With a desire to provide exceptional customer service and an eye toward technological innovation, H&R Agri-Power has watched its business grow from one location in 1990 to 21 locations and more than $700 million in annual revenue. And the dealership comes in at number 30 on the Farm Equipment Dealer 100 list™ — the 4th largest Case IH dealer on the list.

The Kentucky-based Case IH dealership is the 2024 Farm Equipment Dealer of the Year in the over $100 million in revenues category.

Wayne Hunt of Hopkinsville, Ky., purchased Agri-Power, a Case company store in Hopkinsville in 1990. This wasn’t Hunt’s first dive into entrepreneurship. At the time, he had started and was running a successful crop input company he launched 1976.

“I started this equipment company because I thought I would sell the other one and retire, kick a few tires and trade a few tractors,” says Wayne, who is H&R Agri-Power’s chairman and CEO.

That didn’t happen. He quickly added Kubota and Bush Hog to his brand offerings. Within 3 years, he merged Agri-Power with H&R Implement Co. and opened 2 other locations in Kentucky.

Today, H&R Agri-Power owns stores in 6 states, covering over 90 million acres from Illinois to Mississippi. The dealership carries a number of brands (see below).

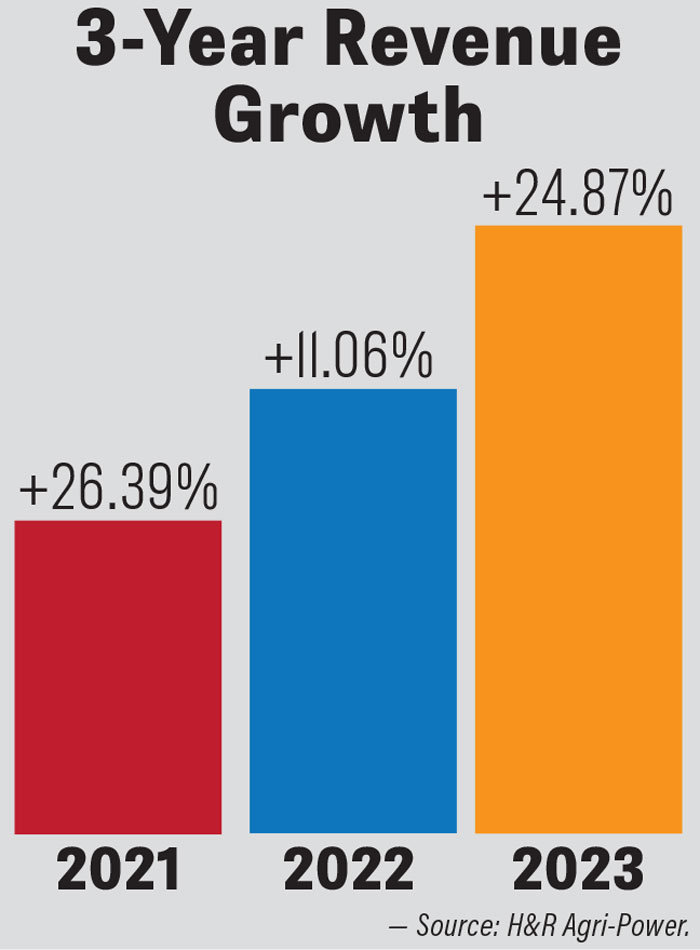

In the past 3 years, the company has experienced exponential year-over-year growth of 26%, 11% and 24% and added 4 new locations, including its first location specializing in power sports. In 2023, sales from all of its entities topped $739 million. The dealership recorded a 25% cash crop market share and 38% livestock market share. H&R’s 2023 return on assets came in at 13.09% and it achieved an absorption rate of 85.11% — above the industry average of 82.7% for dealers with over $300 million in revenue.

“Commodity prices were at record highs, and we had some record deals,” says Steve Hunt, Wayne’s son and H&R Agri-Power president. “Farmers spend money if they have it, so they were looking to buy what they wanted and over what they needed. With cashflow a little bit tighter and net farm incomes being down this year, I think they will go back to only purchasing what they absolutely need.”

