According to Farm Equipment’s second annual survey to farmers about their shortline manufacturers, farmers continue to buy shortline equipment due to the quality they get for the price and the major lines’ lack of experience in niche areas. Farmers also indicated they see shortlines as having better self-repair options for their customers and take the edge in responsiveness.

For the purposes of the survey, the following brands were considered major lines: John Deere, Case IH, New Holland, AGCO (Fendt, Massey Ferguson, Challenger) and Kubota. For more demographics, see "Who are This Year’s Surveyed Farmers?" below.

Shortline Equipment Ownership by Category

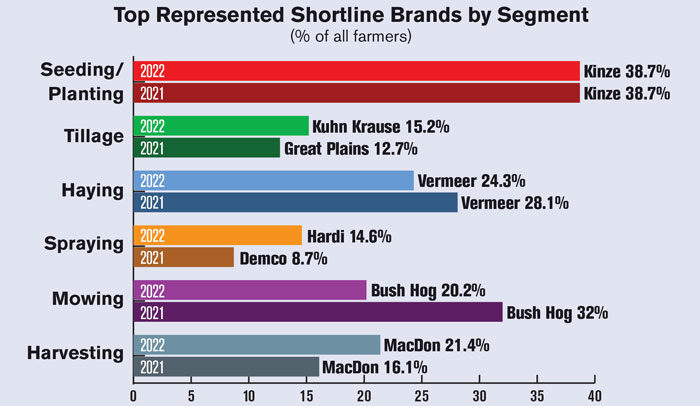

For the second year in a row, Kinze was the most common shortline planter brand for farmers to own, with 38.7% owning Kinze planters, the same percentage as last year. Kuhn Krause was the top tillage shortline brand with 15% of farmers saying the brand is used on their farm vs. the 13% that made Great Plains last year’s top tillage brand. It should be noted that while Great Plains was included as a shortline brand in this year’s study, it is owned by Kubota.

Dealer Takeaways

- Farmers are most open to purchasing seeding and planting shortline equipment vs. buying equipment from the majors.

- Price/value remains one of the biggest reasons farmers consider shortline equipment brands.

- The majority of farmers have gone to a dealership besides their primary dealer to obtain a shortline machine.

- Just over 8% of farmers said their purchase of a shortline brand had something to do with the dealership they bought it from.

Vermeer was once again the top-mentioned hay equipment brand at 24% vs. 28% last year. Almost 15% of farmers with shortline spraying equipment own Hardi sprayers (this year’s top brand), de-throning Demco’s top-spot last year. Bush Hog was again the most-owned shortline brand for mowing, with 20.2% of farmers representing the brand vs. 32% last year. MacDon also maintained its status as the most-owned shortline brand for harvest equipment in the survey, owned by 21% of farmers vs. 16% last year.

When asked what shortline brand had been most significant to their farming operation, Kinze was once again the most selected shortline at 15.4%, down from 18.8% last year. Great Plains was once again the second-most mentioned brand at 4.3%, also down from 6.9% in the 2021 survey. MacDon was the third-most owned shortline, being mentioned by 3.9% of all the farmers that took this year’s survey. Landoll and Vermeer finished the top 5 most-mentioned brands, each being owned by 3.1% of all surveyed farmers. Farmers mentioned 59 different shortline brands across all responses.

When asked for what equipment category they’d be most likely to buy a piece of shortline equipment, seeding/planting took the lead with 34.6% of farmers picking this category. This was followed by tillage at 25.6% and haying at 16.9%. A little over 3% of growers indicated they’d be most likely to purchase shortline harvesting equipment.

Specialization & Price

Farmers were asked to provide their specific reasons for purchasing the shortline machine they wrote in for their most significant shortline piece of equipment, with 25.6% mentioning the specific features of the machine. This was down slightly from 26.4% saying the same last year. Some 24.2% of farmers mentioned the price or value of the machine in their response, also down from 24.5% last year. Another 22.1% were driven by the quality of the machine vs. 21.8% in 2021.

Availability of the shortline machine was a more common answer in the 2022 survey than last year, with 18.9% giving it as a reason for the purchase, up from 14.5% last year. The percentage of farmers driven by the reputation of the shortline brand was only 3.9% this year, a notable fall from 10.5% last year.

A new category added this year was the performance of the shortline machine, which 23.5% of farmers mentioned. Another 8.4% of surveyed farmers mentioned the dealer who sold them the shortline machine — responses included the ability to get parts, good service and even a persuasive salesperson.

The most common reason farmers gave for why they would choose a shortline over a major line was price/value at 41.3%, roughly the same as last year. Not being able to find a comparable product from the majors was once again the second-most common reason with 23.8% of farmers choosing it, up from 20.8% last year. A little over 15% of farmers focused on a shortline manufacturer’s experience in a niche field as a reason to buy from them, a decline from 17.8% last year.

