It has been nearly 6 years since North American farm equipment dealers expressed the level optimism about their revenue prospects as they have for 2018. In 2012, more than 55% of dealers expected revenues from the sales of new farm machinery to increase in the year ahead. By 2015, less than 20% of dealers held out hope for improved business levels for the coming year. This improved very little (22.4%) by 2017.

Looking ahead to 2018, more than double that percentage — 46.5% — are projecting revenues will improve by 2% or more next year, while only 16.9% are projecting further declines.

These projections are based on the responses of 229 ag machinery dealers across the U.S. and Canada to Farm Equipment’s annual Dealer Business Outlook & Trends survey. Dealers were polled during the last week of August and first two weeks of September. Along with dealers that carry the five major equipment brands — AGCO, Case IH, John Deere, Kubota and New Holland — this year’s survey also included dealers who carry Mahindra as their primary brand of tractor.

Breaking down the results further, 6.6% of dealers see revenues increasing by 8% or more in 2018 and 39.9% are projecting business levels to improve by 2-7%. A little over one-third of those responding expect revenues from new equipment sales to be flat during the year ahead.

This compares with last year’s survey results when only 4.2% of U.S. and Canadian dealers anticipated an increase in revenues of 8% or more a year ago and 18.2% who were forecasting gains of 2-7%. A year ago, nearly 45% of dealers were anticipating flat sales for 2017.

U.S. Outlook for New. There’s no doubt that U.S. dealers of farm machinery are far more optimistic moving into 2018 than they were a year ago. Twelve months ago, only 18.5% of dealers operating in the U.S. expected new equipment revenues to increase vs. a year earlier. This year nearly 47% of them are projecting increasing revenues — a difference of more than 28%.

Nearly one-half (46.2%) of North American farm equipment dealers expect revenues from the sale of new equipment to increase by 2% or more in 2018. This is up significantly over the previous year when only 22.4% of dealer projected higher revenues.

How much growth are U.S. dealers looking at in 2018? According to the survey results, 6.3% (vs. 3.8% last year) are forecasting increase of 8% or more. The remaining dealers, 40.6%, are calling for increases of 2-7%.

Last year at this time, less than 4% expected increases in revenues from new equipment sales to rise 8% or more. Another 14.7% of dealers forecasted increases in the 2-7% range.

Going into 2018, 35.4% expect flat sales of new machines. In the 2017 survey, 46% were calling for flat sales.

Canadian Outlook for New. Comparing the outlook for 2018 vs. a year ago, there’s little difference in the Canadian dealers’ view. Going into the new year, 44.7% of these dealers expect increased revenues for new equipment sales. Last year, 45.1% of Canadian dealers were forecasting an improvement in revenues.

For the year ahead, about 8% of Canadian dealers look for revenues to rise 8% or more vs. 6.4% last year. Another 37% see sales of new improving by 2-7%.

Slightly over 42% of these dealers are projecting flat revenues from sales of new machines in 2018. Last year, 38.8% were calling for flat revenues.

Only 13.2% of Canadian equipment sellers expect a fall off in new equipment revenues in 2018, with 7.9% expecting a drop of 2-7% and 5.3% looking at declines of 8% or more. This compares with 16.1% a year ago, with 9.7% anticipating a drop off of 2-7% and 6.4% looking at a decrease of 8% or more.

How Did North American Dealers Fare in 2017 vs. 2016?

Perhaps it’s due to the fact that dealers did better (much better?) in 2017 than they expected to that gives them a higher level of confidence going into 2018 than might be expected.

New Equipment Revenues. Asked how much better or worse they expected new equipment revenues to finish in 2017 vs. 2016, 40% of the dealers responding to Farm Equipment’s most recent Dealer Business Outlook & Trends survey reported that their revenues were up 2% or more in 2017. This compares with only 17.5% who projected a year ago that they would see increased revenues during 2016 of 2% or higher.

Nearly 16% of dealers said their revenues increased by 8% or more in the past year. Last year, less than 7% projected sales of 8% or better for 2017. More than 24% reported their sales revenues will have improved by 2-7% in the past year. A year ago, less than 11% forecast a revenue increase of 2-7%.

Last year at this time, nearly 61% of dealers said they expected revenues to decline in 2017. As this year winds down, only 35.3% of the 229 dealers responding to the survey this year estimate sales would decrease by 2% or more. This compares with more than 43% who projected declining sales revenues last year.

Used Equipment Revenues. Generally, dealers are doing better than expected when it comes to used equipment revenues, as well. Last year, 29.5% projected their 2017 revenues from used equipment sales would increase. At this point, 42.7% of dealers expect used equipment sales to improve compared to 2016.

