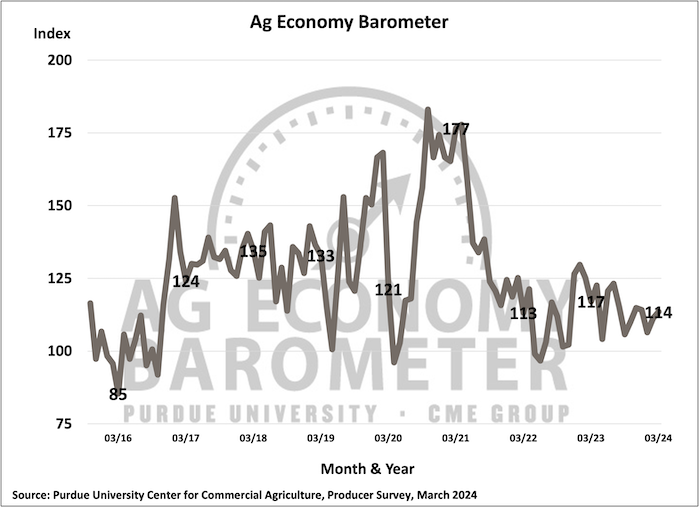

U.S. farmers’ outlook improved in March as the Purdue University/CME Group Ag Economy Barometer index increased to 114, 3-points higher than in February. While the Index of Current Conditions fell by 2 points to 101, the Index of Future Expectations climbed to 120, up by 5 points compared to February. The disparity between current and future indexes was primarily attributable to farmers’ perceptions that a financial downturn took place over the past year, coupled with expectations for some improvement over the next 12 months. The March survey was conducted from March 11-15, 2024.

Producers’ expectations for interest rate changes have shifted which could help explain why producers look for financial conditions to improve. This month 48% of respondents said they expect a decline in the U.S. prime interest rate over the next year, up from 35% in December. Just one-third (32%) of producers foresee an interest rate increase compared to 43% last month. Only 20% of respondents this month identified the risk of rising interest rates as a primary concern, a decrease from the 24% recorded in December 2023. High input costs continue to be producers’ No. 1 concern, with 36% of respondents expressing worry.

The Farm Capital Investment Index increased by 7 points this month, indicating a rise in optimism among producers about making large investments. Producers who said it is a good time for a large investment rose to 15%, up from 11% at the start of the year. Producers who said it's a good time to invest pointed to strong cash flows on their farms coupled with higher dealer inventories for farm machinery as key reasons. However, a majority of producers still feel hesitant to invest due to concerns about high costs for machinery and construction as well as high interest rates.

Producers displayed a more optimistic short-term outlook on farmland values in March, with the Short-Term Farmland Values Index rising to 124, a 9-point increase from the previous month. This month, 38% of producers expect farmland values to increase in the coming year, compared to 31% in January and February. Factors contributing to this optimism included non-farm investor demand, inflation expectations and strong cash flows. An improved interest rate outlook might have been a factor as well, although producers didn’t point to that explicitly in this month’s survey.

More farmers this month (24%) said they believe farmland prices will go up because of inflation expectations compared to last month (18%). There was also a slight increase in producers citing strong cash flows (8% in March versus 6% in February) as a reason, and a modest decline in the number of producers who mentioned non-farm investor demand as a major factor influencing the farmland market. However, despite this decline, 57% of producers still consider non-farm investor demand the primary reason for their bullish outlook on farmland values.

Interest in using farmland for carbon sequestration or solar energy production appears to be increasing. In this month’s survey, nearly 1 out of 5 respondents (18%) said they or their landowners had been approached about carbon capture utilization and storage (CCUS) on their farmland. Additionally, 12% of this month’s respondents said they had discussions with companies interested in leasing farmland for a solar energy project in the last six months, compared to 10% in February. When it comes to long-term farmland lease rates offered by solar energy companies, 54% of respondents this month said they were offered $1,000 or more per acre, while just over one-fourth (27%) were offered $1,250 or more per acre.

The March barometer also revealed that many farmers are concerned about potential government policy changes affecting their farms following this year’s elections. Forty-three percent of respondents anticipate more restrictive regulations for agriculture. Additionally, 4 out of 10 (39%) producers expect taxes impacting agriculture to rise.