The Customer: The Top Priority

Customer service has been a priority for H&R Agri-Power and a big driver of its success from day one. At the time he purchased the store, Wayne Hunt and his family were farming 7,500 acres. One of the big reasons behind that first purchase was they were having trouble getting dealers to service their farm equipment. By buying the store, the Hunts thought they’d be able to improve their equipment’s service time. Today, Steve’s son continues to run their farming operation that now includes more than 10,000 acres. They test out a variety of equipment on their own farm and can offer their customers their honest opinions.

“Whoever can give you the best service is going to win the day,” Steve says. “We brought that mindset into this business. It’s also unique that we are farmers, which gives us insight into what farmers want and need.”

H&R Agri-Power is committed to educating its customers, too. “They try to represent their customer very well,” says Curt Davis, director of marketing at Kuhn North America. “They bring new practices to customers, particularly with conservation tillage practices that are strong in the industry — whether vertical tillage or strip-till.”

H&R Agri-Power

Founded: 1990

Employees: 599

Ownership: ESOP

Leadership Team: Wayne Hunt, CEO, Steve Hunt, President & COO, and Ronnie Barnett, CFO

Board of Directors: Consultants Dr. Jim Weber and Tom Yohe (formerly of Hoober’s Inc.), and Wayne Hunt, Steve Hunt and Ronnie Barnett

Locations: 21 in Alabama, Illinois, Indiana, Kentucky, Mississippi & Tennessee 2023

Revenue: $739.7 million

Market Share: Cash crop — 24.77%; Livestock — 38.32%

Absorption Rate: 85.11%

Major Line: Case IH, New Holland & Kubota

Shortlines: Kinze, MacDon, Martin, Geringhoff, Great Plains, Bush Hog, Land Pride, Unverferth, Brent, Brandt, Kuhn, Krause, Krone, Aguru, H&S, Honda, Kawasaki, Polaris, Gehl, Blue Diamond, Salford, Vermeer, J&M, Schulte, Hurricane, McFarlane, DJI, Grasshopper, Bad Boy, Hustler, Exmark, Westfield, Soil-Max, Miller, Bestway Ag

Davis credits H&R with being one of the dealers to bring strip-till and cover crops to farmers in Kentucky, western Tennessee and even into Alabama and Mississippi.

H&R Agri-Power has been instrumental in helping farmers get comfortable with the strip-till practice, often cited as a gateway into no-till. By the 2016-17 growing season H&R Agri-Power decided to support the effort by making strip-till equipment available on a rental basis to allow growers a chance to experiment without the initial high cost of purchasing equipment.

The company also put a strip-till rig and fertilizer cart in the hands of a seed dealer/crop consultant for 2 seasons which ran test plots. The dealership launched a series of meetings across the area to introduce the practice and was amazed at the level of interest. On several occasions H&R brought groups of farmers to national events on conservation ag to learn alongside their farm customers and to bring value and know-how back to the local area.

Surveying for Success

H&R has always valued its customers’ opinions. As such, it’s conducted customer surveys on equipment purchases and parts and service interactions for many years.

“The customer can fire all of us,” Steve says. “You’ve got to satisfy the customer. Dad and I get calls. Our names are on the website, and people are welcome to call us anytime. That’s what we want. We have to be sure that the customer gets what he pays for, and he is happy with it.”