Nearly 17% estimate their revenues from used equipment will come in at 8% or higher for the year. A year ago, only 6.6% projected sales to be 8% or higher. Almost 26% say these sales will be up between 2-7% this year, almost exactly the same percentage (25.5%) who had forecast used sales in that range 12 months ago.

As for dealers who expected used machine sales to decline, 23.5% say their sales will be down this year (14.6% down 2-7%, 8.9% down 8% or more). It appears their forecast was right on the money as 24% expected declining sales a year ago (15% down 2-7%, 9% down 8% or more).

Improving Sentiment

Ag equipment dealers have shown intermittent levels of improving sentiment throughout the past year. For example, according to Ag Equipment Intelligence’s monthly Dealer Sentiments & Business Conditions Update survey, in August 2016 only 11% of dealers were “more optimistic” about current business conditions and 36% were “less optimistic” for a net of –25%. In August 2017, the net was only –3%, with 23% of dealers “more optimistic” and 26% “less optimistic.” During the intervening months, dealer optimism ranged from –25% in September 2016 to +4% in June 2017. Though erratic, there was a marked improvement in overall dealer sentiment in the past year compared with the previous year.

At the same time, the sales figures for tractor and combine sales published monthly by the Assn. of Equipment Manufacturers continue to show an ongoing decline in the sales of higher horsepower tractor categories. Some suggest that after more than 4 years of declining sales, farmers are now, out of necessity, beginning to replace their older equipment. This could boost sales in the year ahead. However, as farm commodity prices remain at low levels, there is little expectation that there will be a dramatic bounce back in overall large farm machinery sales in 2018.

USDA Projects Net Farm Income to Increase in 2017

While farm cash receipts is a good indicator of farmers’ ability to invest in new ag machinery, it’s usually net farm income that tells them to pull the trigger on equipment and other capital purchases.

Last week USDA issued its outlook for net farm income for 2017, and for the first time in several years the ag agency is projecting an increase, albeit a small one. USDA’s report, issued on Aug. 30, says, “After several years of declines, inflation-adjusted U.S. net farm income is forecast to increase about $0.9 billion (1.5%) to $63.4 billion in 2017, while inflation-adjusted U.S. net cash farm income is forecast to rise almost $9.8 billion (10.8%) to $100.4 billion.”

The agency says the expected increases are led by rising production and prices in the animal and animal product sector compared to 2016, while crops are expected to be flat. The stronger forecast growth in net cash farm income, relative to net farm income, is largely due to an additional $9.7 billion in cash receipts from the sale of crop inventories. The net cash farm income measure counts those sales as part of current-year income, while the net farm income measure counts the value of those inventories as part of prior-year income (when the crops were produced).

“Despite the forecast increases over 2016 levels, both profitability measures remain below their 2000-16 averages, which included surging crop and animal/animal product cash receipts from 2010 to 2013,” the USDA says.

Net cash farm income and net farm income are two conventional measures of farm sector profitability. Net cash farm income measures cash receipts from farming as well as farm-related income including government payments, minus cash expenses. Net farm income is a more comprehensive measure that incorporates non-cash items, including changes in inventories, economic depreciation and gross imputed rental income.

Improving Outlook for New Tractor & Combine Sales

Despite the ongoing doldrums in the sales of row-crop tractors and combines, sales of compact tractors (<40 HP) and mid-range (40-100 HP) have improved, or at least remained fairly steady during the past few years, more dealers apparently see some improvement coming in 2018 for all types and sizes of tractors.

At this time last year, only about 17% of dealers were forecasting sales increases of 2% or more for high horsepower tractors. That percentage has increased by 14.7% going into 2018, as 31.6% of dealers are now projecting improving sales of row-crop tractors. This outlook is very optimistic considering sales of these tractors were down 7% year-over-year through August 2017, according to AEM.

More dealers are feeling even more confident about the potential of increasing sales of 4WD equipment in the year ahead. A year ago, only 16.1% of North American ag machinery dealers were projecting growing sales of this type of equipment. In the most recent survey, 31.3% of dealers expect 4WD sales to improve in 2018, an increase of more than 15%. Through August 2017, North American sales of this equipment were down about 1% year-over-year.

While sales of compact and mid-range tractors have improved over the past few years, a higher percentage of dealers anticipate continuing increases in 2018. For mid-range tractors, 35.5% of dealers expect sales to increase vs. 27% of dealers a year ago, up 8.5%. For compacts, nearly 40% are forecasting sales will increase by 2% or more in the year ahead compared to 33.5% last year, an increase of about 6.3%.

