In this episode of On The Record, we take a look at the FWEDA/AED merger and other association M&A activity that led to this decision. In the Technology Corner, Noah Newman covers Horsch's recently debuted autonomous planter. Also in this episode: strip-till farmers' purchasing plans and analyst coverage of John Deere Financial's earnings.

This episode of On The Record is brought to you by Agrisolutions.

Improve performance and durability with a wide range of premium tillage parts and extended life solutions, with Agrisolutions. As the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting and fertilizing, Agrisolutions is proud of their purpose - to build and feed the world. To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- FWEDA Members Approve Merger with AED

- Dealers on the Move

- Horsch’s Autonomy Vision Comes to Life

- Fewer Strip-Tillers Planning Equipment Purchases for 2023

- Deere Financial Sees Declining 2Q23 Income, Lowers FY23 Forecast

- DataPoint: Manufacturing GDP Contribution

FWEDA Members Approve Merger with AED

On June 14th, the board of directors for the Far West Equipment Dealers Assn., also known as FWEDA, ratified a membership vote approving its merger with Associated Equipment Distributors, or AED.

Joani Woelfel, president and CEO of FWEDA, said that her organization had been in merger talks with AED since last year, after FWEDA rejected joining the merger of several regional dealer groups that would form NAEDA, or the North American Equipment Dealers Assn.

WEDA, the Western Equipment Dealers Assn., was one of the regional players that merged into NAEDA. FWEDA and WEDA were themselves in merger talks in 2016, but they ultimately failed. A few years later when WEDA became part of the group planning what would become the NAEDA merger, FWEDA’s board ultimately voted not to participate. According to Woelfel, other potential members, including the Pioneer Equipment Dealers Assn. and Montana Equipment Dealers Assn., also opted out of merging.

When it came to merging with AED, Woelfel said that “AED provides optimal benefits and resources for our members and the brightest outlook for the future.”

Brian McGuire, president and CEO of AED, said one such benefit will be AED efforts in advocating for dealer issues, such as right to repair.

“There hasn't been a state battle in the right to repair issue that AED has not been at the forefront of making sure that the dealer voice is heard by the legislators. State capital after state capital, our regional managers and our government affairs team have mobilized our members to make sure the message gets out on the right to repair legislation and the devastating effects some of these bills would have on the dealer network.”

FWEDA said its merger with AED is expected to be finalized by the end of August. According to Woelfel, FWEDA will be dissolved as part of the merger.

Dealers on the Move

This week’s Dealer on the Move is Fennig Equipment.

The Ohio shortline only dealer recently announced it has added the Deutz tractor line to its offering. This is the first tractor line for the dealership.

According to the dealership’s newsletter, it has “wrestled with the idea of diversity for a long time, saying no to many companies along the way, but Deutz stuck. A great company with a lot of knowledge and integrity that is motivated to show what they are made of."

Fennig will carry Deutz tractors from 65-340 horsepower and is hosting a Deutz exclusive field day on July 21.

Horsch’s Autonomy Vision Comes to Life

A project 20 years in the making became a reality, when Horsch debuted its autonomous planter at the Bahia Farm Show in Brazil last week, according to a report from Future Farming.

The Horsch Gantry RO G 500 is a self-propelled seeder with the ability to autonomously follow lines previously planned on the computer. It has a centralized motor unit, positioned above the planting rows. Traction is front and rear, with wheel spacing of 36 feet and 13 feet respectively. It also has central seed tanks with a total capacity of 3,170 gallons.

This story reminds me of a conversation we had with Lucas Horsch, CEO of Horsch in North America, at the National Farm Machinery Show earlier this year. We asked him about his vision for the future of the company, and he talked about the importance of learning from new technologies and farming practices in other countries, like Brazil.

“We have so many locations all over the world, we know all the farming practices. We adapted our products to the different worlds. We have a lot of context. Even tonight, we have some guys from Kazakhstan who are visiting us, and we made a dinner appointment.