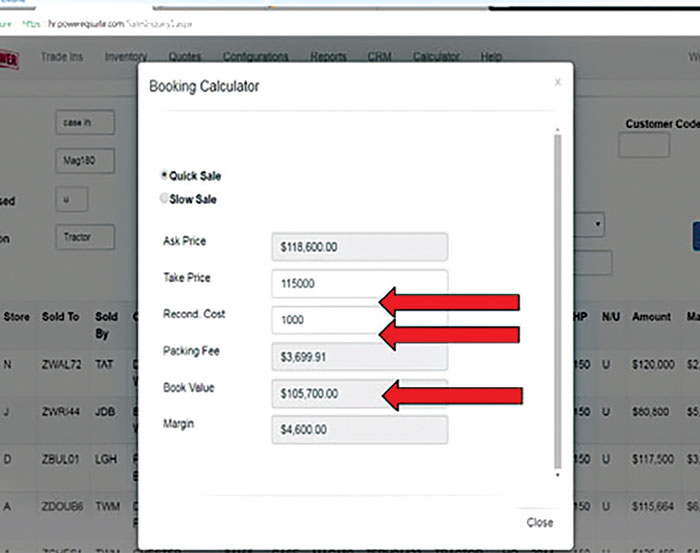

H&R’s Power EQ app includes a booking calculator, formatted with its own margin data. The dealership enters the estimated reconditioning amount from the trade appraisal and an ideal retail price. The calculator then provides an asking and booking price. David Gibson, wholesale division manager, says when he gets a request for an appraisal he can turn it around with a value within 10-15 minutes. Photo by: H&R Agri-power

Asking people to give their opinions may not be the easiest thing to do, but honest feedback from survey participants has helped H&R Agri-Power improve its customer experience over the years and retain clients.

“We started the surveys several years ago, and we never got back a good one, which was OK,” Steve says. “We wanted to know everything that we needed to fix. Steadily over the years, they’ve gotten to where we get a lot of good ones back from people who appreciate what we do. We still get ones with things we need to fix at each location. The surveys go out by the locations and each location’s managers get those back and deal with those customers to be sure the producer gets his issue fixed.”

The company follows up on surveys that convey a problem. They are also willing to share exceptionally good surveys with their team as an incentive to keep up good work.

Wayne says their agriculture background and farmer mentality continue to keep them relevant and on the same page with their customers. They understand what it is like to have an equipment breakdown after hours and are willing to offer service on equipment issues 6 days a week.

“We could easily absorb 20 new technicians a year, if not more…”

“Our service level will match anybody out there,” he says.

Their connection to customers does not end after a business transaction has closed. For the past decade, they have distributed a newsletter to customers. Steve says this helps keep the business at the forefront of customer’s mind. The newsletter shares customers’ stories and gives them insight into the company. It includes meaningful content about all their vendors and previews their specials for the upcoming year.

“We almost quit doing it, but our customers really like it,” Steve says. “We don’t want to halfway do it because it’s laying around on our customer’s desks in their shops. Our marketing group reinvented it about 5 years ago to make it more customer focused.”

Dreaming Big

Growth within the equipment industry came quickly and often for H&R Agri-Power, but the Hunts will tell you they are by no means perfect. They continue to look for ways to improve and grow. Steve chalks some of that up to his father’s go-getter personality and the drive of their employees.

“Dad’s a dreamer for sure,” Steve says. “We try to make it happen and put the motions in the place but somebody’s got to pick up that other end and actually make it happen and that’s our people at every one of these locations.”

Much of their growth has also been about developing a business that is capable of acting on opportunities as they present themselves. Several years ago, the executive team sat down and developed a road map of where they would like to be.

Enlisting the Help of Consultant & Dealer Peers: ‘Best Decision Ever’

By Mike Lessiter, Editor/Publisher

Retired executive Ross Morgan suggested the business get involved with a 20 Group (dealer peer group) to surround itself with the best ideas and practices for the growth chapter ahead. In CFO Ronnie Barnett’s first year, H&R Agri-Power signed on to join Dr. Jim Weber’s dealer group. “It ended up being the best thing we ever did,” he says, citing the relationships with other dealers as well as the tutelage of Weber.

Barnett recalled what they attacked first in those years.

- Internal Controls. “Once the books were accurate and we had statements we could rely on, we had to control things to be sure money wasn’t walking out the door. First you’ve got to know where you are to be able to do anything about it.”

- Establishing Benchmarks. Once the books were accurate, it was about trying to drive the numbers where they needed to be. “Dr. Weber helped us see those benchmarks and where we needed to get, and what we needed to be focusing on and managing toward. We started looking at gross margins, productivity, inventory turns, all those sorts of things.”

- Inventory & Balance Sheet Management. While the dealership grew its revenue 10 times in 4 years, Barnett notes, “You can also sell yourself out of business.” The biggest key in this business is to manage your inventory. Driving the top line sales is important, but cash is king. We really focused on balance sheet management.”

