In this episode, we take a preliminary look at Ag Equipment Intelligence’s 2023 Dealer Busienss Outlook & Trends Report. In the Technology Corner, Noah Newman takes a look AMVAC’s SIMPAS System. Also in this episode, dealers find creative ways to fix and update customer equipment in the midst of supply chain slowdowns and Ben Thorpe shares an interview with 360 Yield Center’s Gregg Sauder on why dealers should be doing more with agronomy.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Dealers’ 2023 Revenue Forecasts Favor Aftermarket

- Dealers on the Move

- Technology Corner: AMVAC Showcases SIMPAS Application System at Technology Summit

- Dealers Get Creative Amid Supply Chain Challenge

- Gregg Sauder: Why Dealers Need to Learn Agronomy

- DataPoint: Global Farm Equipment Market 2020-203

Dealers’ 2023 Revenue Forecasts Favor Aftermarket

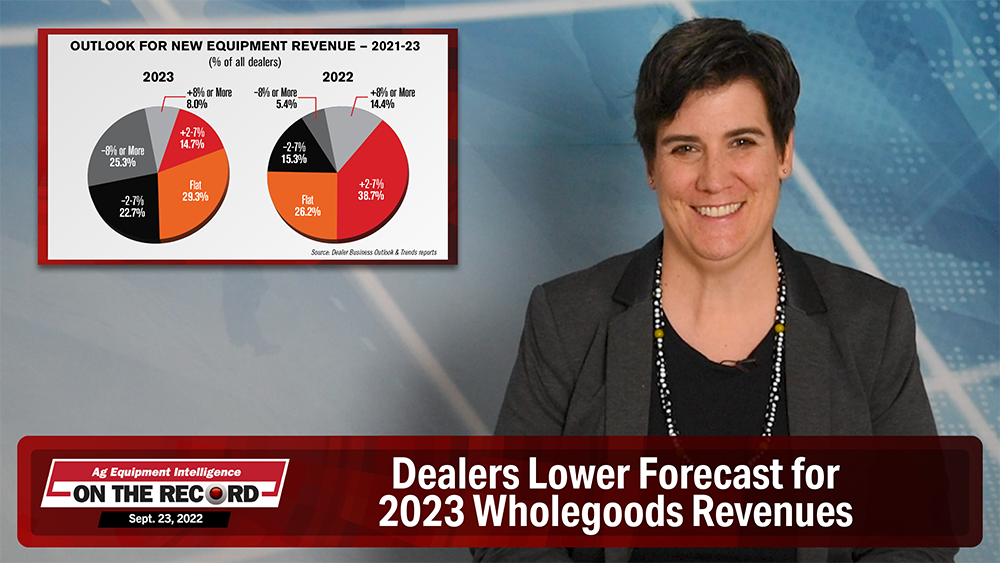

This year’s Ag Equipment Intelligence Dealer Business Outlook & Trends survey saw a notable drop-off in optimism in dealers’ new and used wholegoods revenue forecasts. This, alongside a sharp increase in parts and service revenue optimism, shows just how strongly equipment shortages and price increases have changed dealers’ future expectations. New wholegoods revenue projections were the most negative in this year’s study. Nearly half of all surveyed dealers are forecasting some degree of new wholegoods revenue decline in 2023 vs. 21% who said the same last year. The percentage forecasting a decline of 8% or greater more than quadrupled from 5.4% last year to 25.3% this year. Less than a quarter of dealers are forecasting a revenue increase of 2% or more.

New wholegoods revenue projections were the most negative in this year’s study. Nearly half of all surveyed dealers are forecasting some degree of new wholegoods revenue decline in 2023 vs. 21% who said the same last year. The percentage forecasting a decline of 8% or greater more than quadrupled from 5.4% last year to 25.3% this year. Less than a quarter of dealers are forecasting a revenue increase of 2% or more. Outlook on used equipment revenue growth was down as well, though less severely than with new wholegoods. Almost 32% of dealers are forecasting an increase, down from 49.1% last year. Slightly more dealers held a neutral view on used revenue at 37%, up from 31.8% last year. Almost 32% of dealers forecast their used equipment revenue down 2% or more, up from 19.1% last year.

