Farm Equipment dealers and manufacturers looking for some good news finally got some when last month Congress approved legislation that includes extensions of Section 179 and Bonus Depreciation.

The provision permanently extends the small business expensing limitation of $500,000, but will phase out bonus depreciation over the next 5 years for property acquired and put in service during 2015-19. The bonus depreciation percentage is 50% for 2015, 2016 and 2017. In 2018, it will be phased down to 40% and down to 30% in 2019.

Section 179 vs. Bonus Depreciation

There are key differences between allowances under Section 179 and bonus depreciation. Understanding how to best apply each can improve the dealer’s sales process and aid farmers in making smart decisions in their capital equipment purchases.

Section 179 allows for accelerated depreciation of an asset in the year of purchase; the newly passed law allows for up to $500,000 in deductions, with this benefit phasing out once buyers purchase over $2 million of equipment. If farmers cannot expense their entire machinery purchase using Section 179, they may write off 50% of the initial purchase price using bonus depreciation.

Other key differences include:

- Bonus depreciation can only offset new equipment, but Section 179 can offset new and used as long as it’s “new to you.”

- Bonus depreciation can be taken in a year with a net operating loss, and carried forward to future years; Section 179 cannot.

- Bonus depreciation does not have a $500,000 deduction limit and does not phase out with equipment purchases over $2,000,000.

Examples of the impact of utilizing Section 179 compared with bonus depreciation were presented in a Farm Equipment special report, (See “How Special Depreciation Rules Impact Farm Equipment Purchases,” Sept. 2013).

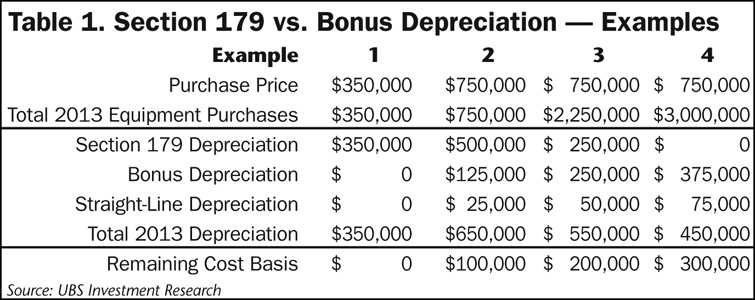

Table 1 below illustrates how the two differ and how they affect different size farmers and purchase amounts. This table shows various examples of Section 179 depreciation vs. bonus depreciation. Section 179 provides a greater deduction and primarily benefits small to medium sized farmers. In the report, Deere pointed out that Section 179 primarily supports the used machinery market, as large new machinery buyers are typically purchasing at amounts where Section 179 no longer provides a benefit.

On the other hand, bonus depreciation is a benefit to large new machinery buyers of any size, though this benefit as a percent of total machinery cost is lower than that provided under Section 179.

Example 1 is for a small farm with a single machine purchase. Example 2 shows a single, large machine purchase that exceeds the $500,000 deduction limit of Section 179. After the Section 179 deduction is exhausted, the remaining cost basis ($250,000) qualifies for a 50% bonus depreciation, and the remaining basis thereafter ($125,000) qualifies for normal depreciation, which in this case, is straight line over 5 years.

Example 3 shows the impact of a 50% phase-out of the Section 179 depreciation allowance. Example 4 shows a complete phase-out of the Section 179 depreciation allowance.