Slight Uptick in Early Orders

Early orders, or pre-sells, are considered by many to be a bellwether of sales for the coming year. If this is indeed the case, then dealers could see a slight increase in overall sales in 2018.

Results of Farm Equipment’s annual dealer survey don’t appear to indicate a significant increase of early orders — up 14.5% for 2018 vs. up 14.3% for 2017 — but a larger decrease in the percentage of dealers reporting a drop in early orders.

Last year at this time, 68.5% of dealers said their early orders were off compared to the peak of 5 years earlier; 38.9% down more than 10%, 13.8% down 6-10% and 15.8% down 1-5%.

This year 61.4% of dealers report their early orders for 2018 were off the pace of the peak 5 years ago; 32.5% down more than 10%, 16% down 6-10% and 12.9% down 1-5%.

In the most recent study, about one-quarter, or 24.1%, of dealers say their early orders are about the same as they were 5 years ago. This compares with 17.2% who reported the same level of sales as 5 years earlier 12 months ago.

This being the case, the dealers’ responses would indicate a slowing of the large and rapid fall off of early orders in 2016 when more than 73% of dealers reported a significant decline in early orders.

Used Equipment Inventories Still Challenge

For farm equipment dealers, the struggle of the past 4 years was as much about managing excessive used equipment inventories as it was about steep declines in the sales of new ag machinery. In the past year, many dealers appear to have gotten a better handle on their used inventories and described their used equipment situation as “manageable.”

48 Page 2018 Dealer Business Outlook & Trends Report

The complete 48 page 2018 Dealer Business Outlook & Trends report — Farm Equipment Forecast will be sent to Ag Equipment Intelligence subscribers and dealers who participated in the survey in mid-October. It is also available for sale for $399. You can order by going to www.Farm-Equipment.com/forecast2018.

Nonetheless, 45.2% of dealers in this years Business Outlook & Trends survey say their used inventories remain “too high” or “way too high.” This compares with 49.5% who echoed these same sentiments a year ago. One dealer’s comment seemed to sum up the current environment: “The used equipment situation has improved, but remains an issue for us.”

Looking ahead to next year, North American equipment dealers are expecting much better results than they’ve seen in the past few years. Overall, 37.4% of them expect used equipment revenues to rise by 2% or more in 2018. This compares with 29.5% who were projecting an increase 12 months earlier.

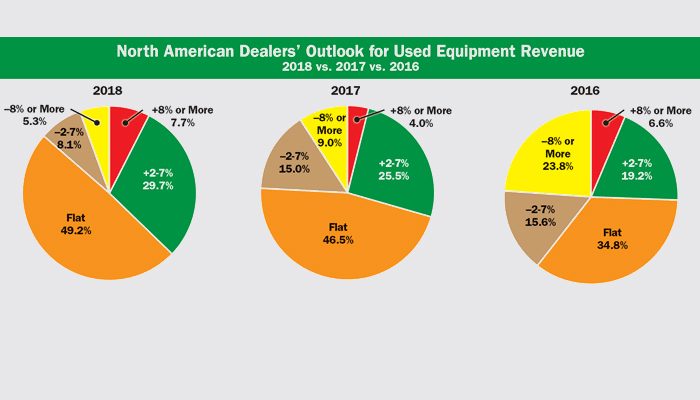

Breaking the numbers down further, 7.7% see revenues from sales of used machinery rising by 8% or more, while 29.7% are forecasting increases in the 2-7% range. Last year, 4% anticipated used equipment revenues to increase by 8% or more and 25.5% projected improvements between 2-7%.

The same trend held true for the dealers who are forecasting more declines in used machinery sales. For next year, 13.4% expect sales to fall. This compares to 24% one year ago. Some 8.1% of dealers see revenues falling by 2-7% (15% a year ago) and 5.3% anticipate a drop of 8% or more (9% last year).

Overall, about one-half of North American dealers see flat used revenues in 2018. Last year, 46.5% anticipated flat revenues.

The percentage of dealers looking for an increase in revenues from the sale of used machinery rose by about 4.5%, from 33% a year ago to 37.4% for 2018. Similarly, fewer dealers are projecting a decline in used equipment revenues for 2018.

U.S. Outlook for Used. Breaking out dealers operating in the U.S. shows this group is also more confident about 2018 than they were going into 2017. For the coming year, 33% of U.S. dealers expect a pick up in revenues from used equipment; 6.5% see an increase of 8% or more and 26.5% project improving revenues in the 2-7% range.

A year ago, a little less than 28% of U.S. dealers saw used equipment revenues increasing; 4.1% expected revenues to fall 8% or more and 23.7% projected a drop off of 2-7%.

