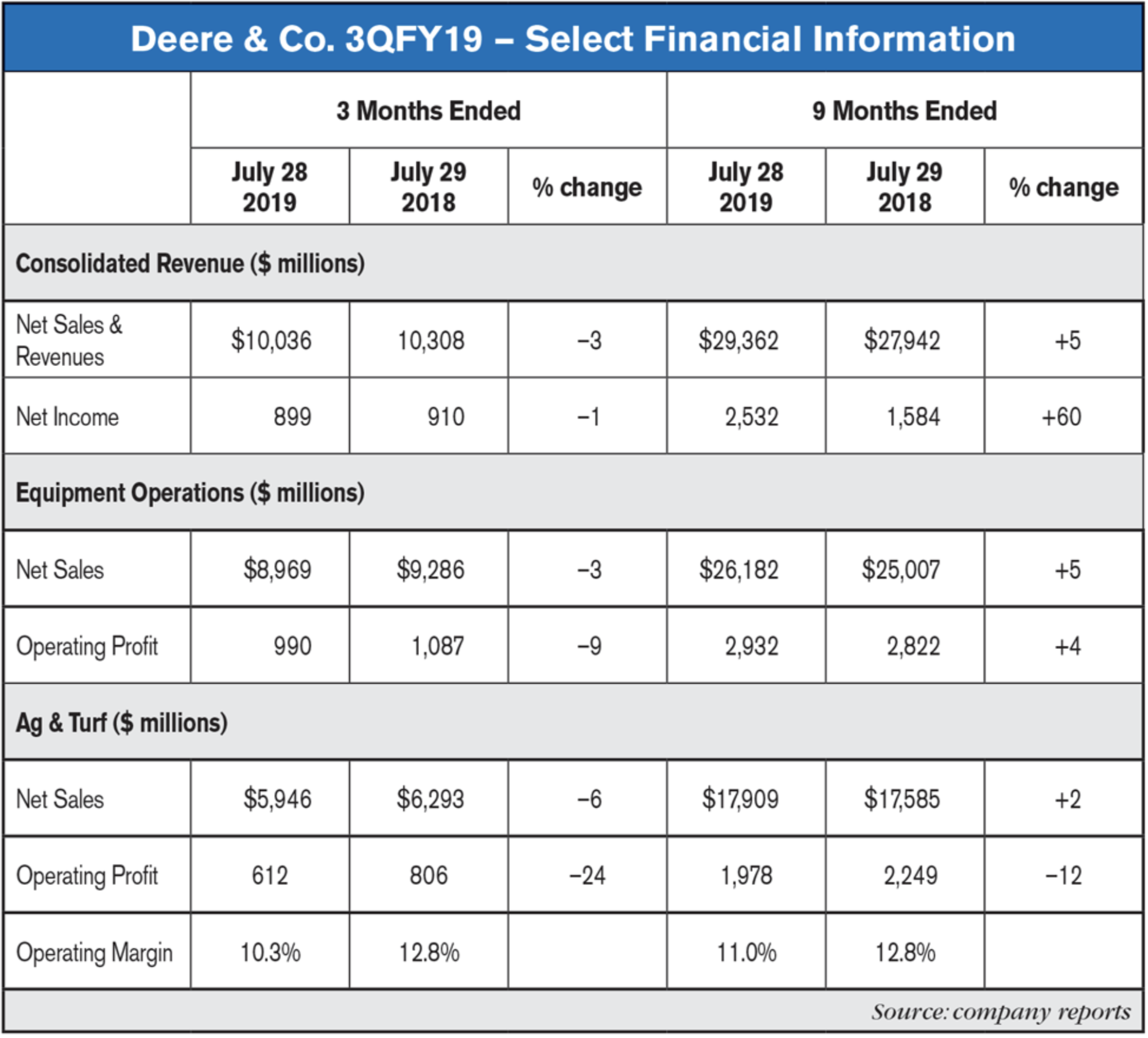

Deere & Co.’s worldwide net sales and revenues decreased 3% to $10 billion, for the third quarter of 2019 and increased 5% to $29.4 billion, for 9 months. Net sales of the equipment operations were $9 billion for the quarter and $26.2 billion for 9 months, compared with $9.3 billion and $25 billion last year.

“John Deere’s third-quarter results reflected the high degree of uncertainty that continues to overshadow the agricultural sector,” said Samuel R. Allen, chairman and chief executive officer. “Concerns about export market access, near term demand for commodities, such as soybeans, and overall crop conditions have caused many farmers to postpone major equipment purchases.”

Company Outlook & Summary

Company equipment sales are projected to increase by about 4% for fiscal 2019 compared with 2018.

Included in the forecast are Wirtgen results for the full fiscal year of 2019 compared with 10 months of the prior year. This adds about 1% to the company’s net sales forecast for the current year. Also included is a negative foreign-currency translation effect of about 2% for the year. Net sales and revenues are projected to increase about 5% for fiscal 2019. Net income attributable to Deere & Co. is forecast to be about $3.2 billion.

Agriculture & Turf

Ag & Turf sales decreased for the quarter due to lower shipment volumes and the unfavorable effects of currency translation, partially offset by price realization. Year-to-date sales increased mainly as a result of price realization and increased shipment volumes, partially offset by the unfavorable effects of currency translation. Operating profit declined for the quarter primarily due to lower shipment volumes, higher production costs, and the unfavorable effects of foreign-currency exchange, partially offset by price realization. Nine month operating profit moved lower resulting from higher production costs, the unfavorable effects of currency translation, increased research and development costs, and a less favorable sales mix. These factors were partially offset by price realization and higher shipment volumes.

Ag & Turf Outlook

Industry sales of agricultural equipment are expected to be about the same as last year for the U.S. and Canada as well as for the EU28 member nations. South American industry sales of tractors and combines are projected to be flat to up 5% benefiting from strength in Brazil. Asian sales are forecast to be flat to down slightly. Industry sales of turf and utility equipment in the U.S. and Canada are expected to be flat to up 5% for 2019.