Outlook on used equipment revenue growth was down as well, though less severely than with new wholegoods. Almost 32% of dealers are forecasting an increase, down from 49.1% last year. Slightly more dealers held a neutral view on used revenue at 37%, up from 31.8% last year. Almost 32% of dealers forecast their used equipment revenue down 2% or more, up from 19.1% last year. Parts revenue forecasts were up year-over-year, an impressive feat given last year’s forecasts were already remarkably positive. A little over 75% of dealers are forecasting at least a 2% increase in their parts revenue for next year. This was slightly above the 71.8% who said the same last year. Some 26% of dealers are forecasting an increase of 8% or more.

Parts revenue forecasts were up year-over-year, an impressive feat given last year’s forecasts were already remarkably positive. A little over 75% of dealers are forecasting at least a 2% increase in their parts revenue for next year. This was slightly above the 71.8% who said the same last year. Some 26% of dealers are forecasting an increase of 8% or more. Almost three-fourths of surveyed dealers are forecasting a service revenue increase for 2023, up from 70.9% who said the same last year. In this increase, the percentage forecasting an increase of 8% or more rose from 17.3% to 21.6%.

Almost three-fourths of surveyed dealers are forecasting a service revenue increase for 2023, up from 70.9% who said the same last year. In this increase, the percentage forecasting an increase of 8% or more rose from 17.3% to 21.6%.

The full report, including breakouts by majorline OEM, will be available in October.

Dealers on the Move

This week’s dealers on the move include Agriteer and Taylor Implement.

AGCO dealers Binkley & Hurst and MM Weaver will finalize their merger on Oct. 1 to form the new 7-store dealership Agriteer.

Taylor Implement, a Claas and Kioti dealer, recently broke ground on its 4th location in Granade, Color,

Technology Corner: AMVAC Showcases SIMPAS Application System at Technology Summit

Talking today about AMVAC’s SIMPAS system which is taking prescription application to a new level.

Retailers and farmers got an up-close look at the new technology during a special summit in Rockford, Illinois this past week.

SIMPAS stands for smart integrated multi-product prescription application system.

It’s an aftermarket system that can be put on most planters, 22-inch or wider rows, that allows growers to prescriptively apply up to three products per row.

How does it work? AMVAC breaks it down into three steps:

- Prescribe – Get custom prescriptions from retailers or agronomists

- Apply – Exactly what’s needed, precisely where it’s needed.

- Return – Return all product cartridges to the retailer. Every cartridge has a smart tag, with an RFID chip that keeps a record of what products have been in the cartridge, and the amount used, so farmers can be charged by the acre instead of by the entire container.

Jim Lappin, director of SIMPAS product portfolio alliances tells us the goal is to eventually have over 30 products in the AMVAC SIMPAS portfolio, things like insecticides, fungicides, micronutrients and more.

And Caleb Shultz, who’s the precision ag channel retail lead…tells me that’s exactly what customers are most excited about…the expanding product portfolio.

We think that’s really going to drive the adoption of the system as we bring a lot of products into the portfolio. When you have three opportunities on a pass at planting that really opens up a farmer’s mind to think about ‘wow, all the things I wanted to address but either just haven’t thought about or didn’t have a way to think about.’ One specific example – like when we apply our zinc product, often times zinc is just riding along with starter fertilizer or in a fertilizer blend…zinc is the most common deficient micronutrient. It’s actually not difficult but uncommon to only target that one nutrient. So, with something like SIMPAS we can completely target just the needs in any part of the field for that one nutrient instead of having it ride along with the nitrogen or the phosphorous, P and K, stuff like that.

The equipment can be purchased from participating Trimble dealers, AMVAC’s development and distribution partner for SIMPAS. we’ll have much more about SIMPAS technology on next week’s episode of the Precision Farming Dealer podcast.

Dealers Get Creative Amid Supply Chain Challenges

With supply chain issues continuing to put pressure on equipment inventories for both dealers and manufacturers, some dealers have found creative ways to serve their customers. During a conference call last month, Stacy Anthony, president of AGCO dealer AgRevolution, and Fred Lulich, title with Titan Machinery, shared how their dealerships are responding to the challenges the supply chain is causing.