A little over 52% expect flat revenues in 2018 vs. 45.5% last year.

As for U.S. dealers looking at falling used equipment revenues, 14.7% see a decline; 8.8% dropping by 8% or more and 5.9% by 2-7%. Last year, nearly 27% were forecasting a decline in revenues from used equipment sales; 16.6% by 8% or more and 10.1% by 2-7%.

Canadian Outlook for Used. As has been the case throughout the history of Farm Equipment’s annual Dealer Business Outlook & Trends survey, dealers operating in Canada are exhibiting a higher level of optimism for the 2018 selling year than do their colleagues to the south.

More than 56% of Canadian dealers say they expect revenues from the sale of used machinery to increase. Of this group, nearly 13% forecast increases of 8% or more, while 43.6% project improvements in the 2-7% range.

This compares with slightly under 39% who expected increased used revenues 12 months ago. That survey revealed that 3.2% of Canadian dealers anticipated growth of 8% or more, while 35.5% forecast more modest increases ranging 2-7%.

Slightly under 40% of Canadian dealers are anticipating flat revenues from used machinery sales. A year earlier, nearly 52% projected little or no change in used revenues.

Only 7.7% of Canadian operators see declines in used equipment sales in the next year; 5.1% see sales falling by 2-7% and 2.6% see them dropping by more than 8%.

Consumer Products, Small Tractors ‘Best Bets’ for 2018

While dealers are expecting better things when it comes to revenues in the year ahead, from where will the increased business come? It most likely will come principally from general consumers, hobby farmers and the like. In other words, it looks as if smaller equipment will continue fueling growth in equipment sales in 2018.

Rankings for “Best Bets” products for 2018 were calculated by combining the percentages of dealers who projected either an 8% or more increase and those forecasting a 2-7% increase in unit sales.

Lawn and garden equipment once again topped dealers’ list of best potential to increase revenues in the year ahead as it has for the past 3 years. And like last year, compact tractors (<40 HP) is #2 on the Best Bets list for increasing revenues in 2018. Dealers also see mid-range tractors (40-100 HP) as having good potential for growth in the next 12 months, which placed it #3 on the Best Bets list for 2018. This is up from the #5 spot a year ago.

Making the biggest leap on the Best Bets list for 2018 was self-propelled sprayers. It was #9 last year and #15 the year before. It moved all the way up to #4 on the dealers’ list. GPS/precision farming equipment and systems rounded out the top 5 places for the new selling season.

Dealers specializing in bigger farm equipment should be heartened to see row-crop tractors (>100 HP) and 4WD tractors moving up the list to #6 and #7. This is up from #8 and #9 a year ago.

Round balers (#8), planters (#9) and farm loaders (#10) completed the dealers’ top 10 Best Bets list for 2018.

Technician Availability Biggest Concern for Dealers

Recruiting and retaining shop technicians has been a front of mind issue for dealers since Farm Equipment initiated its first annual Dealer Business Outlook & Trends survey in 2005. But it never claimed the top spot on the dealers’ list of biggest concerns, until this year. Some 92% of dealers said they were “concerned” (50.3%) or “most concerned” (41.7%) about the availability of technicians. Last year, it finished #6 on dealers’ listing of their biggest issues/concerns.

Dealers’ issues and concerns are ranked by combining the percentage of “most concerned” and “concerned” responses. *Note: #5 was not included in the list last year. As a result, it was not ranked in 2017.

At least part of what makes this so challenging for farm equipment dealers is the growth of precision farming technology, where farmers need (demand) more attention to get it up and keep it running. Another aspect of this issue is dealers’ overall push to increase service revenues, which usually produce the highest margins for equipment dealers.

Availability of technicians displaced farm commodity prices at the top of the list, where it had been for the last 3 years. It fell to the #3 slot for 2018.

Finishing #2 this year, like last year, is the increasing cost of new farm equipment.

Dealers Looking for Techs

To back up their aim to increase service revenues in the coming year, the dealers also indicate that they’re planning to increase their hiring of techs — if they can find them.

Nearly 61% of the dealers polled say they want to add more service technicians to their staffs in 2018. This is up from 49% last year. Otherwise, 39% say they are planning no additions or cutbacks to the service staffs during the next 12 months.

The dealers also indicated that they plan to add parts counter people in the year ahead. More than 25% say they plan to add staff to the parts departments. This compares to 22.7% who planned to do likewise last year.

A few more dealers say they’re planning to add precision farming specialists; 12.6% vs. 11.6% last year. Slightly more, 6.6%, also say they will add to the administrative staffs 2018. This is up from 6.3% of dealers a year ago.

October/November 2017 Issue Contents