The majors’ products not being specialized enough was a slightly more common reason this year, with 8.9% of farmers picking it vs. 6.9% last year.

Immediate product availability and warranty & after-sales support remained less common reasons to purchase shortlines over majorline equipment, with 3.3% and 3.9% of farmers respectively choosing these options.

In this year’s “other” category, farmers mentioned having a hard time getting service from the majors, proximity to the shortline’s dealer and warranty.

Dealer Loyalty Tested with Shortlines

When asked if visiting a dealer besides their primary dealer had resulted in purchasing shortline equipment, over 53% of farmers said yes, down from almost 60% who said the same last year. Another 68.4% said they’d purchased shortline parts from another dealer, roughly the same percentage as last year. Another 43.5% said they’d gotten their shortline equipment serviced by another dealer, also about the same as last year.

Farmers this year once again said that, when asking their dealer about a shortline product it doesn’t carry, the dealer most commonly tries to get it for them (34.3% of farmers said this). This was down, however, from 40.1% last year. Another 33.3% said their dealer directs them to a similar product their major offers, down slightly from 35.9% in 2021.

Almost 12% of farmers said their dealer refers them to a different dealer who carries the shortline, below the 17% who said the same last year. Just 7.4% said their dealer suggests a late-model used piece and tries to get it for them, just above the 6.9% who said the same in 2021.

Among the 13.1% who selected the “other” category, responses included farmers not asking their dealer for products they don’t carry, looking for the machine themselves, finding another dealer and being offered no help from their primary dealer.

Better Innovation, Customization

Shortlines earned farmers’ top choice in price of equipment (56.9% of farmers picking shortlines), configurations and customizations (56.1%), self-repair resources (52.2%), manufacturer responsiveness (50.5%) and product innovation (48.7%), in this year’s survey. Major-line manufacturers topped the shortline manufacturers in just one category — warranty programs (35.2%).

Topics where farmers were the most neutral one shortlines vs. majors were warranty programs (53.8% neutral), price of parts (45.8%) and product engineering (41.8%).

Rising prices were considered the biggest potential impact on farmers as a result of brand purity at major-line dealerships, with 58.9% picking that option. Having fewer customizable products followed with 29.1% of farmers considering it to be heavily impacted by brand purity effort, followed by a slower rate of specialized innovations at 21.7%.

Farmers considered a slower rate of specialized innovation to be the least impacted trend in brand purity efforts by the majors, with 47.6% considering it to be the least impacted.

Who are This Year’s Surveyed Farmers?

This year’s Farm Equipment 2022 shortline equipment farmer survey asked additional identifying information of its participants. The majority of respondents were over 55 years old, farmed less than 1,000 acres and grow corn and soybeans.

Almost 38% of farmers in this year’s survey considered themselves early adopters of new farm equipment, up from 34.9% last year. The percentage who consider themselves innovators declined, however, from 13.6% to 11.5%. The percentage self-identifying as part of the early majority when it comes to new equipment stayed mostly unchanged at 23.9%.

Fewer farmers considered themselves in the late majority this year, coming in at 14.6% vs. 19.6% last year. More farmers in this year’s survey (12.1%) considered themselves slow to adapt new tech than last year (8.5%), surpassing the percentage who considered themselves innovators.

Source: Farm Equipment Shortline Equipment Farmer surveys

Almost three-fourths of this year’s surveyed farmers grow corn and another 68% grow soybeans. Hay/alfalfa was the third-most popular crop with 45% of farmers growing it, followed by winter wheat at 40%. Hemp was the least popular commodity with just 1.3% of surveyed farmers growing it. Popular options in the “other” category were rye, barley, livestock and vegetables.

Source: Farm Equipment Shortline Equipment Farmer surveys

Farmers with 100-500 acres made up the largest portion of surveyed farmers, with 23.5% reporting this acreage. Over half of this year’s surveyed farmers (58.9%) reported total cropping acreage of 1,000 acres or less. A little over 6% of this year’s farmers reported farming over 5,000 acres.

Source: Farm Equipment Shortline Equipment Farmer Surveys

Almost 46% of this year’s surveyed farmers most identified their operation with John Deere-branded equipment, down from 49% last year. Case IH was the second-most popular major line with 28% of surveyed farmers, and AGCO was third-most popular at 10.2%.

Source: Farm Equipment Shortline Equipment Farmer Surveys

Over half of surveyed farmers this year were 55 or older, with over 29% being over 65 years of age. Almost 10% of this year’s farmers were under 35 years old, with just under 1% being under 25 years of age.

Source: Farm Equipment Shortline Equipment Farmer Surveys