Anthony compares what he is seeing today to situations he saw several years ago in a previous role traveling to 27 different countries to help a Deere dealer set up a channel across Europe and Asia and Central and South America.

I used to watch those guys be pretty creative with repairs, and they didn't throw away anything, right? And that's kind of where we are right now. We take something off that's wore out, we're not throwing away. We may have to rebuild it and use it and weld on it and create something, remanufacture something new later, because all the while the supply chain people tell us that things are getting better at the dealership level, currently we're not seeing it yet. And maybe there's a lag time that we need to be patient on, but quite honestly, we're still running into lots of issues with getting the supplies we need, getting the parts we need on time, things like that.

So, we're rebuilding, we're going to welding shops, we're going to machine shops, we're taking auger [inaudible 00:06:17] and slidings, and things like that. And if you can't get the new one, we're building it new ourselves. So, those are taking us back to some unique times, but that's what we're going to do to kind of get through some of these periods until things get restored. But I think you just kind of got to be a MacGyver right now. You got to navigate through some things we haven't had to do for a long time.

Anthony adds that farmers who wanted to make a trade but couldn’t get the machine in time are having to make reconditioning decisions to run another year. Farmers are having to fix repairs above what they had anticipated and the dealership is finding ways to help them accomplish that.

Lulich agrees and says at Titan has found ways to fix and rebuild equipment when necessary for customers.

Just like Stacy said, we're having to pull apart hydraulic cylinders, having them rebuilt, having to have stuff welded and redone, have pumps fixed and stuff where we just can't get replacements. And it seems like, specifically in forestry and in the construction side, is they... Doesn't matter if the machine's 10 hours old or if it's got 10,000 hours, they want it fixed. So, if we've got to go to NAPA, we'll go to NAPA. If we've got to go to a machine shop, we'll go to a machine shop. If we got to hire a welder, we'll hire a welder. And the company's been pretty good as far as paying for that, just to keep these guys up and running.

Gregg Sauder: Why Dealers Need to Learn Agronomy

In a recent interview with Ag Equipment Intelligence, 360 Yield Center CEO Gregg Sauder explained why he believes cutting edge dealers need agronomy to succeed. When asked if he believes the dealership of the future leans more heavily on agronomy, Sauder agreed, saying he’d held that view even when he founded Precision Planting in the 90s.

“We’ve done that from the very beginning, all the way back in 1994 when we started with Precision [Planting]. We taught and designed all of our field days, and when we would bring dealers, bringing farmers in. And then we would take them into the cornfield, and we were teaching agronomy, how a corn plant thinks, how nature coordinates with the technology that we are designing.

“So from day one, we have been — you can’t separate sales and knowledge of what’s happening in production agriculture. And we like to live on the bleeding, cutting edge. And so there’s where you always have to keep your dealers up to speed. And sometimes, you know, our equipment sales folks, maybe that aren’t as comfortable doing agronomy, and on that side of it [is] when we lean really hard and help them. We go into their dealerships, and we bring our regional managers in, and we put trainings on there and really give them — you’ve got to encourage them, and you’ve got to give them the background so that they’re comfortable going out and talking to the professional farmer.”

Sauder adds that the company’s new autonomous applicator, the 360 RAIN System, requires a different caliber of dealer that its planter-mounted products. You can watch a video breakdown of the 360 RAIN System on the Farm Innovations YouTube channel.

DataPoint: Global Farm Equipment Market 2020-2030

This week’s DataPoint is brought to you by LAFORGE. The global farm machinery market is expected to grow from $207.80 billion in 2020 to $291.40 billion in 2025, a rate of 7.0%. Between 2025 and 2030, a compounded annual growth rate of 5.6% is projected, to reach $381.90 billion.

The global farm machinery market is expected to grow from $207.80 billion in 2020 to $291.40 billion in 2025, a rate of 7.0%. Between 2025 and 2030, a compounded annual growth rate of 5.6% is projected, to reach $381.90 billion.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.