We want to be a platform where everybody can learn from each other, and we can just exchange, and give some other perspective. Talking product is easy, it’s nothing very fun. Because in farming you always need to adapt, that’s the most important thing.”

We’ll continue to follow the development of the Horsch Gantry RO G 500 autonomous planter on PrecisionFarmingDealer.com.

Fewer Strip-Tillers Planning Equipment Purchases for 2023

According to the latest benchmark study from Strip Till Farmer, 2023 is going to see a smaller percentage of strip-till farmers purchasing equipment.

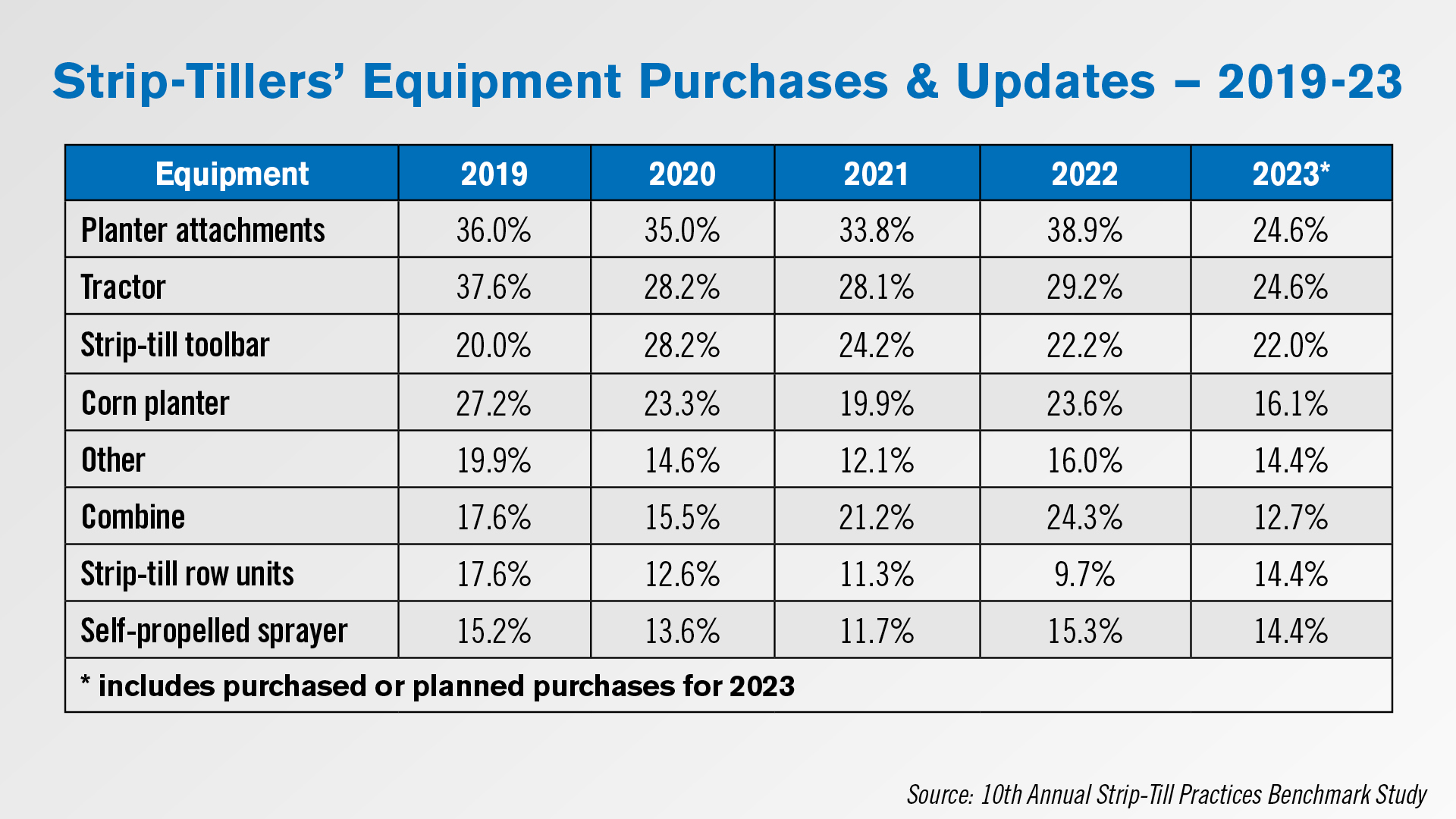

39% of strip-till farmers updated their planter attachments in 2022 or bought new ones, the highest percentage among all equipment categories. 25% forecast the same for 2023, marking a 5-year low.

Tractors and corn planters also saw declines in the percentage of farmers planning purchases, with both forecast to hit 5-year lows in 2023. The percentage of strip-tillers planning combine purchases or updates for 2023 came in at 12.7%, half of the 24.3% who reported the same for 2022.

Overall, 7 of the 8 equipment categories saw declines in the percentage of strip-tillers planning purchases for 2023 vs. 2022. The only category that saw an increase was strip-till row units, where 9.7% reported purchasing or updating them in 2022 and 14.4% forecast doing the same in 2023.

