Rural equipment dealer confidence had been soaring for 2 years. Then 2020 happened — a year like most had never experienced. Uneven demand. Uncertain supply chains. Rising costs. Make no mistake, 2020 was a year that tested even the most battle-tested equipment dealers.

Many rural lifestyle equipment dealers passed the test with flying colors. With rural lifestylers spending even more time at home due to the pandemic, money historically spent on vacations and other outings was redirected toward home projects and products — including outdoor power equipment.

Outdoor Power Equipment Institute (OPEI) data shows that consumer lawn mower shipments were up 15% in 2020 while handheld products grew 17%. Commercial mower shipments dipped modestly (5%) as many landscape contractors acted cautiously, limiting capital expenditures while wrestling with rising operating costs. A strong rebound is expected this year, though, which will help deliver another healthy-growth year across the power equipment industry.

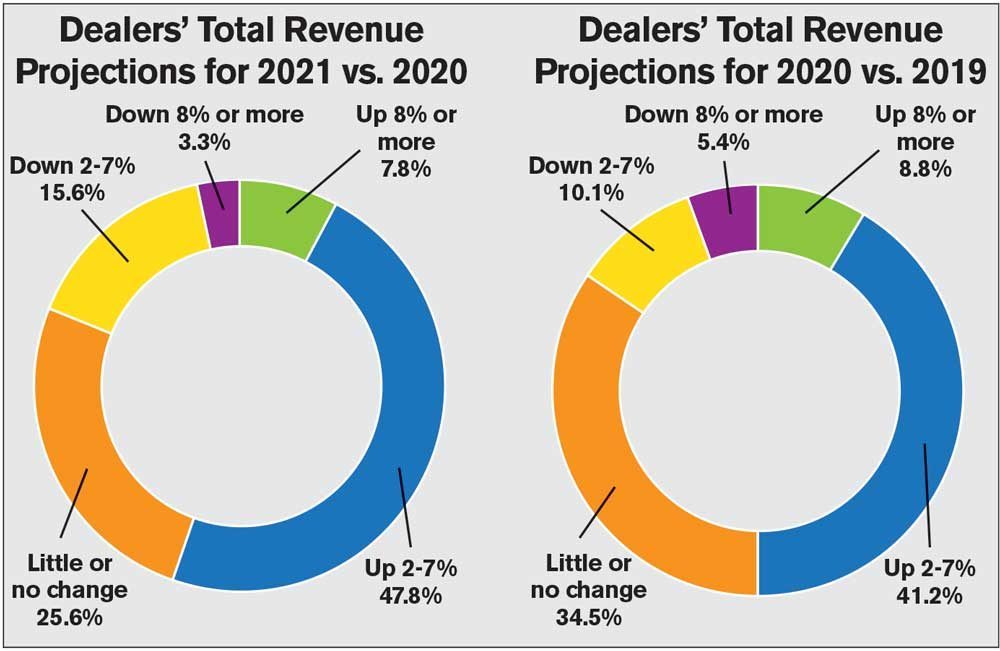

Rural equipment dealers can sense it. According to results from Rural Lifestyle Dealer’s annual Business Trends & Outlook surveys, 85% of dealers expected overall revenue to at least remain flat heading into 2019, and the same percentage felt that way heading into 2020. Now, after an especially strong year in 2020, roughly 81% of dealers expect overall revenue to remain flat or grow this year. Furthermore, more dealers are feeling better about their prospects for growth than last year at this time.

Aftermarket parts and service continues to be a big driver of dealership growth. Roughly 93% of dealers think aftermarket sales will at least remain flat this year. In fact, 60% are expecting an increase in sales, which nearly matches the strong 65% recording last year.