Titan Machinery, CNH Industrial’s largest ag equipment dealership group, reported a 6% gain in consolidated revenues for its second quarter of fiscal year 2020 ended July 31, 2019.

“We achieved better than expected growth in our Agriculture segment and our Construction segment achieved its fourth consecutive quarter of increased quarter-over-quarter top and bottom line results. Given the better than expected performance of our Agriculture segment during the first 6 months, we are increasing our fiscal year 2020 Agriculture revenue expectations,” said Titan Machinery’s chairman and CEO.

The company also raised its outlook for fiscal 2020.

| Segment Revenue | Current Assumption | Previous Assumptions |

| Agriculture | Up 2-7% | Flat |

| Construction | Up 5-10% | Up 5-10% |

| International (1) | Up 2-7% | Up 10-15% |

(1) Includes the full year impact of our AGRAM acquisition completed on July 2, 2018.

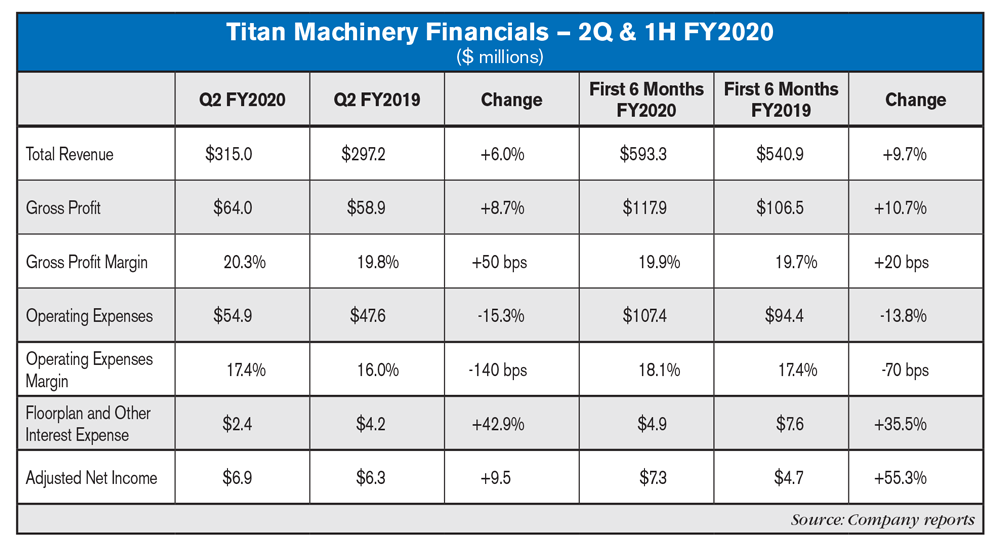

Consolidated Revenues

For the second quarter of fiscal 2020, revenue was $315 million, compared to $297.2 million in the second quarter last year, an increase of 6%. Equipment sales were $214.4 million for the second quarter vs. $203.6 million in the second quarter last year. Parts sales were $59.2 million compared to $55.5 million in the second quarter last year. Revenue generated from service was $26.8 million compared to $23.2 million in the second quarter last year. Revenue from rental and other was $14.5 million for the second quarter of fiscal 2020, compared to $15 million a year earlier.

Gross profit for the second quarter was $64 million vs.$58.9 million in the second quarter last year. The increase in gross profit was primarily driven by higher revenue. Gross profit margins increased 50 basis points to 20.3% vs. the comparable period last year largely due to a shift in gross profit mix.

Operating expenses increased by $7.2 million to $54.9 million, or 17.4% of revenue, for the second quarter of fiscal 2020, compared to $47.6 million, or 16% of revenue, for the second quarter of last year.

Floorplan and other interest expense, which totaled $2.4 million in the second quarter of fiscal 2020, decreased a combined $1.9 million, or 43.9%, compared to the second quarter of last year. Most of the decrease was due to lower interest expense resulting from the May 1, 2019, retirement of the remaining balance of the company's convertible notes.