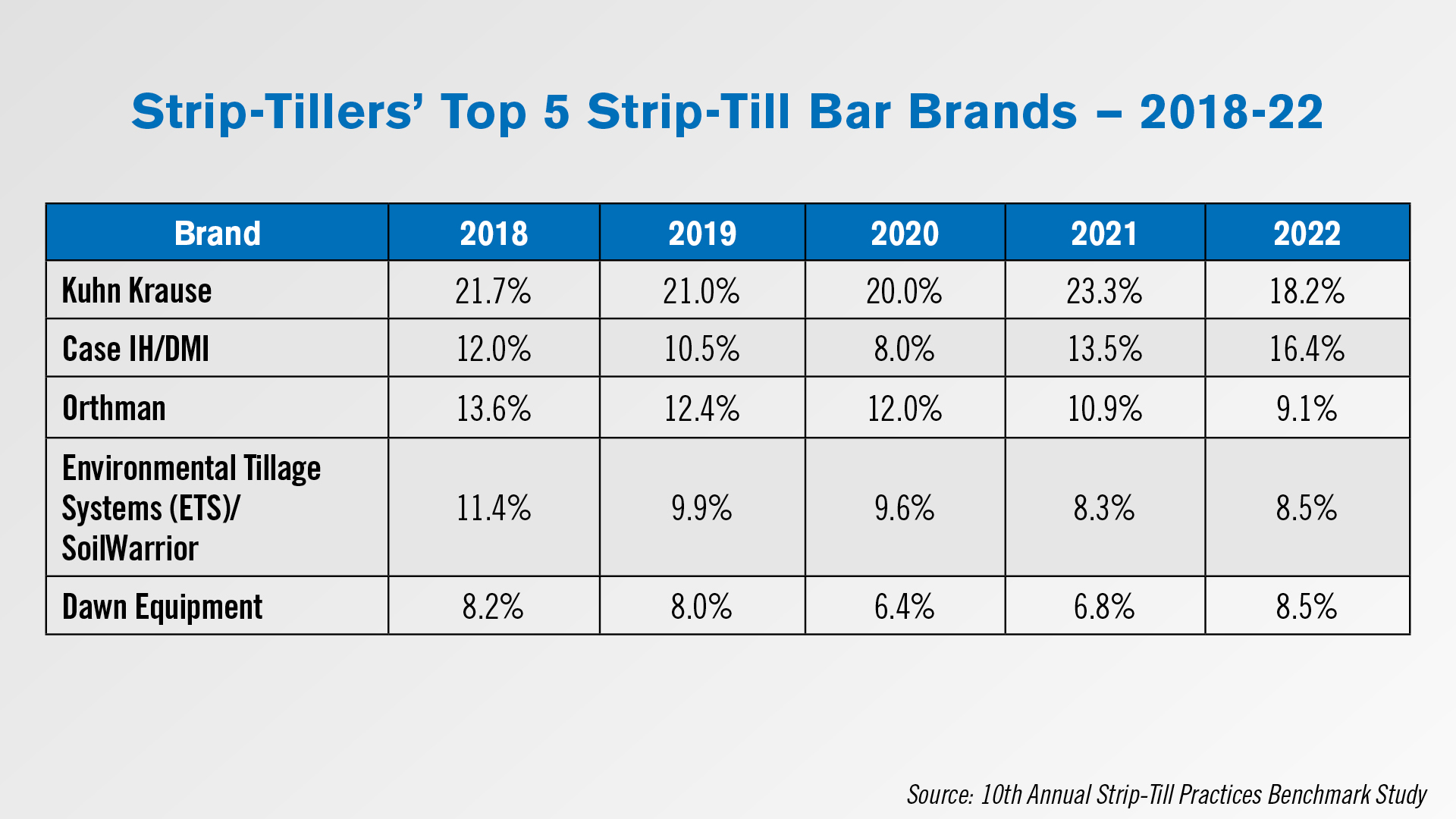

When asked what brand strip-till bar they’re using, Kuhn Krause remained the most popular option with 18.2% of growers indicating that as their brand. However, this was a 5-year low, down from 23.3% in 2021. Case IH/DMI, on the other hand, gained ground with 16.4% of strip-till farmers using that brand strip-till bar, a 5-year high. Orthman was the third-most selected brand at 9.1%, though this was also a 5-year low and the fourth year in a row of decline. ETS tied Dawn Equipment as the fourth-most popular brand. For Dawn, 8.5% was the highest percentage of strip-tillers using its toolbar in the last 5 years.

Deere Financial Sees Declining 2Q23 Income, Lowers FY23 Forecast

J.P. Morgan analysts updated their analysis on Deere’s Financial Services business on June 18, following Deere’s second quarter SEC filingc s earlier this month. The update said the portfolio performed well in the second quarter; equipment on operating lease was relatively flat, and delinquencies decreased sequentially.

