ARMSTRONG, Iowa — Art's Way Manufacturing Co., Inc., a diversified manufacturer and distributor of equipment serving agricultural and research needs, announces its financial results for the second quarter of fiscal 2024 and six months ended May 31, 2024.

Sales: Art's Way's second quarter sales in its Agricultural Products segment were $4,555,000 compared to $6,368,000 during the same period of fiscal 2023, a decrease of $1,813,000, or 28.5%. For the six months ended May 31, 2024, sales were $8,792,000 compared to $11,813,000, a decrease of $3,021,000, or 25.6% for the same period of 2023. In February of 2024, the U.S. Department of Agriculture reported a 25% expected decline in farm income levels for 2024 due to weaker row crop prices and expected increases in production expenses. Art's Way's sales year to date have mirrored the USDA's sentiments on projected farm income. Incoming orders on the fall 2023 and spring 2024 early order programs declined for the first time in three years.

As we approach mid-year of calendar 2024, live cattle, lean hogs, sugar beet and milk commodity prices are all exceeding their five-year averages while corn, soybeans and wheat commodity prices are all down significantly from where they were a year ago. High interest rates are putting additional pressure on farmers' bottom lines and also reducing the amount of inventory dealers are able to carry on their lots. We expect sales are going to be more speculative in the near future and product availability will be a key factor in sales success moving forward. We began cost cutting measures in the first quarter of fiscal 2024 to partially mitigate the effect on cash flow from decreased sales, including layoffs of non-production employees and offering early retirement incentives to employees at retirement age. We also entered the Iowa Work Force Development's voluntary workshare program in April 2024 which eliminates the need for additional production layoffs by allowing us to cut employee's hours while employees receive unemployment benefits for lost hours. We will be putting additional focus on investments that move our operational improvement strategy towards increased automation and production efficiency as we move forward in fiscal 2024. From a sales standpoint, we continue to work with dealers to help move field inventory to generate more sales opportunities for our products. We are targeting new dealer acquisitions to penetrate geographic markets in which we lack a substantial presence.

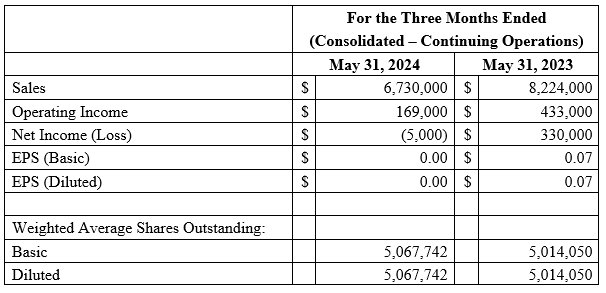

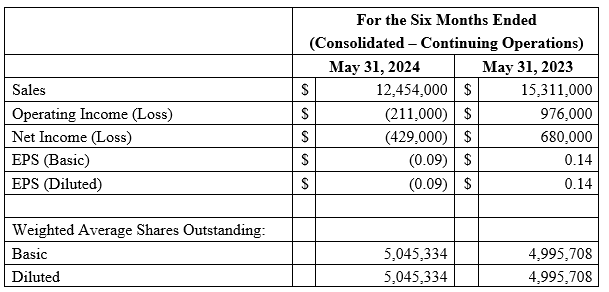

Net Income (Loss): Consolidated net loss from continuing operations was $5,000 for the three-month period ended May 31, 2024, compared to net income of $330,000 for the same period in fiscal 2023. For the six months ended May 31, 2024 our consolidated net loss was $429,000 compared to net income of $680,000 for the same period of fiscal 2023.

While we had positive operating income from continuing operations for the three months ended May 31, 2024, high interest rates on our debt, have put strain on our bottom line in fiscal 2024. We expect that our sales in the Agricultural Products segment will continue to follow the 25% farm income decrease trend predicted by the USDA. We will rely on inventory reduction, debt retirement and cost cutting to minimize losses in an attempt to again generate net income from this segment.

King added, "Lower commodity prices continue to affect farm income, resulting in demand softness and putting pressure on the Agricultural Products segment. We are committed to navigating these challenging market conditions by focusing on operational efficiency and prudent fiscal management. We have adjusted our production output to meet current demand and help manage inventory levels. As we move forward, we remain dedicated to supporting our dealers and customers, ensuring we are well-positioned for future growth once market conditions improve."