Net income in the second quarter of fiscal 2020 was $5.5 million compared to net income of $5.2 million for the second quarter of last year.

Segment Results

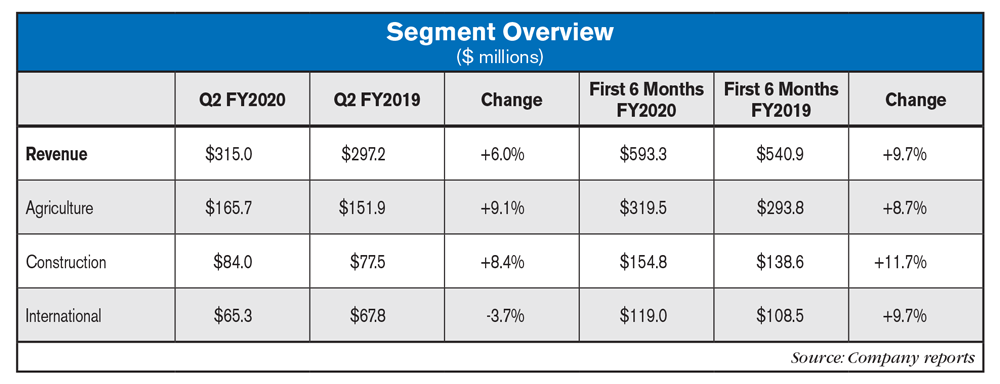

Agriculture Segment: Revenue for the second quarter of fiscal 2020 was $165.7 million, compared to $151.9 million in the second quarter last year. The increase in revenue was driven primarily by increased equipment revenue and increases in parts and service revenues. Income before income taxes for the second quarter of fiscal 2020 was $6.2 million, compared to $5 million of income before income taxes and $5.2 million of adjusted income before income taxes, in the second quarter last year.

Construction Segment: Revenue for the second quarter of fiscal 2020 was $84 million, compared to $77.5 million in the second quarter last year. The increase in revenue was the result of increased equipment, parts and service revenues. Income before income taxes for the second quarter of fiscal 2020 was $1.3 million, compared to break even income before income taxes and $0.3 million of adjusted income before income taxes, in the second quarter last year.

International Segment: Revenue for the second quarter of fiscal 2020 was $65.3 million, compared to $67.8 million in the second quarter last year. The decrease in revenue was the result of lower equipment sales, partially offset by the revenue contribution from our AGRAM business following our acquisition in the third quarter of fiscal 2019. Income before income taxes for the second quarter of fiscal 2020 was $0.5 million, compared to $3.7 million of income before income taxes and $3.9 million of adjusted income before income taxes, in the second quarter last year.

Fiscal 2020 First 6 Months Results

Titan Machinery’s revenue was $593.3 million for the first 6 months of fiscal 2020 compared to $540.9 million for the same period last year. Net income for the first 6 months of the year was $5.1 million compared to a net income of $3.6 million for the same period a year ago. On an adjusted basis, net income for the first 6 months was $7.3 million vs. an adjusted net income of $4.7 million a year earlier.

Equipment Inventory

Titan Machinery's inventory level increased to $629.2 million as of July 31, 2019, compared to $491.1 million as of January 31, 2019. This inventory increase includes a $130.2 million increase in equipment inventory, which reflects an increase in new equipment inventory of

$151.9 million, partially offset by a $21.8 million decrease in used equipment inventory. The company had $451.9 million outstanding floorplan payables on $640 million total floorplan lines of credit as of July 31, 2019, compared to $273.8 million outstanding floorplan payables as of January 31, 2019. The increase in our floorplan payable balance is primarily due to increased equipment inventory levels and the payoff of the company's convertible notes in the quarter ended July 31, 2019.

Meyer said, “We continue to prudently manage our overall business through this prolonged challenging agriculture cycle with an emphasis on customer support. This focus is driving continued overall growth in our higher margin parts and service businesses, particularly in service where we grew nearly 16% in the second quarter. The improved performance of this higher margin business, along with the strength of our balance sheet, has us well positioned to capitalize on future strategic opportunities.”