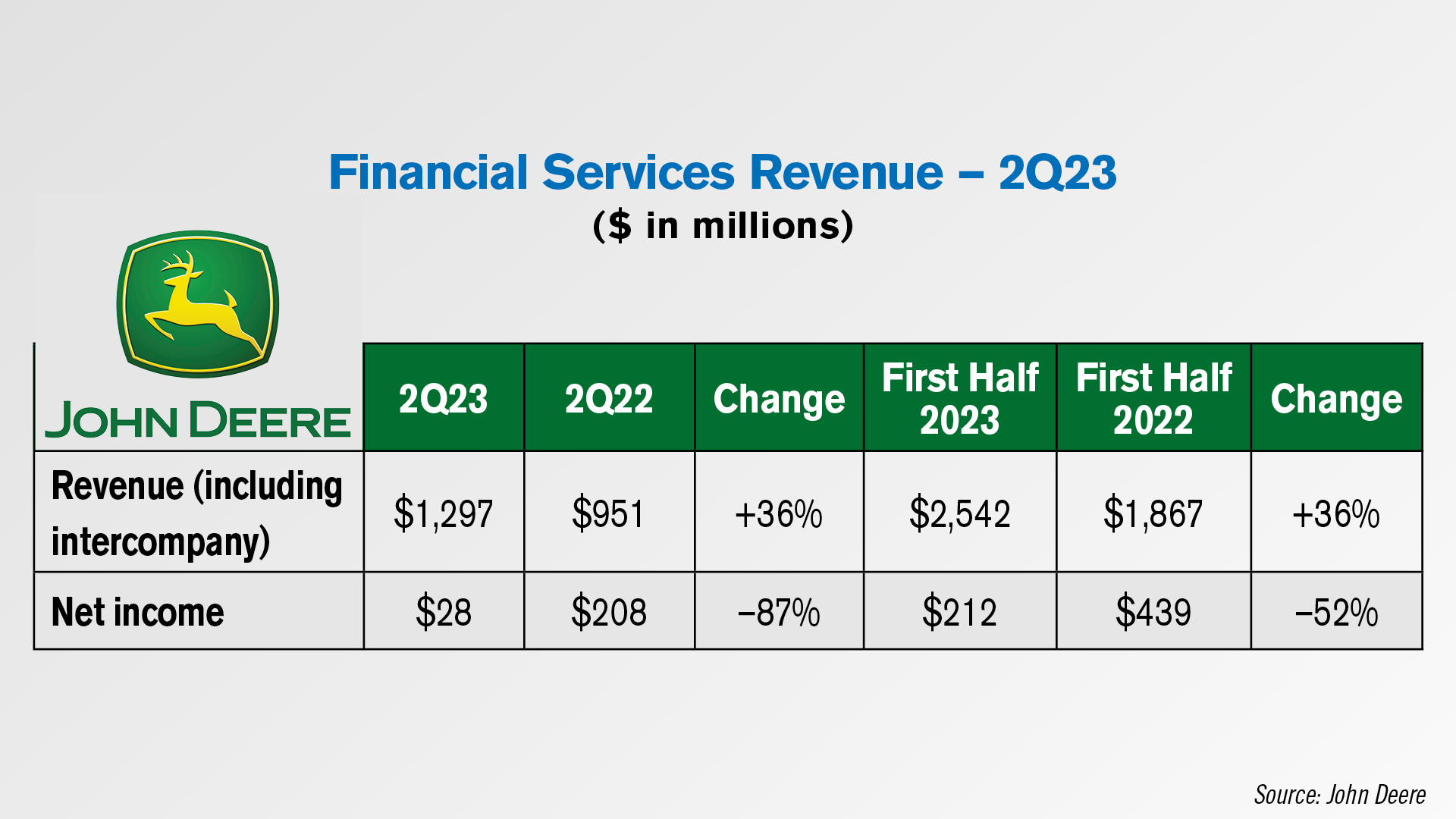

Net income for the Financial Services business, however, dropped 87% year-over-year in the second quarter to $28 million and was down 52% for the first 6 months of the year. Deere stated in its SEC filings that the lower net income was partially caused by a correction to the accounting treatment of its dealer incentives, resulting in a $135 million after-tax expense. Excluding the accounting change, net income was down 22% year-over-year. Revenue for the quarter rose 36% to $1.3 billion and up 36% for the first half of the year as well to $2.5 billion.

