Of the 12 product categories included in Ag Equipment Intelligence’s monthly Dealer Sentiments survey, only one has consistently shown positive results during the past 12 months when it comes to dealer sales — commercial and consumer equipment. This includes equipment typically utilized by large property owners, hobby farmers, as well as landscape and light construction contractors. In other words, zero-turn mowers, lawn tractors, compact tractors (less than 40 horsepower), utility vehicles, power tools, skid steers and a host of other smaller equipment.

As dealers handling high horsepower machines have faced a downturn in sales for the past 2 years, more than 88% of what we refer to as “rural lifestyle dealers” throughout North America expect total revenues to be as good as or better than last year. This is according to Ag Equipment Intelligence’s sister publication Rural Lifestyle Dealer’s 2016 Dealer Business Trends & Outlook survey. This optimism follows the 2015 survey when nearly 84% expected total revenues to be as good as 2014. Lynn Woolf, managing editor of Rural Lifestyle Dealer, says, “Dealers have good reason to be optimistic as the economy overall is sending good signals.”

She cites new home construction, a leading indicator for the market, and builder confidence, which has been in the 60s, with 50 being neutral, as measured in the National Assn. of Home Builders/Wells Fargo Housing Market Index. NAHB Chief Economist David Crowe says, “A firming economy, continued job creation and affordable mortgage rates should keep housing on an upward trajectory as we approach 2016.”

Another potential industry barometer, the Green Industry & Equipment Expo (GIE+Expo), a leading trade show for the industry, saw registrations up 11% in 2015 and the number of exhibitors increased 4%, according to Woolf.

Survey Results

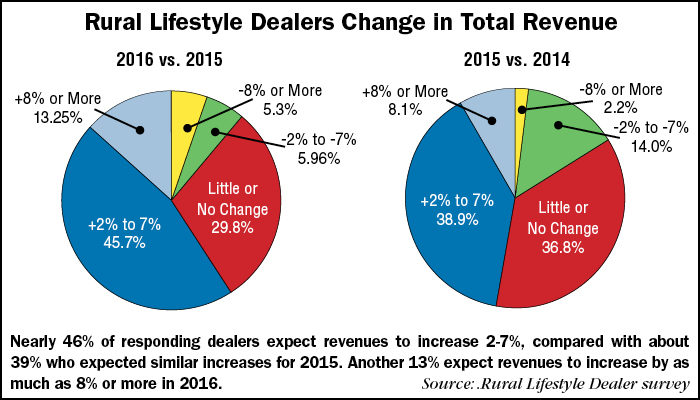

A total of 152 usable responses were received from dealers this year. Rural lifestyle dealers are strongly positive about 2016. Nearly 46% of responding dealers expect revenues to increase 2-7%, compared with about 39% who expected similar increases for 2015. Another 13% expect revenues to increase by as much as 8% or more in 2016, compared to 2015 when 8% of dealers expressed that high level of optimism. Overall, about 30% are expecting this year to be as good as 2015, compared with 37% in last year’s survey.

There are fewer dealers this year than last year who are pessimistic about potential sales in the year ahead. Only 11% expect revenues to decline 2-8% or more, compared with 16% who forecast similar declines for 2015.

The upward trend is also evident when calculating the results on a weighted average basis. Based on the results of the survey, the weighted average for 2016 is 2.42% compared with 1.59% for 2015 overall revenues.

Optimism for Aftermarket

Dealers’ optimism extends to aftermarket revenues as well. More dealers than last year are expecting growth in the 2-7% range for service and parts revenues, about 54% for 2016 vs. about 46% for 2015. Those who are most optimistic, expecting growth in the 8% or more range, remained about steady. There are slightly more dealers expecting aftermarket declines in 2016. About 9.4% are expecting aftermarket revenue decreases of 2-7%, compared with 8.6% in 2015.

The weighted average for aftermarket revenues again bears out the optimism — 2.6 for 2016 vs. 1.8 for 2015.

Customer Growth

Besides strong consumer sentiment, another factor contributing to the upward trend is the growing customer base. About 68% of dealers say their markets have grown 5-20% in the last 5 years, compared with about 76% for 2015, and 16% report market growth of 20% or more, compared with about 13% last year. Fewer dealers reported a shrinking market, 7.3% compared with 10.4% in the 2015 survey.

A full summary of the 2016 Dealer Business Trends & Outlook survey appears in the Winter 2016 issue of Rural Lifestyle Dealer. Please see RuralLifestyleDealer.com.