climbing up to 120, 25 points above the September reading. The long-term index also rose, improving to 159 versus 147 a month earlier. Once again, the rise in both farmland value expectation indices suggests that producers retain some optimism about the agricultural economy’s future strength, which, in turn, could support farmland values.

Wrapping Up

The October Ag Economy Barometer survey revealed a surprising rebound in U.S. farmer’s sentiment. In a survey taken just three weeks before the U.S. presidential election, the Future Expectations Index rose 30 points compared to a month earlier. The future expectations index upturn was correlated with improvements in farmers’ outlook for farmland values and a somewhat more optimistic view regarding investments in their farm operations. Producers still have reservations about current economic conditions on their farms since, despite this month’s rise, the Current Conditions Index remains below 100, which indicates farmers still have a weak view of their current situation. Comments provided by survey respondents this month indicate that politics and policy are top of mind for many U.S. farmers. The November barometer survey, to be conducted one week following the presidential election, will provide an update on how the election’s outcome affects producers’ outlook.