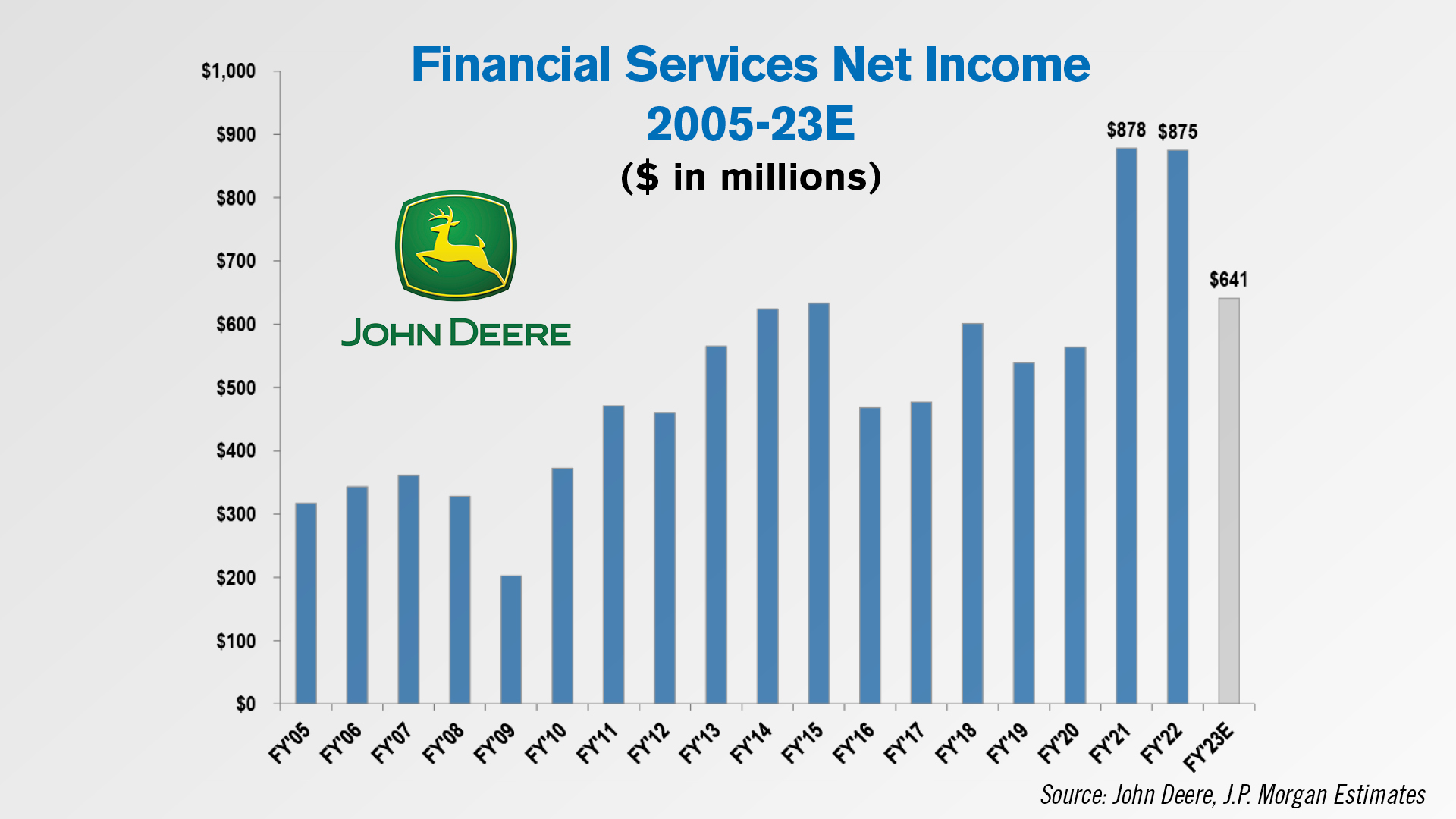

The decline in net income caused Deere to downgrade its outlook for Financial Services net income for the year from $820 million to $630 million. According to J.P. Morgan’s update, this revision implies a 28% year-over-year decline in net income in FY23. J.P. Morgan is estimating $641 million for Deere Financial’s 2023 net income, which would represent a 27% decline.

According to the authors of the update, the Financial Services business represented 7% of John Deere’s consolidated revenue and 1% of its net income in the second quarter, down from 11% and 33% at peak contribution in FY16 and FY15, respectively.

