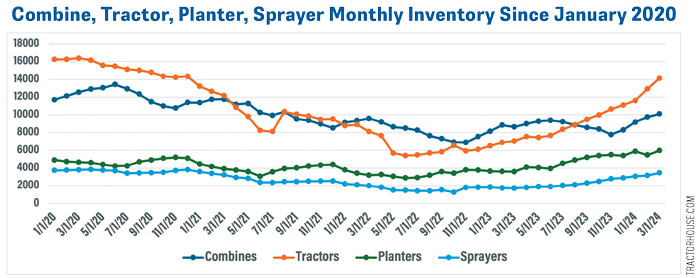

Combines are the last to the party and the first to leave — every time. When new equipment started to get tight and used equipment was selling at a record pace and price, combines lagged in the rear.

Tractors, planters and sprayers had an excellent long run, but combines, they didn’t have the same drawdown in inventories as other platforms. Similarly, during the last upcycle, combines took a back seat while other platforms sold off. The one thing combines are good at is growing inventory levels.

Growing inventory levels are easy to explain. Like tractors, combines are often bought in multiples and, in turn, traded in multiples. Unlike tractors, combines have a longer, more rigid trade cycle. A tractor is more likely to be updated regardless of the economic situation. This leads to the fact that combine inventories grow so rapidly compared to other machinery platforms.

Since January 2020, the combine market has steadily reduced inventory and shown a slightly sharp incline, but nothing compared to tractors or planters. Row-crop tractor inventory has increased by 188% since February 2023, and planters are up 159% in the same period. During the same period, inventory for combines rose by 10%.

Since June 2023, many combines have been sold at auction. During this time, 1,755 combines were sold between the model years 2012 and 2023. Even if these combines are added back to inventory, they would have risen 30% year over year. The hyper-focused view on combines has them at the forefront of every used inventory manager. Knowing how many combines you have and where they are priced comparatively to the market is something learned early in an inventory manager’s career.

Interest Rate Pressure

Low crop prices and interest rates have inventory managers looking at washouts and inventory turns, unlike any other time. When thousands of dollars a month per machine are lost to interest costs, equipment needs to turn, and it needs to turn quickly. If a machine has a value of $500,000 and is financed at a 7% interest rate, the holding cost is $35,000 per year, $2,916.66 per month and $95.89 per day. The amount of equipment that will go to auction will continue to rise through the rest of 2024.

Combines are a problem and will always be a problem, but this time, there are others to blame as well. Tractors are going to be an issue that will be dealt with in 2024. The number of tractors on the market is not the highest, but since 2017, pricing has increased from 40% to 60%. Tractors increased by 1,219 units from February to March. Tractors will see a correction sooner rather than later.

The first quarter of 2023 saw a large amount of equipment hit the ground, and it never stopped. Everything delayed or canceled in 2021-22 was delivered in 2023. This is why the explosion in used inventories has been so rapid, except for combines, even when you count the auction numbers. I’m not saying combines are in the clear — because they aren’t. The other machine platforms will have their issue in 2024 and will be the most significant contributors to the auction market.

Post a comment

Report Abusive Comment