“To grow, you must be intentional,” says Ronnie Barnett, H&R Agri-Power’s chief financial officer. “About 15 years ago, we sat down, looked at a map and thought about what could be. When those opportunities developed, we were in position to take advantage of them.”

As they continue to grow and acquire new entities, they adjust their road map to focus on new goals. The 4 new locations added since 2019 include 2 Kubota dealerships, a large ag entity and a power sports operation that strategically fit in the company’s portfolio.

“The recent acquisitions were more strategic because they were in our footprint and we’d worked on a couple of them for a good while,” Steve says. “We never want an acquisition to happen at the wrong time. It needs to be good for both of us.”

The firm’s also becoming more selective with its acquisitions and the brands it offers based on strengths and weaknesses.

“I hate to be a dealer for something we aren’t good at, and you can’t be successful doing that,” Steve says.

“I like to see people be very successful. My No. 1 goal in life is to see our people reach their maximum capability with the company.”

Advantage of Technology

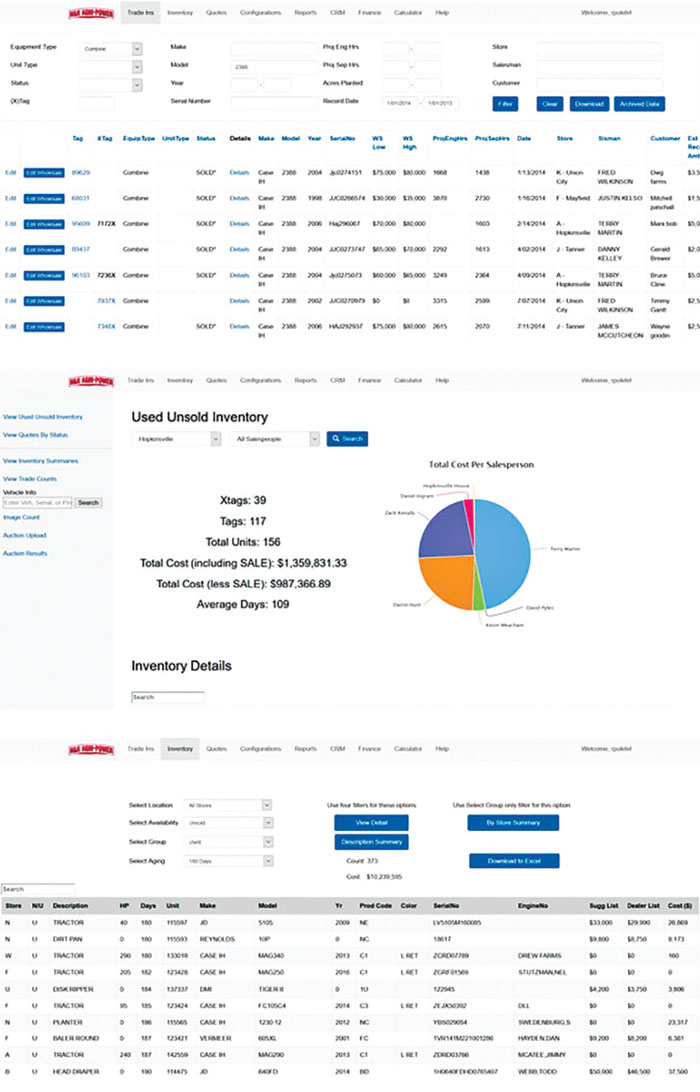

H&R does not shy away from technology. The dealership has had a partnership with DIS since its founding in 1990. With such a large territory, it can be difficult to relay information. To help create consistency within the organization and keep all the stores on the same page, H&R Agri-Power developed a quoting and business management software system called Power EQ. This systems helps all locations operate consistently and more efficiently as it stores all their quotes into one system. It also helps when new dealerships come into the fold.

Learn More Online

Gain more insight...

- Exclusive video interviews filmed on-site with Steve Hunt, Wayne Hunt and Ronnie Barnett. Coming soon!