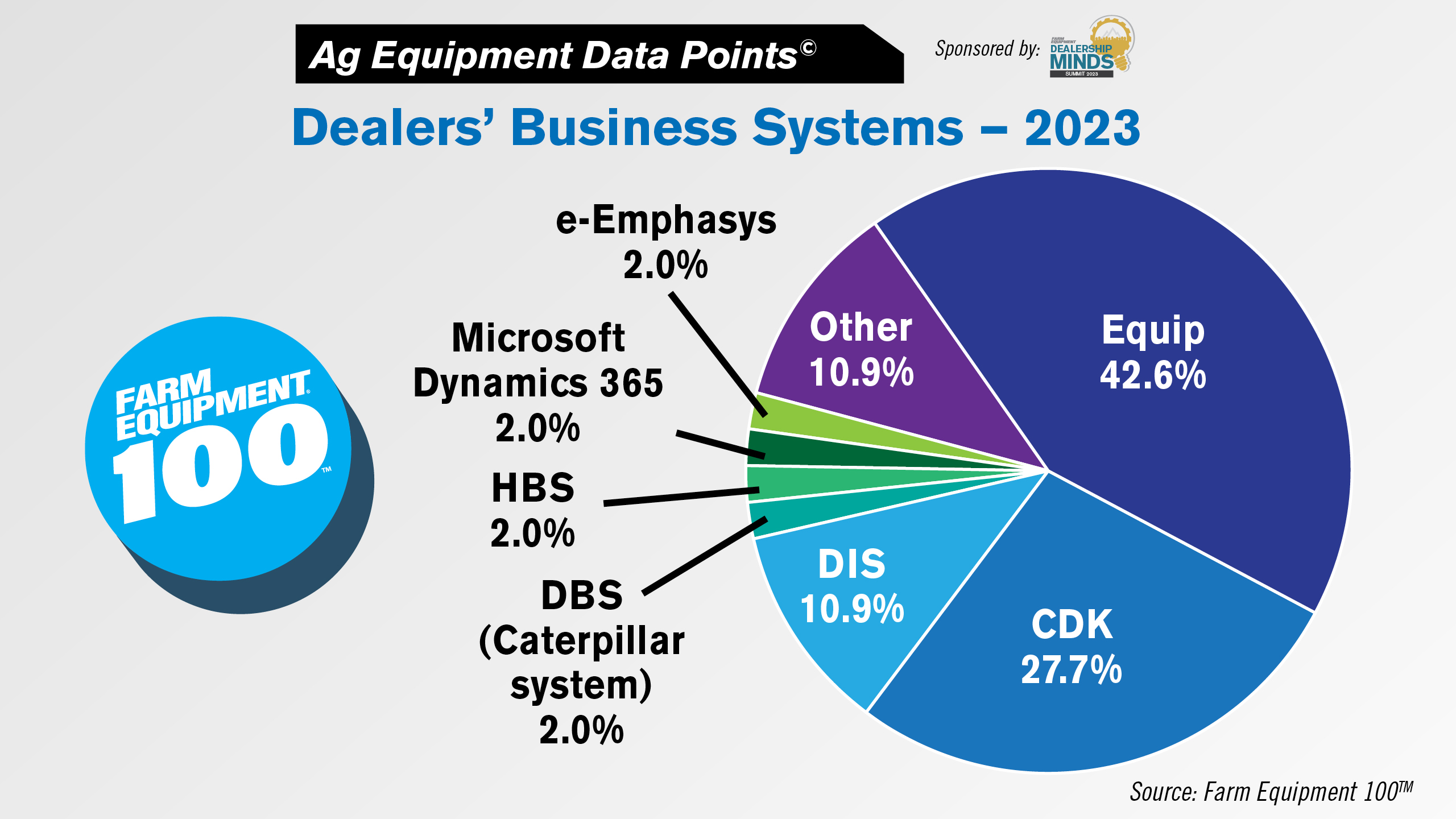

DataPoint: Top Ag Equipment Dealers’ Business Systems

This week’s DataPoint is brought to you by the Dealership Minds Summit.

In the recently released June issue of Farm Equipment, editors put together the Farm Equipment 100TM, a list of North American’s 100 largest ag equipment dealers and the details on their stores, product lines, employees, executives and business system software.

Among these top dealers, 43% used Equip, John Deere’s proprietary dealer business system. A little over 70% of Deere dealers on the Farm Equipment 100TM reported using Equip. CDK was the second-most used software at 28%, followed by DIS at 11%. Other business systems were used by 1 or 2 dealers, with the other category including systems such as Tandem, PowerEQ and AS400.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.