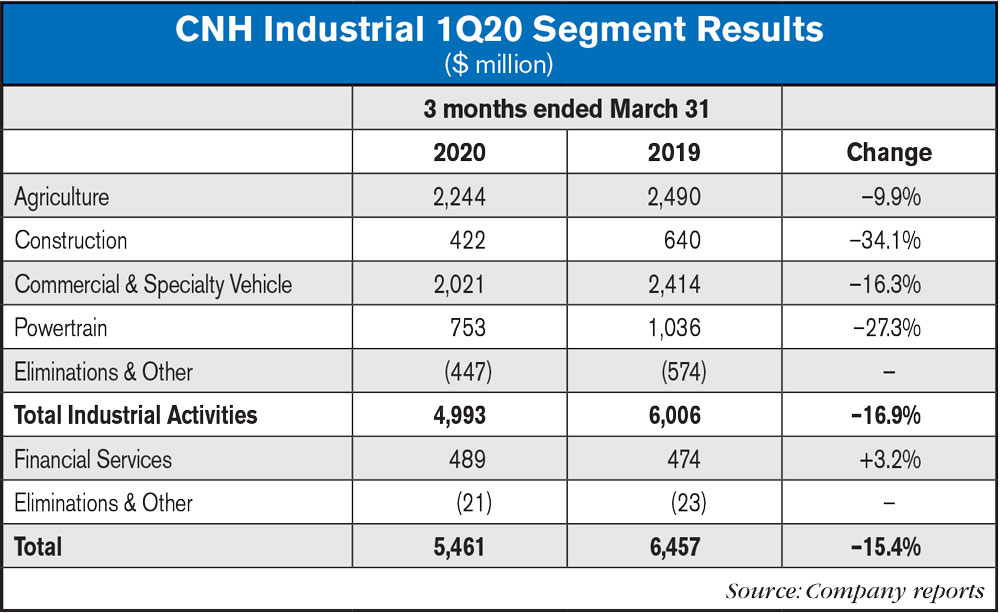

CNH Industrial reported on May 6 that its consolidated revenues for the first quarter 2020 ended March 31 were $5.5 billion, down 15% vs. the first quarter 2019. The company reported a net loss of $54 million compared to net income of $264 million for the same period last year.

Net sales of $5 billion in the first quarter of 2020 were down 17% compared to the first quarter of 2019 (down 14% on a constant currency basis), due to adverse COVID-19 impact on market conditions across all regions, coupled with previously announced actions to reduce dealer inventory levels.

Agricultural Equipment Segment

Sales of agricultural equipment declined 9.9%, from $2.49 billion during the first period of 2019 to $2.24 billion during the first 3 months of 2020. According to the company, the decrease was driven by lower industry volumes across all geographies and further deterioration linked to the COVID-19 outbreak. These factors were coupled with actions to reduce dealer inventories in North America and were partially offset by positive price realization across all regions.

Adjusted EBIT was $24 million, a $144 million decrease compared to the first quarter of 2019. Positive price realization, disciplined cost management and favorable purchasing performance were more than offset by lower wholesale volume and market and product mix, negative fixed cost absorption (primarily in Europe) due to plant shutdowns, higher product costs, and costs associated with product quality actions. Foreign exchange impact was negative, primarily from South America. Adjusted EBIT margin was 1.1% (6.7% in the first quarter of 2019).

Construction Equipment Segment

Construction’s net sales totaled $422 million in the first quarter of 2020, down 34% compared to the first quarter of 2019 (down 32% on a constant currency basis), as a result of deteriorating market conditions across all regions due to the COVID-19 outbreak. This was particularly severe in the month of March in many key end markets, including North America and Europe, combined with actions to reduce dealer inventory levels.

Adjusted EBIT loss was $83 million, a $96 million decrease compared to the first quarter profit in 2019. Net pricing was impacted by retail program enhancements in response to COVID-19 impacted market conditions. Product cost was increased by negative fixed cost absorption due to plant shutdowns and costs associated with continued quality improvement initiatives.

Suzanne Heywood, chair and acting chief executive officer of CNH Industrial, said: “CNH Industrial is continuing to implement measures to quickly adapt and react to the extraordinary circumstances of the COVID-19 outbreak. We have prioritized four issues: the health and wellbeing of our employees; the continuity of our business from a liquidity, cost management and market presence perspective; the strength of our dealer network and our supplier base; and supporting our customers and the communities in which we operate.

“We are dedicated to ensuring we emerge from this public health crisis a stronger and more efficient company, and that our customers and other stakeholders, operating in many end markets essential to the well being and prosperity of society, know that we have given them the best support possible throughout this extraordinary time.

“Our available liquidity position was $9.9 billion at March 31, 2020, the second highest level in company history at the end of the first quarter, providing a solid cash base and headroom within our credit facilities to navigate this uncertain and challenging environment. The company has recently demonstrated its ability to access funding programs enacted by governments as public responses to the COVID-19 outbreak. Management has modeled a variety of different scenarios on the evolution of the current extraordinary circumstances and is focusing its efforts on selecting the optimal response strategies to each potential scenario.

“Persisting uncertainties in evolving end market conditions, together with possible further disruptions in our supply chain do not allow us to provide helpful guidance on the second quarter or full year results at this time. The company will continue to communicate with the financial markets, and with all of its other stakeholders as the short and medium term implications of the evolving business environment for the company’s operations and performance become clearer.”