- 2020 Dealership Minds Deep Dive

- H&R’s Valuation Process Minimizes The Risk That Comes With Trade-Ins

- H&R Agri-Power Recognized as 2023 No-Till Innovator

- [Video] Identifying & Moving at Risk Equipment

Access this exclusive content by visiting this link.

“We bring a lot to the table during acquisitions and mergers that other companies don’t necessarily have in their toolbox,” says Steve. “We aren’t perfect by any stretch of the imagination, but over time we’ve definitely tried to refine our processes and put systems in place to make sure the operation runs smoothly.”

They have also been able to sell subscriptions to the Power EQ software to other equipment dealers. About 10 other dealers have the software. The revenue generated from these subscriptions goes back into the software to further enhance its capabilities.

Barnett says DIS worked closely with H&R to help integrate Power EQ with the software company’s system. The company has also been responsive in developing new technology for H&R Agri-Power, including a recently implemented service tech app, he says.

Supplier Communication

A good relationship with suppliers is also critical to success by ensuring H&R Agri-Power balances supply and demand and has ready access to the inventory it needs.

Web Exclusive: Expanding into Power Sports

As they were in the process of acquiring a truck and tractor dealership in Washington, Ind., in October 2022, H&R Agri-Power was presented with a unique opportunity to also acquire the dealer’s power sport division. They accepted the challenge and a new division, H&R Power Sports was born.

While farm equipment and power sports may seem like different entities — and they are — they can attract similar customers.

“It is a totally separate business,” Steven Hunt, president of H&R Agri-Power, says, “But we had a little bit of insight into the field and a bit of a customer base by being a Kubota dealer. A lot of our farm equipment customers buy those products, so there was a little bit of crossover there.”

While they have had early success with the dealership, Hunt says they are still learning how to navigate the power sports industry.

“It’s a whole different segment that you have to approach differently from a marketing perspective, but we are excited about it,” Hunt says. “We have a couple of friends who are in both the ag business and power sports business and we have reached out to them and we share notes back and forth. We are also trying to become a part of a power sports group that gets us sitting at the table with some pretty big successful companies.”

The company’s management team regularly provides suppliers honest feedback when it comes to their market conditions. The company’s southern Kentucky base also means that their farmers sometimes require different pieces of equipment vs. more traditional row-crop areas. While local farmers grow cash crops, H&R also has a large base of livestock customers. Kentucky also still has a good amount of tobacco production, which requires small tractors.

Making It Regional

Growth does not come without hiccups and challenges. A large territory and many stores can pose challenges for even the best managers to provide oversight, support and effective communication. Several years ago, to ease their growing pains, the Hunts restructured the dealership and established 4 regional managers. These managers are responsible for the day-to-day operations for stores in their areas and oversee store managers, parts managers and service managers. They are also responsible for knowing the needs of customers in their area.

“It’s important that they are on the ground and in contact with employees, answering their questions and driving that business every day,” Steve says. “It wouldn’t run as smoothly if my dad, Ronnie or I were the ones answering questions from all 21 stores.”

Ryan Polete, territory manager with H&R Agri-Power, helped the dealership develop its in-house quoting tool, Power EQ, which has streamlined the valuation process for used equipment. The tool allows the sales team and management to get a quick look at the dealership’s trade ins (top), whether the unit has been sold, the salesperson, customer and estimated reconditioning costs. The team can also get a big picture look at the used inventory (middle), which shows the number of units in inventory, total cost including sale, total cost less sale, and the average days in inventory. This screen also shows a breakdown of the total cost per salesperson. Power EQ can drill down deeper into the details, showing a complete list of the used equipment inventory (bottom), with details like where the unit is, the make/model, year, serial number, engine details and price and cost details. Photo by: H&R Agri-power

If they have concerns, regional managers address those with senior management. Steve says this structure works well for the dealership.

“Before, the managers at the stores would have questions, and they wouldn’t always get answers,” he says. “Today, the regional managers call me, and we work through details that they don’t have the answers to and make decisions. It’s working a lot better. They get their questions answered more quickly and are able to run the business and be more productive.”

Employee Development

As with many skilled trades, H&R faces a shortage of skilled employees. It’s developed training programs for parts employees and leadership training opportunities for department managers, store managers and regional managers to help recruit and retain top talent.

“We want H&R Agri-Power to be a company that people like to work in and want to come work with us,” Steve says. “We want to draw people in this company because we’re successful only by the grace of God, number one, but our people are the second reason. It’s all about the people.”

Remembering Greg Burch

The late Greg Burch was H&R Agri-Power’s chief operating office until his sudden passing in March 2024. Burch served as a member of the executive team for 30 years in both Hunt-owned companies, serving the last 20 years with the dealership. As COO, he focused on making sure the entire operation ran smoothly and served as a liaison between the executive team and the regional managers.

H&R Agri-Power President Steve Hunt says Burch was instrumental in helping the company grow and was at the table with them 15 years ago when they began to plan their expansion.

Hunt says he and Burch’s goals for the company where strategic growth and a people first mentality. “He would be so proud to be named Dealership of the Year.”

"He would be elated,” Hunt says. “He would be a part of this conversation with Ronnie, dad and myself. It’s not about us. It’s about our people and our company. This is their award.”

Skilled technicians in their area are hard to come by. H&R partnered with Parkland College and the local community college to help fill those gaps. However, Parkland is 6 hours away, and some people do not want to stay there long enough to earn an associate degree, which takes around 2 years. As a result, the dealership group is exploring the possibility of developing a technician training center for its up-and-coming technicians near its Hopkinsville headquarters.

H&R Agri-Power’s leadership team includes (l-r) CEO Wayne Hunt, President Steve Hunt and CFO Ronnie Barnett. Photo by: Michaela Paukner

While the training facility idea is in its infancy, company leaders think it would help recruit and retain skill tradespeople.

“We think we could easily absorb 20 new technicians a year, if not more,” Barnett says.

ESOP Benefits

People — whether they are customers or employees — are top priority at H&R Agri-Power. To help recruit and retain top talent, the company began offering an employ stock ownership program (ESOP) in 2006. At the time, the Hunts opted for an ESOP vs. going public with the company.

“So really an ESOP did a couple of things to this company,” Steve says. “No. 1, Dad could have an estate plan in place and it filled that void for him. It did allow us to grow as well. We could keep the money in the company that we had been paying tax on and acquisitions were a lot easier at the point and time.”

In 2014, H&R Agri-Power decided to go 100% employee owned. This benefit program allows employees to become owners of the company. The Hunts say it has helped improve the company’s culture and employee retention, especially in the last 5 years. Some of the first enrollees into the ESOP are beginning to retire, and they’re seeing its benefits.

“Whoever can give you the best service is going to win the day. We brought that mindset into this business…”

“Everybody’s looking and trying to grow the company and do the right things to make that ESOP successful,” Steve says.

Barnett says an ESOP is also attractive to other businesses looking for a buyout or merger with H&R. It’s another way they stand out from their competition.

“Anybody who is selling their business is worried about their employees and how the next employer will take care of their employees,” he says. “With us, they are going to own part of the company. It’s been a big thing in terms of helping us get deals done.”

The decision to become an ESOP did not happen overnight. The Hunts had previous experience offering an ESOP with their farm supply company. Barnett says it takes company owners working with accountants, appraisers, attorneys and other professionals to make the transition to an ESOP smooth.

“It’s a major decision,” he says. “You’re not going to flip a switch overnight and do your due diligence on it. You probably need a year to do the research and some of the background things that have to be accomplished to have a successful ESOP.”

Managing Downturns

The ag industry is cyclical. While H&R has experienced great growth, it must also be able to manage downturns. Tighter profit margins this year are causing customers to pause some purchases, like large equipment. Steve says this year has been about reducing inventory and watching the balance sheet.

“We have to write our inventory orders to really and truly mirror what we think our outlook is going to be for this year,” he says. “We are not far off from that. But we’ve had to be smart and reactive fairly quickly to get it to where it needed to be.”

While the dealership is expecting 2024 wholegoods revenues to be down roughly 15%, Barnett says he expects the aftermarket business to be up, with parts sales up 5-7% and service up around 10%. In addition, Barnett expects similar results in 2025 with possibly even greater wholegood revenue reduction.